excalibur

Diamond Member

- Mar 19, 2015

- 18,166

- 34,437

- 2,290

Like watching a train wreck in slow motion.

And inaptly named Biden deficit reduction bill is a key part of the mess.

With the failure of three regional banks since March, and another one teetering on the brink, will America soon see a cascade of bank failures?

Bloomberg reported Wednesday that San Francisco-based PacWest Bancorp is mulling a sale.

Last week, First Republic Bank became the third bank to collapse, the second-largest bank failure in U.S. history after Washington Mutual, which collapsed in 2008 amid the financial crisis.

After the demise of Silicon Valley Bank and Signature Bank in March, a study on the fragility of the U.S. banking system found that 186 more banks are at risk of failure even if only half of their uninsured depositors (uninsured depositors stand to lose a part of their deposits if the bank fails, potentially giving them incentives to run) decide to withdraw their funds.

Uninsured deposits are customer deposits greater than the $250,000 FDIC deposit insurance limit.

...

And inaptly named Biden deficit reduction bill is a key part of the mess.

With the failure of three regional banks since March, and another one teetering on the brink, will America soon see a cascade of bank failures?

Bloomberg reported Wednesday that San Francisco-based PacWest Bancorp is mulling a sale.

Last week, First Republic Bank became the third bank to collapse, the second-largest bank failure in U.S. history after Washington Mutual, which collapsed in 2008 amid the financial crisis.

After the demise of Silicon Valley Bank and Signature Bank in March, a study on the fragility of the U.S. banking system found that 186 more banks are at risk of failure even if only half of their uninsured depositors (uninsured depositors stand to lose a part of their deposits if the bank fails, potentially giving them incentives to run) decide to withdraw their funds.

Uninsured deposits are customer deposits greater than the $250,000 FDIC deposit insurance limit.

...

US banking crisis: Close to 190 banks could collapse, according to study

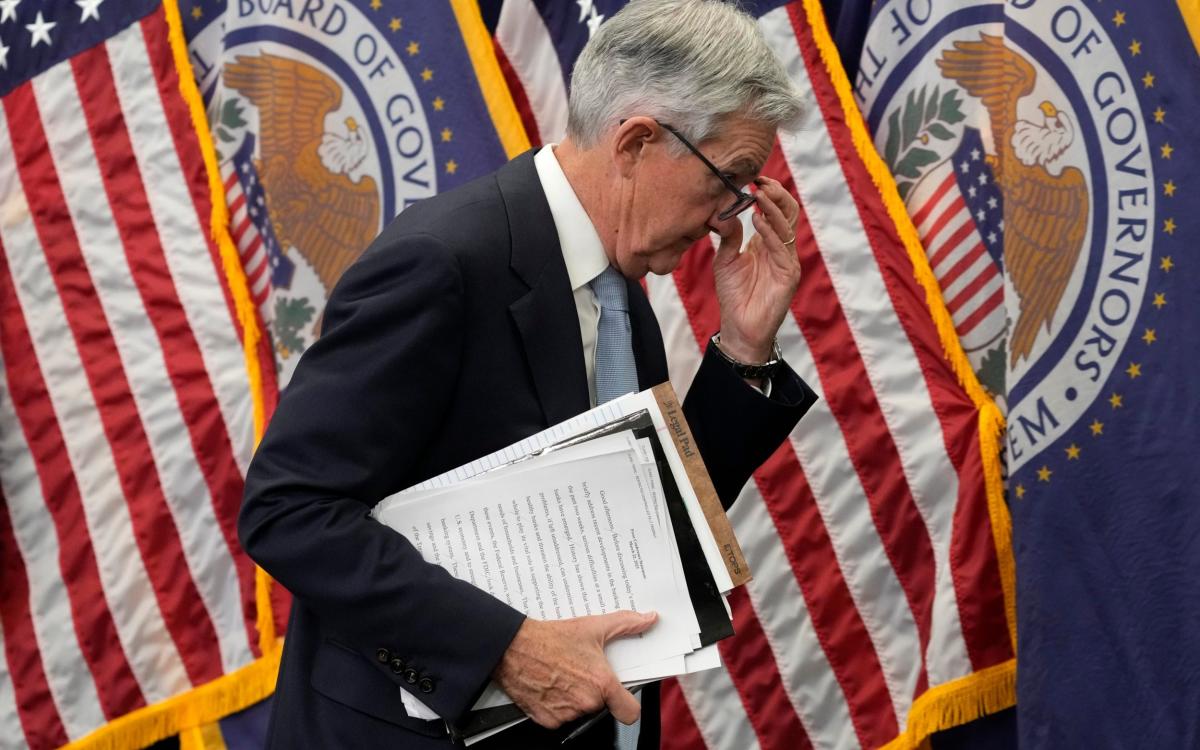

The Fed's aggressive interest rate hikes have eroded the value of bank assets such as government bonds and mortgage-backed securities.

www.usatoday.com