Toro

Diamond Member

Toro, the standard measure for real estate is $/sq. ft. It tells you whether to build or buy existing property or rent for a given acreage. That was standard when Granddad used a workout to buy the house I lived in after granny died. And he had been a contractor in the late 1890s.

Two things happened in the 1970s the development of the nail gun and a lighter recipe for building block. The next iteration of Case-Shiller will be build/buy/rent ratios which are much more important than the current index but the current index does create a starting point for more fruitful research. At the moment just a quick down and dirty index does start the ball rolling and is long overdue.

Fair enough.

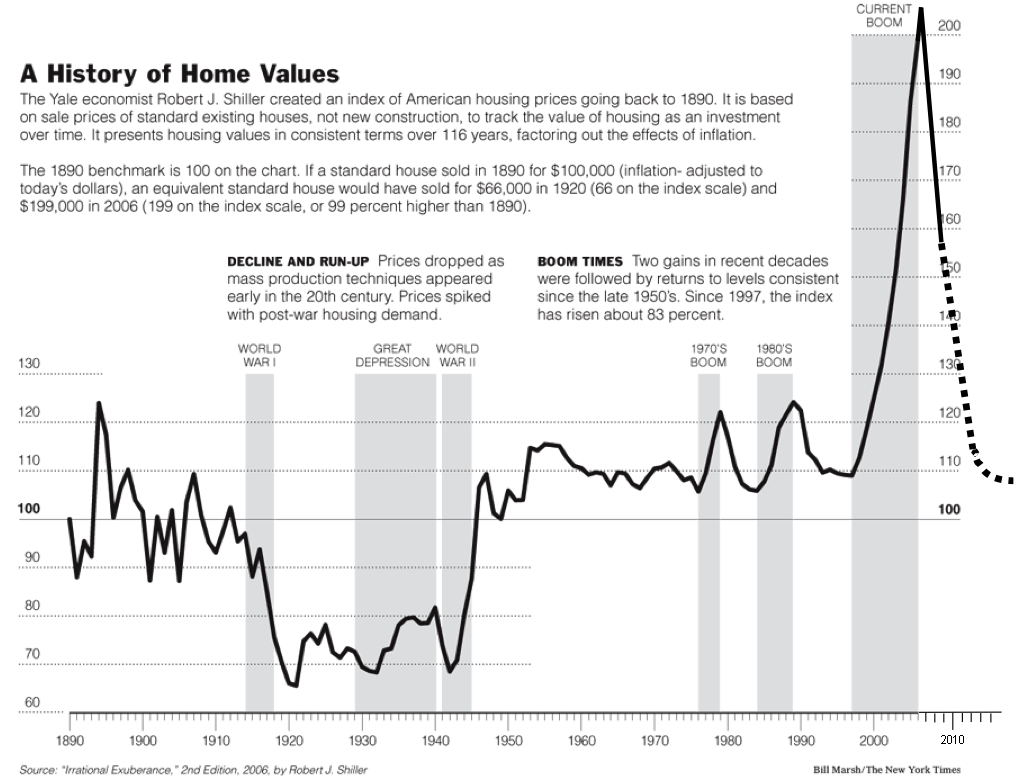

However, if the price of something stays constant, as Shiller's graph demonstrates, and the quality improves, as you are arguing, that's not inflation, that's deflation. So how can you have a bubble during deflation?

Last edited: