cbirch2

Active Member

- Jul 9, 2011

- 1,394

- 49

- 36

Well it depends if you talking about fiscal multipliers or keynesian multipliers that only measure aggregate demand.

Both depend on the concept that each dollar of stimulus is immediately spent and that the recipient of that dollar turns around and spends it again. Even Keynes acknowledged that this isn't true and sought to tax savings in order to promote spending. BUT Friedman proved that even such a measure is fruitless.

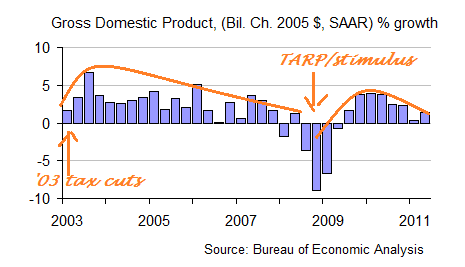

I said that a 1.44 multiplier is an utter failure. Now some might say, "44%" ROI is good. Except that ad Friedman showed, the reality of deficit stimulus is that (in 1968 dollars) 1.68 is used to repay every dollar borrowed, due to the attrition of cash through federal bureaucracy. So the 1.44 is in fact a negative multiplier, contracting the economy by $.24 for each dollar of stimulus. The net effect of the Obama stimulus is to retard the economy. A bounce followed by a crash is the inevitable result of deficit stimulus.

As we tumble into the second dip of our double dip recession, there can be no denying that the stimulus failed, what I point out is that it could do nothing other than fail.

Sorry but once you started quoting milton friedman i stopped listening. You mean the person whos predictions about monetary policy were proved absolutely wrong during the last 3 years? ie, liquidity traps are possible.