Wyatt earp

Diamond Member

- Apr 21, 2012

- 69,975

- 16,391

- 2,180

Prove your claim.

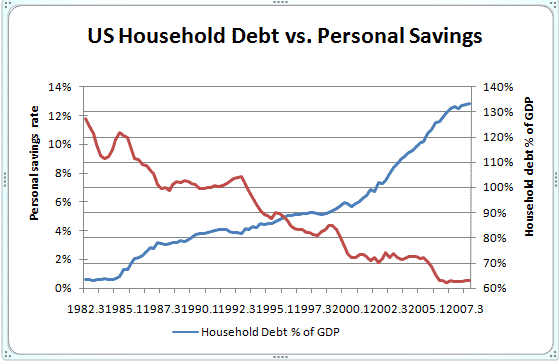

Actually, it's incumbent on you to prove they do. I have 37 years of empirical data showing they don't. Can't help it that you have a fundamental misunderstanding (deliberate or not) of the economy.

Supply fulfills demand, not the other way around.

Basically, your ideology boils down to "if you built it, they will come". If "they" don't have any money to spend because "they" have not seen wages grow, then "they" will not come.

You're proposing a solution for which there is no problem. You're completely missing the mark. It's not the suppliers who need money, it's consumers. From that consumption will naturally evolve innovation and demand. But you gotta start off with demand. Right now, demand is stagnant, as we saw in last quarter's GDP growth rate of 0.7%.

if you built it, they will come". If "they" don't have any money to spend

Earth to derp, ever hear of credit cards?

.