EdwardBaiamonte

Platinum Member

- Nov 23, 2011

- 34,612

- 2,153

- 1,100

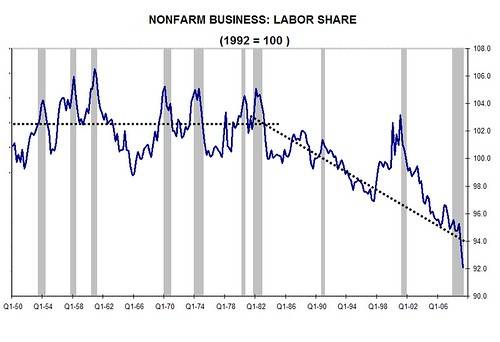

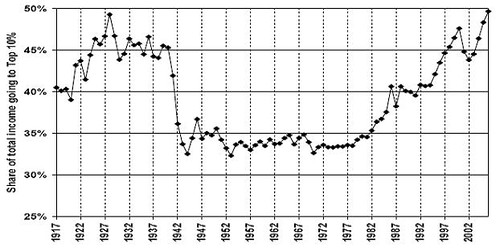

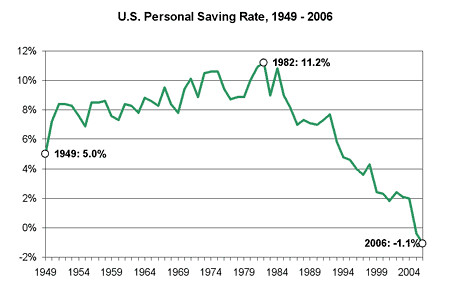

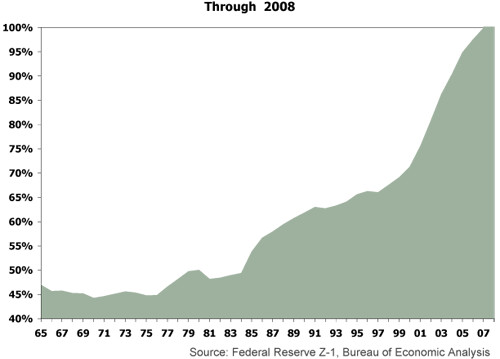

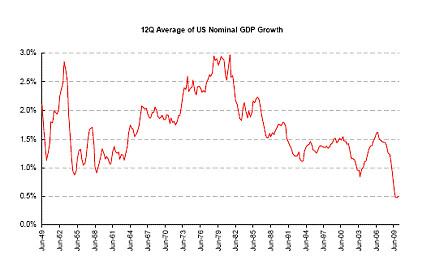

Totally moronic brainwashed and typical liberalism!!Here are some handy charts showing the extent of the theft of wealth and democracy by the 1%.

The top 1% pay 40% of what state and federal govt spends up from 20% under Reagan. If there was theft they would not be paying double what they paid under Reagan they would be paying half or less or to be perfectly fair, 1%.