M14 Shooter

The Light of Truth

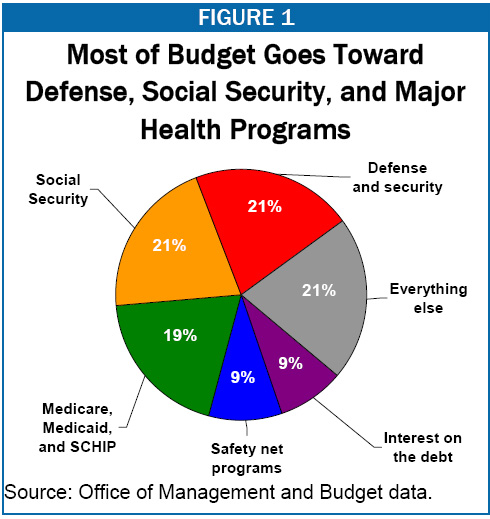

The vast majority (almost 60%) of what the Federal government spends is entitlement and other mandatory spending. This money is spent regardless of how much revenue comes in because the law says it must be spent. As such, even more than just the raw dollars spent, this contributes FAR more to deficits than discretionary spending, as no one asks 'can we afford this?'The first thing I'd do, before cutting taxes, is to rein in the deficit spending. If we're going to go hog wild on spending, then let's man up and decide which taxes are going to go up. Relying on the federal reserve to fix things is simply boosting the hidden tax of inflation.

If you want to get a handle on spending, you need to start with entitlements.