- Dec 18, 2011

- 12,919

- 4,823

- 350

Politicians are irresponsible with money and that's a fact. This is worth reading, even if you're a liberal. Our savings, retirement and income are going to be sacrificed to pay for government's foolish spending. I'm sure the public pensions and welfare are safe but those who work are being robbed blind.

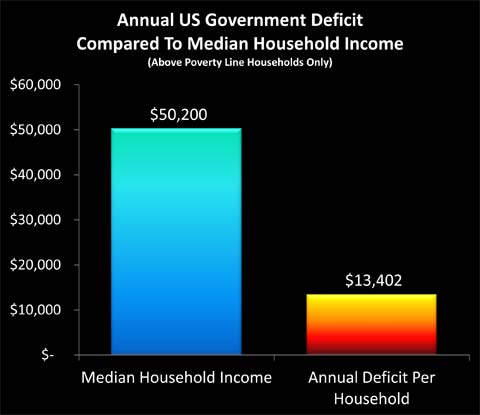

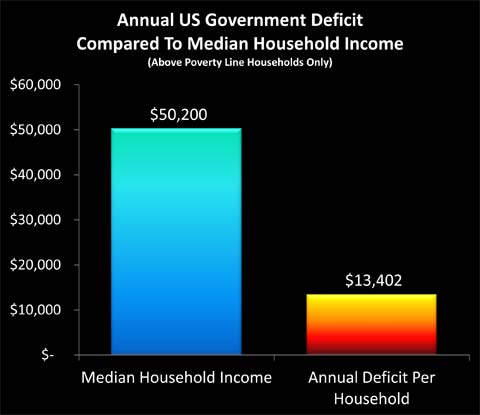

"To keep a constant, personal comparison / reality check for the six layers of deficits, each graph has the same blue bar on the left, which is annual median household income of $50,200. The "fire" bar on the right is the particular deficit measure, which for layer one is the annual deficit of $13,402 per above poverty line household.

In other words, your share of the national "credit card" went up by about $13,400 in the last year, on top of whatever else was going on in your household. Your household - and 97 million others - essentially borrowed enough money to buy a new car just in the last year, albeit a quite basic subcompact.

This is a useful perspective when it comes to evaluating budgetary proposals. For instance, let's say someone wants to spend $500 billion in an attempt to improve the economy. Your share of this increased deficit spending comes to about $5,100. This means you are now borrowing enough to buy a 2nd car this year alone, albeit a five to ten year old used vehicle this time, on top of the new car equivalent you are borrowing with just the "normal" deficit. By itself, this doesn't answer the question about whether a $500 billion stimulus is worthwhile - that depends on whether you believe the stimulus will work or not - but it does remove the abstract nature of the question and make the very real and personal cost for each of us easy to evaluate.

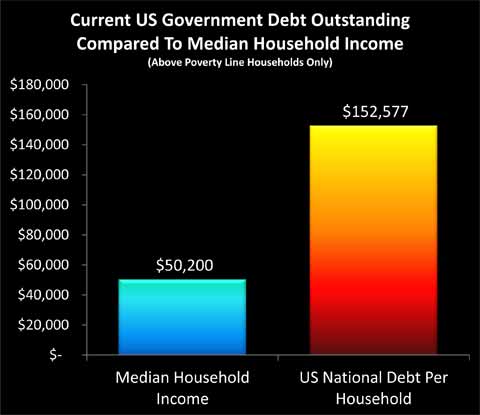

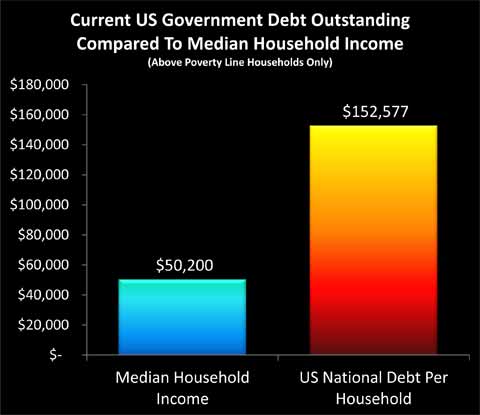

Layer 2: Current US Government Debt Outstanding

Every able-to-pay household in the United States borrowing enough to buy a new car in the last year adds up to a whole lot of money - but it wasn't the first or only time that we took out a loan. Far from it, as the federal government has been incurring deficits much more often than not throughout our lifetimes, and deficit spending jumped up to the current fantastic levels of roughly a subcompact car per year about three years ago, when the financial crisis kicked fully into gear.

The total national debt outstanding is currently about $14.8 trillion. When we divide that by 97 million above poverty line households, then the government debt per household works out to a little over $152,000 per household, as shown below.

Forget a new car; we all already each owe enough to finance a second home equal to the value of our primary residence. The median value of a single family home in the US as of the first half of 2011 was $171,900 (per the National Association of Realtors), thus each of our households' share of the national debt is equivalent to having a mortgage outstanding at an 89% loan-to-value ratio on an average home.

So in addition to food, utilities, gas, health care payments, taxes and everything else, we also all have to make payments on a second house, even while we borrow enough to pay for a new car each consecutive year. Except that there is no actual house or annual new car to add to the line-up in the driveway, just an insatiable federal government.

Layer 3: US Govt Debt Outstanding In 10 Years

Buying a new car every year - while still making payments on the new cars from each previous year - would seem to be a good way to get in much worse shape and very quickly. If we keep this up - how much trouble will each of our households be in ten years from now?

There are a couple ways of approaching this question. The easy way is political gamesmanship, and making all kinds of assumptions about the future that make the numbers look good, so the politicians can justify the actions they want to take today. The bottom line is that the politicians, wonks and pundits all assume that future politicians will be braver and more disciplined than the current politicians, and will fearlessly make the changes in terms of slashing benefits that today's politicians refuse to do. The government also makes ever freer use of accounting gimmicks / deceptions, which is why the current deficit is reported as "only" $1.3 trillion.

Of even more importance to the projections used by the government is the assumption that economic growth gets right back on track, unemployment plummets, and tax revenues surge over time. Even with these optimistic economic projections, but absent major tax increases or much larger benefits reductions than those proposed in the latest rounds of agreements, the deficit continues right along at about $1.3 trillion per year over the next ten years. So the baseline optimism scenario translates to borrowing the money each year to buy yet another car."

Six Layers Of Deficits Mean Retirement Disaster by Daniel R Amerman

"To keep a constant, personal comparison / reality check for the six layers of deficits, each graph has the same blue bar on the left, which is annual median household income of $50,200. The "fire" bar on the right is the particular deficit measure, which for layer one is the annual deficit of $13,402 per above poverty line household.

In other words, your share of the national "credit card" went up by about $13,400 in the last year, on top of whatever else was going on in your household. Your household - and 97 million others - essentially borrowed enough money to buy a new car just in the last year, albeit a quite basic subcompact.

This is a useful perspective when it comes to evaluating budgetary proposals. For instance, let's say someone wants to spend $500 billion in an attempt to improve the economy. Your share of this increased deficit spending comes to about $5,100. This means you are now borrowing enough to buy a 2nd car this year alone, albeit a five to ten year old used vehicle this time, on top of the new car equivalent you are borrowing with just the "normal" deficit. By itself, this doesn't answer the question about whether a $500 billion stimulus is worthwhile - that depends on whether you believe the stimulus will work or not - but it does remove the abstract nature of the question and make the very real and personal cost for each of us easy to evaluate.

Layer 2: Current US Government Debt Outstanding

Every able-to-pay household in the United States borrowing enough to buy a new car in the last year adds up to a whole lot of money - but it wasn't the first or only time that we took out a loan. Far from it, as the federal government has been incurring deficits much more often than not throughout our lifetimes, and deficit spending jumped up to the current fantastic levels of roughly a subcompact car per year about three years ago, when the financial crisis kicked fully into gear.

The total national debt outstanding is currently about $14.8 trillion. When we divide that by 97 million above poverty line households, then the government debt per household works out to a little over $152,000 per household, as shown below.

Forget a new car; we all already each owe enough to finance a second home equal to the value of our primary residence. The median value of a single family home in the US as of the first half of 2011 was $171,900 (per the National Association of Realtors), thus each of our households' share of the national debt is equivalent to having a mortgage outstanding at an 89% loan-to-value ratio on an average home.

So in addition to food, utilities, gas, health care payments, taxes and everything else, we also all have to make payments on a second house, even while we borrow enough to pay for a new car each consecutive year. Except that there is no actual house or annual new car to add to the line-up in the driveway, just an insatiable federal government.

Layer 3: US Govt Debt Outstanding In 10 Years

Buying a new car every year - while still making payments on the new cars from each previous year - would seem to be a good way to get in much worse shape and very quickly. If we keep this up - how much trouble will each of our households be in ten years from now?

There are a couple ways of approaching this question. The easy way is political gamesmanship, and making all kinds of assumptions about the future that make the numbers look good, so the politicians can justify the actions they want to take today. The bottom line is that the politicians, wonks and pundits all assume that future politicians will be braver and more disciplined than the current politicians, and will fearlessly make the changes in terms of slashing benefits that today's politicians refuse to do. The government also makes ever freer use of accounting gimmicks / deceptions, which is why the current deficit is reported as "only" $1.3 trillion.

Of even more importance to the projections used by the government is the assumption that economic growth gets right back on track, unemployment plummets, and tax revenues surge over time. Even with these optimistic economic projections, but absent major tax increases or much larger benefits reductions than those proposed in the latest rounds of agreements, the deficit continues right along at about $1.3 trillion per year over the next ten years. So the baseline optimism scenario translates to borrowing the money each year to buy yet another car."

Six Layers Of Deficits Mean Retirement Disaster by Daniel R Amerman