- Feb 12, 2007

- 59,384

- 24,019

- 2,290

Why should I read the article? If you think a portion of it proves your claim, post it.

The debt guarantees weren't forever. They have expired. The government never guaranteed all bad debt, as you originally claimed. And do not now.

Still waiting for your proof that Bush deregulated and allowed banks, for the first time, to sell mortgages instead of hold them forever. You haven't admitted your error so that makes you a liar.

As far as the assets of BOA, that's not "my number", that's the real number.

The fact that they have $2.2 trillion in assets and a market cap of only $64 billion doesn't tell you how much bad debt they have or how much bad debt the market thinks they have.

I could explain how a balance sheet works, but based on your weak understanding, it seems like it would be a waste of time.

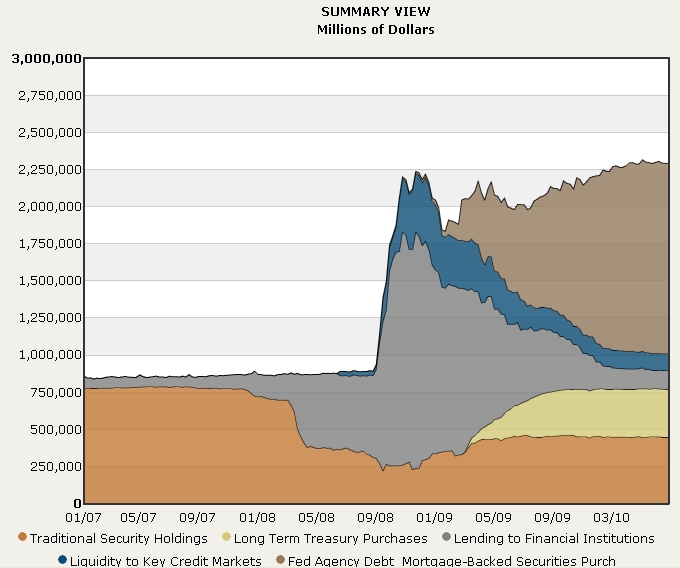

Government loans, spending or guarantees to rescue the U.S. financial system total more than $12.8 trillion since the international credit crisis began in August 2007, according to data compiled by Bloomberg as of March 31. The total includes about $2 trillion on the Feds balance sheet.

Fed Shrouding $2 Trillion in Bank Loans in

The government still guarantees all that money. If the euro blows up in the next few weeks and US banks get into trouble the government will guarantee anything they haven'y guaranteed already. That's to reassure the markets and prevent panic, bank runs, market panic etc. You may remember the Fed and the other big central banks recently provided unlimited dollar loans to any banks that might need them :

LONDON -- Five of the world's top central banks acted jointly Thursday to provide unlimited dollar loans to banks, a move aimed at easing the growing tensions in the eurozone's financial sector and shielding the global economy from its jitters.

The European Central Bank said it will coordinate with the U.S. Federal Reserve, the Bank of England, the Bank of Japan and the Swiss National Bank to offer three-month dollar loans to banks through the end of this year.

World's central banks flood market with dollars - Forbes.com

This was to calm markets and try and prevent the current euro crisis spiralling. So yes, they're guaranteeing everything they guaranteed back in 2008 and will continue to guarantee basically the entire financial system until the crisis is over, maybe a decade or two down the line. And when the next crisis happens, they'll do exactly the same thing again.

Looking at BOA's balance sheet is a waste of time because they're marking their assets to make-believe instead of to market. Looking at how the market values the bank is a better way to approximate BOA's situation. Markets are never wrong, right?

"Fed Shrouding $2 Trillion in Bank Loans"

Yeah, Fed loans have been repaid. Now what are you whining about?

"The government still guarantees all that money"

No they don't. Check this out.

The Debt Guarantee Program, part of the FDICs Temporary Liquidity Guarantee Program, backed almost $350 billion of debt at its peak. At the end of December, $267 billion was still guaranteed

FDIC warns on end of giant debt guarantees - MarketWatch

"Looking at BOA's balance sheet is a waste of time"

It's a waste of time for you, because you don't know the difference between asset and capital.

He clearly doesn't know how to read a balance sheet.

BAC has over $2T in assets.

BAC Balance Sheet | Bank of America Corporation Com Stock - Yahoo! Finance