The Derp

Gold Member

- Apr 12, 2017

- 9,620

- 661

- 205

- Banned

- #1,321

Nope. Never did. Because I actually understand markets, bubbles and history.

You say that, but you never take any of that into account. It's all "magical" for you...things happen for no reason, "invisible hand", woo-wap-da-bam. Unfortunately, just like physics, nothing happens for no reason. Everything that happens in our economy does so because of specific actions taken. Nothing is by chance, it's all by design. You may as well say elves grow the economy because it's just as magical as thinking things happen for no reason. So the argument, like the tax cut argument, seems to shift and redefine its parameters as you find each position you argue less defensible as you make them. It's easier for lazy people to just throw up their hands and say "just because" or "the will of God" because they are accustomed to fantastical thinking, intellectual laziness, and sloppy work.

Nope. Never did. Partially responsible for the bubble? Hell yes!!!!

Not even a little bit. The "bubble" were the subprimes, not the GSE-backed loans because it was the subprimes that went delinquent first. You are ignoring GSE loan performance, why?

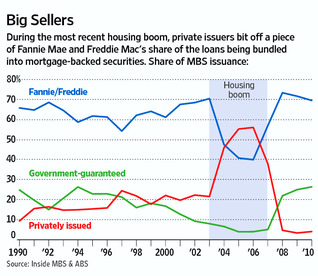

Which of my actual arguments do you feel is refuted by that chart?

That GSE's played any role in the bubble.