- Banned

- #121

Clever abuse of the language

"Cut the deficit by 75% and you still" blah blah blah.

How about "Cut Spending by X%" where X is chosen in such a way as to eliminate the deficit altogether.

You know fiscal responsibility - the change people hoped for.

But of course cutting spending would not allow the democrats to buy enough votes.

Finally recall it was a Democratic congress which pushed though the 2008 and 2009 budgets, so they can take the fall for those numbers.

OK, great, let's cut spending by the amount necessary to eliminate the deficit.

Which amounts to the exact same thing, but hey, I"m game.

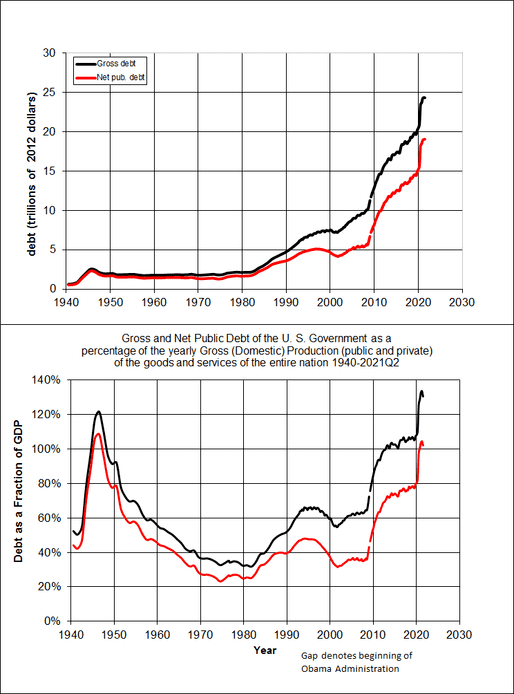

The deficit is equal to roughly 40% of the spending in the federal budget, which means that to eliminate the deficit, we'd have to cut spending by 40%.

Tell me where you'd like to cut the 40% from, I'd be happy to listen.

Keep in mind that the Military, Social Security, Medicare, and Interest on pre-existing debt make up 65% of the budget, and are increasing with every year, as more and more people reach age 65.

Also keep in mind that "Pork", the strawman of the right, makes up .6% of the budget. If you cut all pork, you'd still have to cut 39.4%.

Last edited: