If that were true then Rshermr would have agreed with the curve and begun talking numbers. He didn't because it isn't. Many on these threads avoid premises talk, refuse to accept the curve at all, and like Rshermr deny the idea that any economist uses the model.Here're the basics:

Please speak up if anyone here disagrees with any of those first three understandings. Here's the kind of picture that's often included:

- No reveue if the tax rate is zero.

- No revenue if the tax rate is 100%.

- Revenue is higher someplace between nothing and 100%.

Economics is funny in that while most people say they're reasonable, many choose doctrines on an emotional level and ignore reality. The way to tell which faction is reality based is to observe how one group creates wealth, and the other group tries to confiscate it.

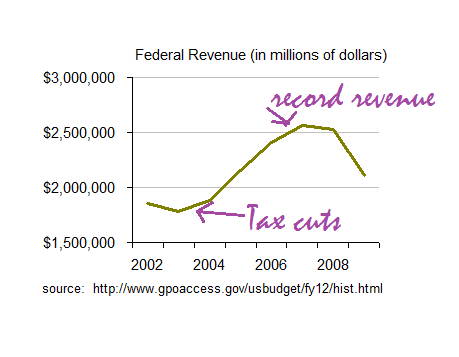

The entire academic debate is over what that equilibrium point is. No one disagrees with the premises...--and the answer is seen by looking to see if revenue went up or down after the '03 cuts......The question is where does that maxima sit.

Before the '03 cuts revenue was falling, and then it increased after the rate cuts. Later revenue fell after the Obama taxes. We're on the left side of the peak.

Revenue was falling before the 2003 cuts because there was an initial (and larger) round of cuts in 2001. Saying "well, revenue went up after" doesn't help your argument, since if the economy is going, revenue will go up if rates are exactly the same.