He tried to warn us!

“It is the wrong thing. These guys are getting away with murder. I want to lower the rates for the middle class.”

www.reuters.com

www.reuters.com

Of course no one in Congress would ever approve of such changes in the tax code:

But Cohn told Axios that the hedge fund and private equity lobby was too strong to overcome. “The reality of this town is that constituency [hedge funds and private equity] has a very large presence in the House and the Senate. They have really strong relationships on both sides of the aisle,” he said. “We just didn’t have the support on carried interest.”

www.cnbc.com

www.cnbc.com

Of course Bloomberg, shills for the Hedge Fund Brigade, claims President Trump’s proposed taxes for them would hurt the regular guy:

www.bloomberg.com

www.bloomberg.com

“It is the wrong thing. These guys are getting away with murder. I want to lower the rates for the middle class.”

Trump says tax code is letting hedge funds 'get away with murder'

Republican presidential front-runner Donald Trump blasted hedge fund managers on Sunday as mere "paper pushers" who he said were "getting away with murder" by not paying their fair share of taxes.

Of course no one in Congress would ever approve of such changes in the tax code:

But Cohn told Axios that the hedge fund and private equity lobby was too strong to overcome. “The reality of this town is that constituency [hedge funds and private equity] has a very large presence in the House and the Senate. They have really strong relationships on both sides of the aisle,” he said. “We just didn’t have the support on carried interest.”

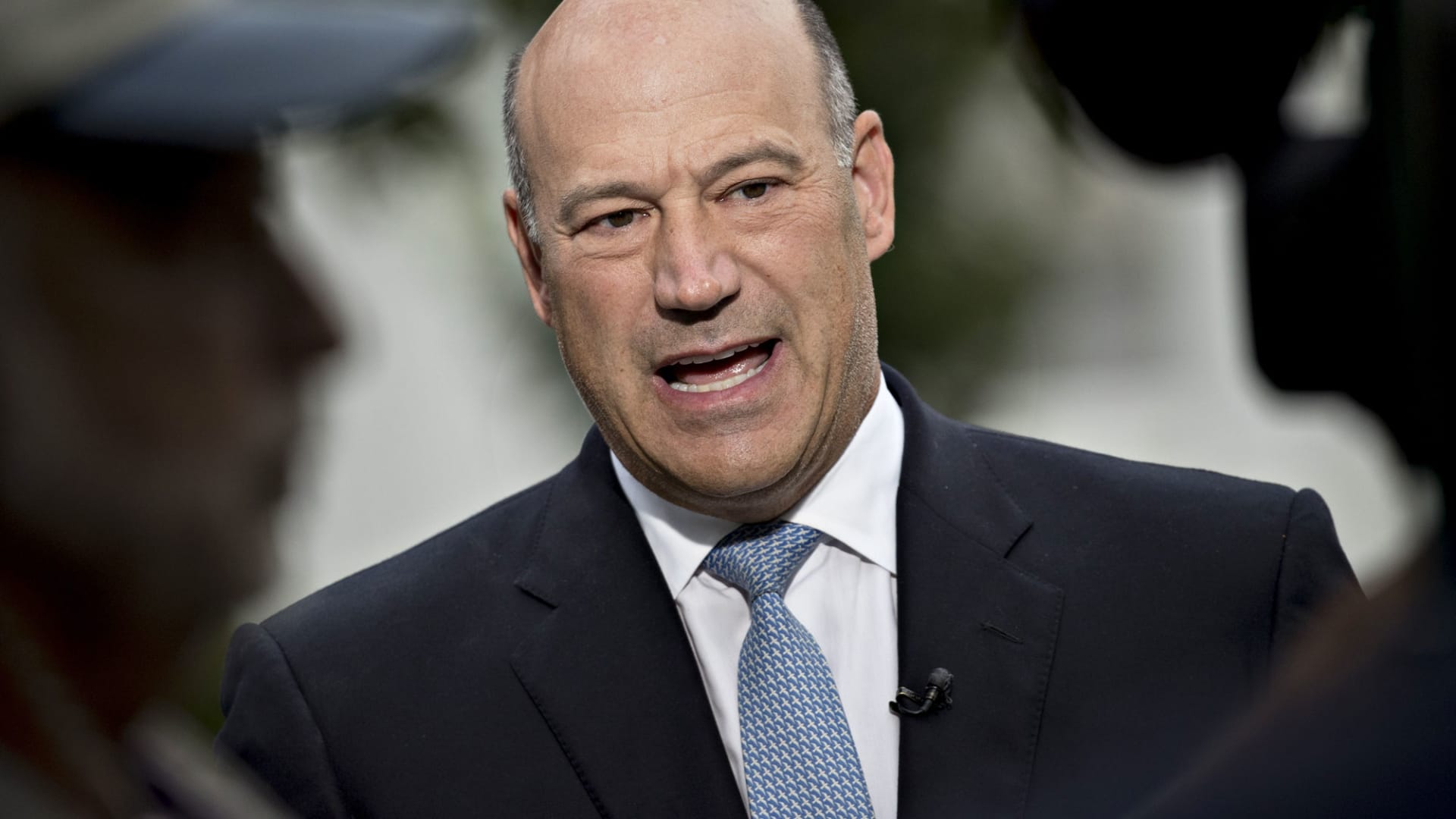

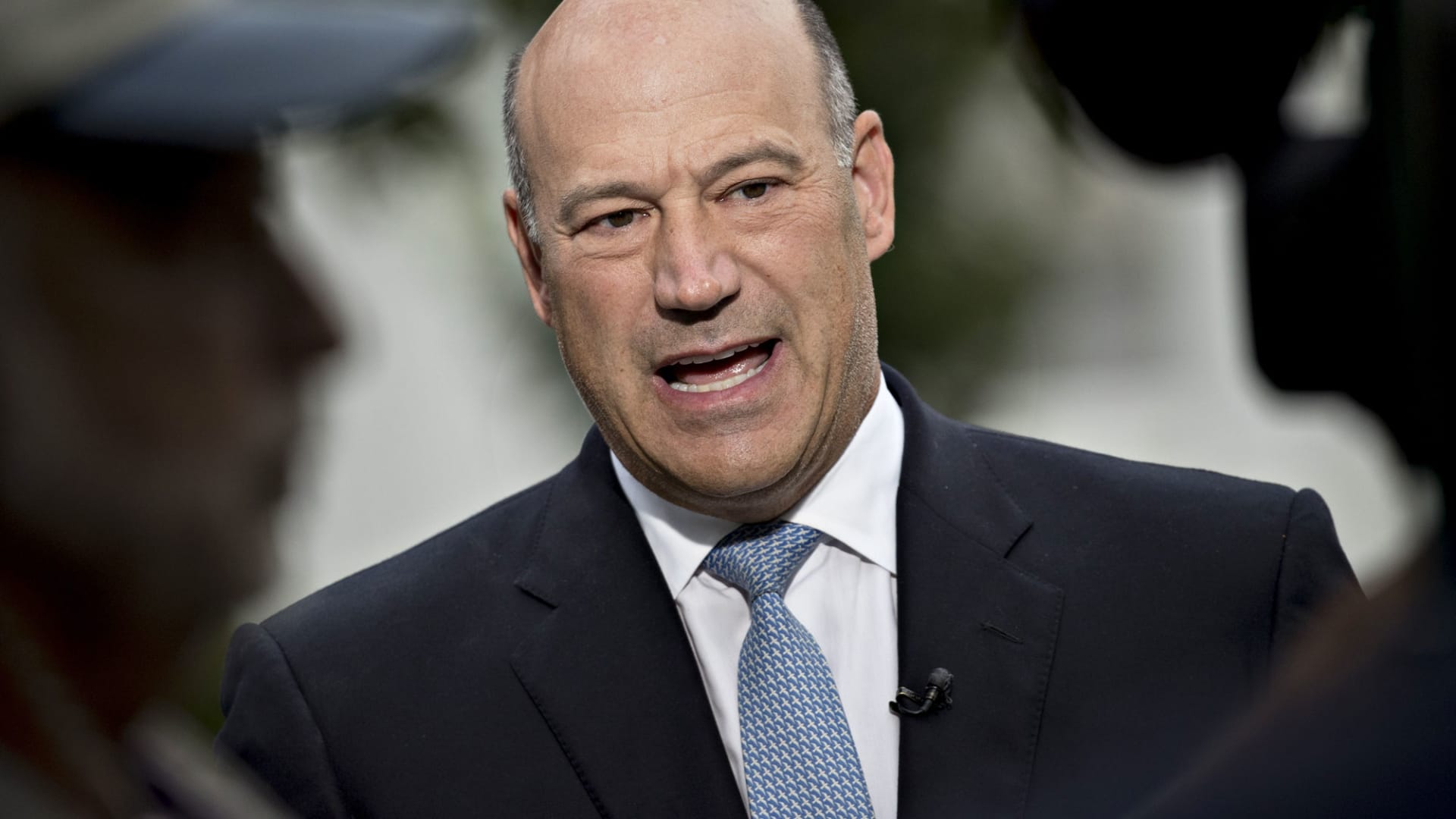

Gary Cohn: We 'tried 25 times' to cut hedge fund loophole in tax reform bill, but failed

White House chief economic advisor Gary Cohn says the administration attempted to eliminate the carried interest tax loophole.

Of course Bloomberg, shills for the Hedge Fund Brigade, claims President Trump’s proposed taxes for them would hurt the regular guy:

Trump’s Capital Gains Taxation Idea Could Have a Surprising Victim

Depending on how it’s implemented, indexing cap gains for inflation could harm hedge funds at the expense of ordinary investors.