Candor about taxes is rare in Washington, so when House Speaker Nancy Pelosi admits that Democrats may have to impose a huge new tax on the middle class to fund their spending ambitions, believe her.

Speaking with PBS's Charlie Rose on Monday, Mrs. Pelosi mused publicly about the rising possibility of enacting a value-added tax, or VAT, as part of broader tax reform. "Somewhere along the way, a value-added tax plays into this," she said. "Of course, we want to take down the health-care cost, that's one part of it. But in the scheme of things, I think it's fair to look at a value-added tax as well."

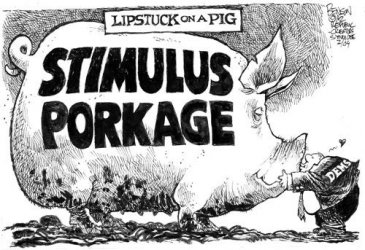

The allure of a VAT for politicians is that it applies to every level of production or service, rakes in piles of money, and is largely hidden from those who ultimately pay it—namely, consumers. With a $9 trillion 10-year budget deficit, $4 trillion in spending in fiscal 2010 alone, and a $1 trillion (at a minimum) health-care entitlement in the wings, Mrs. Pelosi knows that not even the revenue from the expiration of the lower Bush tax rates in 2011 will cover the bills. Nearly every European country that has passed national health care has also eventually imposed a VAT, and it's foolish to think the U.S. will be different.

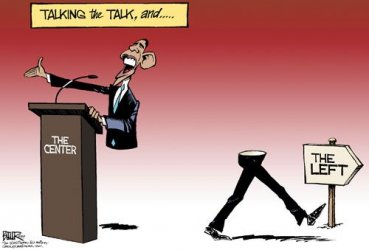

Mrs. Pelosi is the second prominent Democrat to call for a VAT in recent weeks. John Podesta, an adviser to President Obama and president of the very liberal Center for American Progress, called in September for a "small and more progressive" VAT. Mrs. Pelosi and Mr. Podesta argue a new tax is necessary to address the nation's exploding financial liabilities, as if those liabilities exploded on their own. Of course, VATs always start "small" and get bigger. The bills for the Democratic spending blowout are coming due even sooner than advertised, and the middle class will pay, whatever Mr. Obama's campaign promises.

http://online.wsj.com/article/SB10001424052748703298004574457512007010416.html

"What the heck"---

What happened to the PROMISE that anyone making less than 250 K per year would not see their taxes raised by one single dime? So they're going to add a huge tax increase--& HIDE it from us--

What happened to the PROMISE that anyone making less than 250 K per year would not see their taxes raised by one single dime? So they're going to add a huge tax increase--& HIDE it from us--

The irony: The generation who will pay the most for this national sales tax will be the youngsters of this country that overwhelmingly voted for Obama. They will be out buying washers/dryers/T.V's & other large appliances- & paying not only state sales taxes but a national sales tax too.--

How's all that hopey & changey working for ya?

Speaking with PBS's Charlie Rose on Monday, Mrs. Pelosi mused publicly about the rising possibility of enacting a value-added tax, or VAT, as part of broader tax reform. "Somewhere along the way, a value-added tax plays into this," she said. "Of course, we want to take down the health-care cost, that's one part of it. But in the scheme of things, I think it's fair to look at a value-added tax as well."

The allure of a VAT for politicians is that it applies to every level of production or service, rakes in piles of money, and is largely hidden from those who ultimately pay it—namely, consumers. With a $9 trillion 10-year budget deficit, $4 trillion in spending in fiscal 2010 alone, and a $1 trillion (at a minimum) health-care entitlement in the wings, Mrs. Pelosi knows that not even the revenue from the expiration of the lower Bush tax rates in 2011 will cover the bills. Nearly every European country that has passed national health care has also eventually imposed a VAT, and it's foolish to think the U.S. will be different.

Mrs. Pelosi is the second prominent Democrat to call for a VAT in recent weeks. John Podesta, an adviser to President Obama and president of the very liberal Center for American Progress, called in September for a "small and more progressive" VAT. Mrs. Pelosi and Mr. Podesta argue a new tax is necessary to address the nation's exploding financial liabilities, as if those liabilities exploded on their own. Of course, VATs always start "small" and get bigger. The bills for the Democratic spending blowout are coming due even sooner than advertised, and the middle class will pay, whatever Mr. Obama's campaign promises.

http://online.wsj.com/article/SB10001424052748703298004574457512007010416.html

"What the heck"---

What happened to the PROMISE that anyone making less than 250 K per year would not see their taxes raised by one single dime? So they're going to add a huge tax increase--& HIDE it from us--

What happened to the PROMISE that anyone making less than 250 K per year would not see their taxes raised by one single dime? So they're going to add a huge tax increase--& HIDE it from us--The irony: The generation who will pay the most for this national sales tax will be the youngsters of this country that overwhelmingly voted for Obama. They will be out buying washers/dryers/T.V's & other large appliances- & paying not only state sales taxes but a national sales tax too.--

How's all that hopey & changey working for ya?

Last edited: