ilia25

I can do math

- Jan 12, 2012

- 1,859

- 100

- 48

Right here.

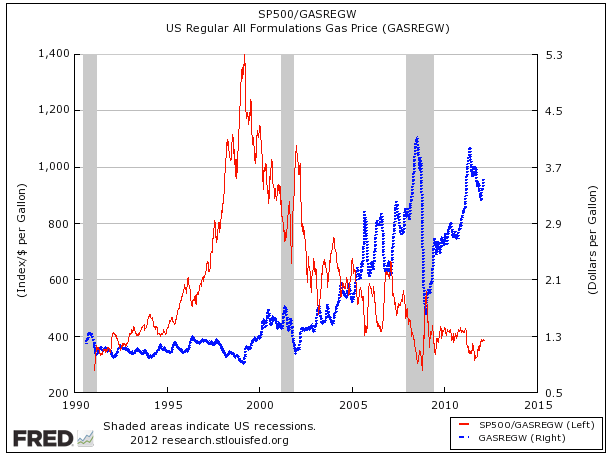

In case you are wondering what you are looking at, the red line is the average of the S&P divided by the cost of a gallon of gas, the blue line is tracking the price of a gallon of gas. Prices of commodities are going up, and the return on investments is going down. That, despite all the numbers that indicate otherwise, is inflation.

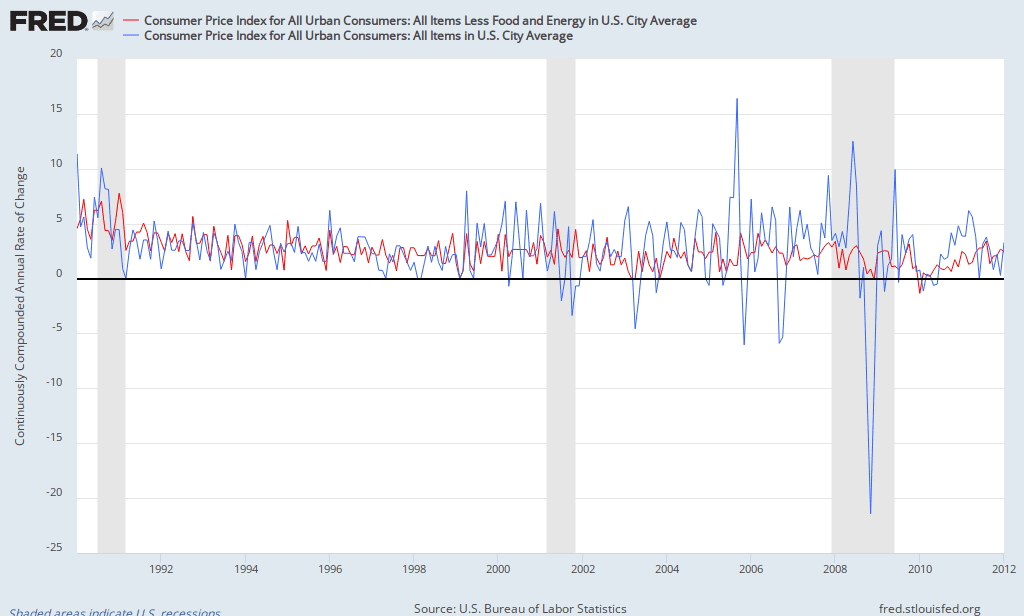

There are always things that get more expensive, while others get cheaper. What matters is the overall inflation.

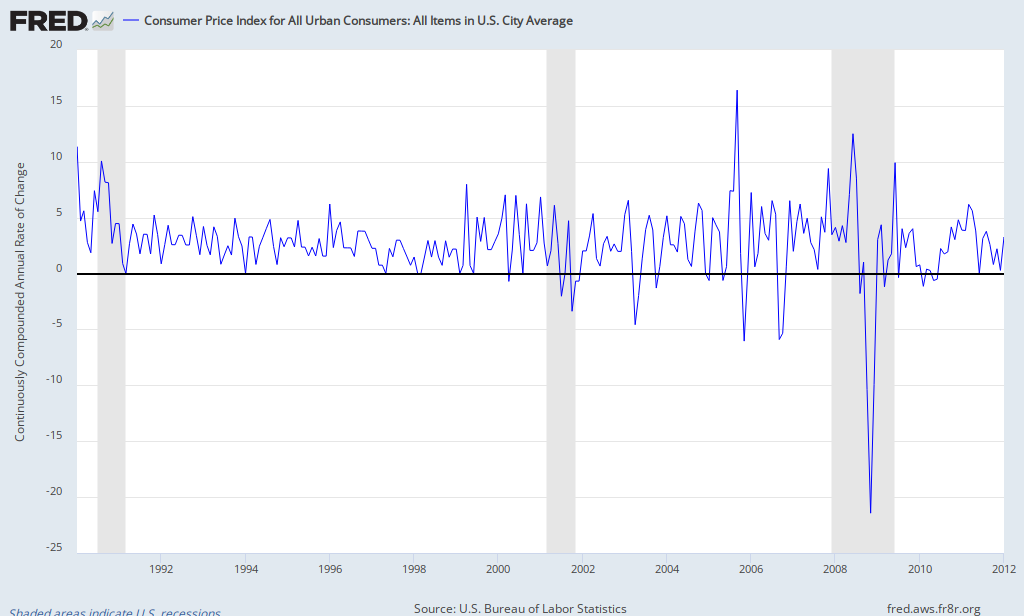

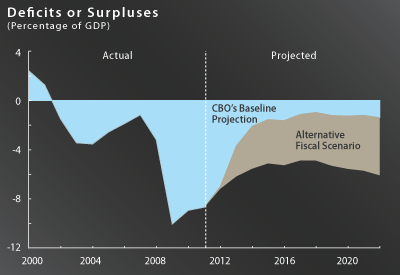

If Keynes was actually correct then the only thing keeping us put of inflation is the fact that we are in a recession.

Bingo!