Dad2three

Gold Member

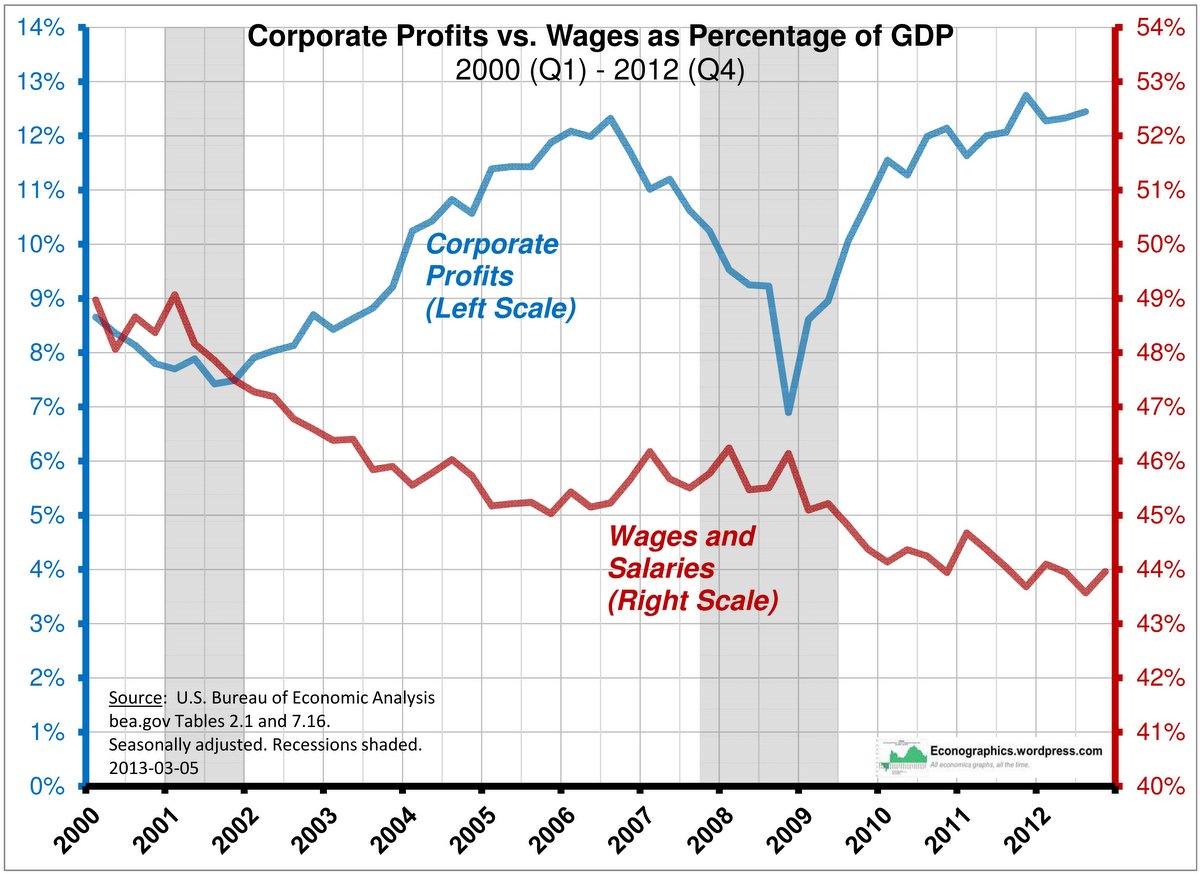

We had record numbers of people not in the workforce throughout the entire Bush Regime, funny none of the Right accused Bush of using them to keep his UE rate artificially low.Cue outrage over workforce participation rate

Employers added 173,000 jobs in a key report that could help the Federal Reserve decide whether to raise interest rates later this month.

The unemployment rate fell from 5.3% to 5.1%, lowest since March 2008.

Jobs

Is that counting all the illegals doing jobs "Americans don't want"?

We still have a record number of people not in the workforce. That is the only way the "unemployment rate" goes down with this administration.

Uh, no we didn't. During the Bush years we had record high workforce participation rates. Only after Dems took Congress and sank the economy in his last year did it go down. It continued to go down during the Hussein's Presidency.

Don't let FACTS OR TRUTH stop your screed Bubs

But since 2000, the labor force rate has been steadily declining as the baby-boom generation has been retiring. Because of this, the Federal Reserve Bank of Chicago expects the labor force participation rate to be lower in 2020 than it is today, regardless of how well the economy does.

In a March report titled "Dispelling an Urban Legend," Dean Maki, an economist at Barclays Capital, found that demographics accounted for a majority of the drop in the participation rate since 2002

The incredible shrinking labor force