Dad2three

Gold Member

There were multiple causes of the Balloon/Crash, but the most important was government fiscal and monetary policy OF WHICH THE CRA WAS JUST PART.

yes very well put!! And lets not forget Fanny/Fredie, huge huge GSE's designed to subvert the free market to get people into homes the free market said they could not afford!

RIGHT WING LIAR. I'm shocked, I've already spanked you on that nonsense here

http://www.usmessageboard.com/economy/362889-facts-on-dubya-s-great-recession.html

Examining the big lie: How the facts of the economic crisis stack up

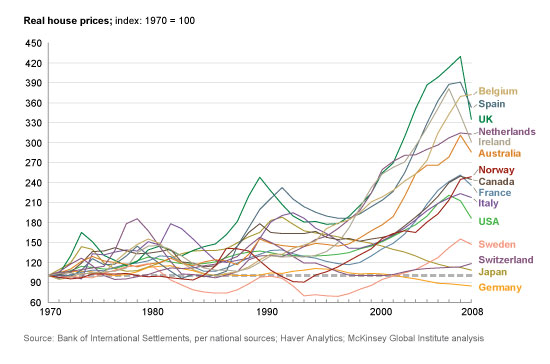

The boom and bust was global. Proponents of the Big Lie ignore the worldwide nature of the housing boom and bust.

A McKinsey Global Institute report noted from 2000 through 2007, a remarkable run-up in global home prices occurred. It is highly unlikely that a simultaneous boom and bust everywhere else in the world was caused by one set of factors (ultra-low rates, securitized AAA-rated subprime, derivatives) but had a different set of causes in the United States. Indeed, this might be the biggest obstacle to pushing the false narrative.

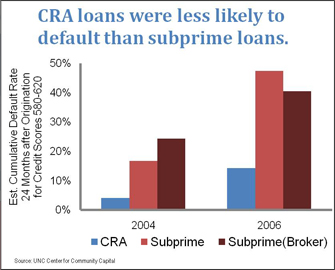

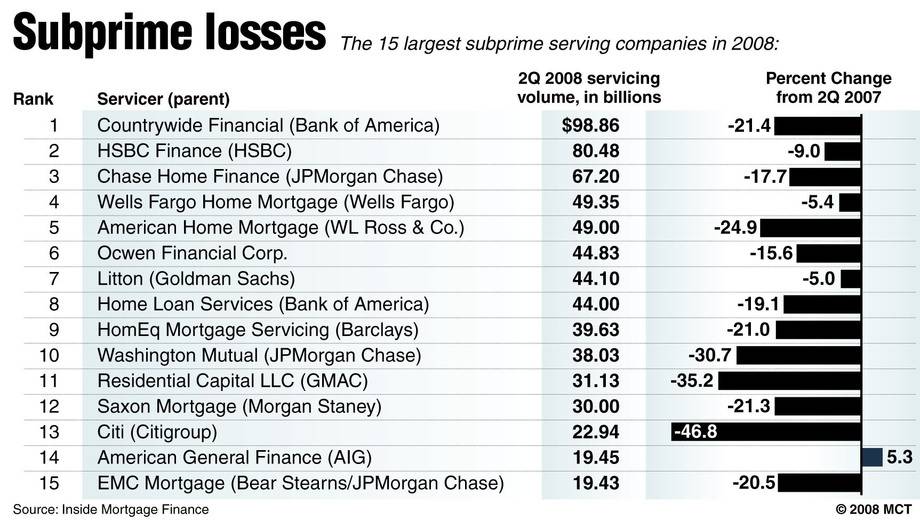

Nonbank mortgage underwriting exploded from 2001 to 2007, along with the private label securitization market, which eclipsed Fannie and Freddie during the boom.

http://www.ritholtz.com/blog/wp-content/uploads/2011/11/fannieFreddie2.jpg

Private lenders not subject to congressional regulations collapsed lending standards.

Only one of the top 25 subprime lenders in 2006 was directly subject to the housing laws overseen by either Fannie Mae, Freddie Mac or the Community Reinvestment Act Source: McClatchy

Examining the big lie: How the facts of the economic crisis stack up | The Big Picture