eots

no fly list

When we took delivery of my wife's 2012 Chevrolet Volt back in March, I figured we'd be putting gas in it every 6 weeks or so.

Now, here we are 8-1/2 months and 8,930 miles later and I'm refueling it for the first time. Spent $24.50 for 6.6 gallons of premium (tank is 9.3 gallons, so there was still about 2.7 gallons left)

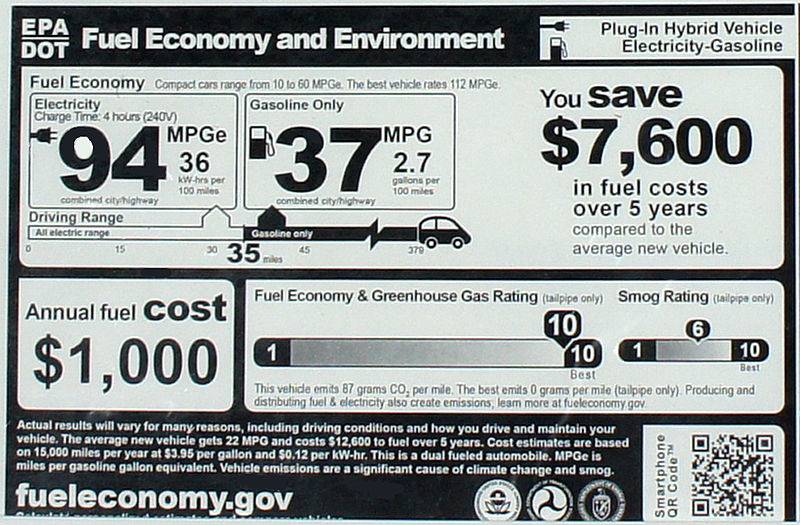

When I did my first calculations to see whether it made more sense to lease the Volt or go with our second or third choice vehicles (2012 Chevrolet Equinox or 2013 Chevrolet Malibu) I factored in the idea that the first 35 miles would be electrically driven, then I added in gas driven miles. What I did not factor in is that since most of my wife's trips are less than 20 miles, she would be returning home and plugging back in, so by the time she needed to make another trip, she would be back at or near a full charge.

As a result, she often went weeks without burning any gas. So our total energy cost for the car are $344.50 for 8+ months. That's $320 in electricity cost (we have a flat $40/mo deal with DTE Energy) + $24.50 in gas. That amounts to 3.86 cents per mile driven.

It be cool to drop one of these bad boys in her

[ame=http://www.youtube.com/watch?v=rxyH2WUKwPw]1969 427 corvette motor - YouTube[/ame]