Ravi

Diamond Member

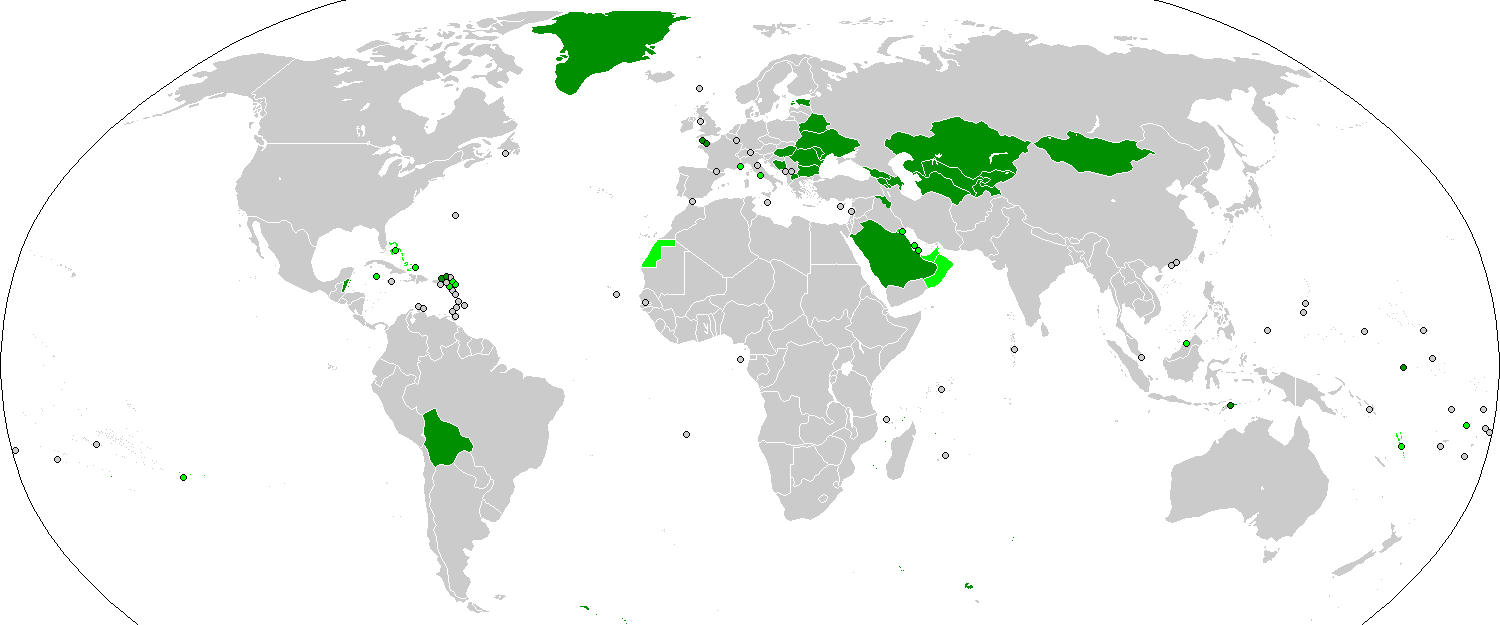

Countries with Flat Taxes:

It would appear that the ex-soviet states have largely embraced flat taxes...perhaps because their populations have given up on socialist wealth-redistribution schemes?

Oh well, it was a nice dream while it lasted.