CrusaderFrank

Diamond Member

- May 20, 2009

- 148,629

- 71,937

- 2,330

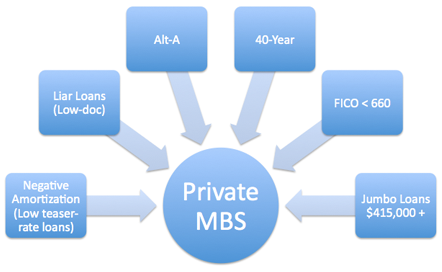

.the damage was already done by Wall Street bankster and PRIVATE lenders outside of government regulations.

too stupid by 1000%!! Wall Street operated within an environment created by Fed Fanny Fred, etc etc .Did the dummy think Wall Street printed its own money to constantly inflate the housing market?

Is it possible you are THAT dense? Wall Street created their own environment. They were catering to speculators had who NO INTEREST in a "mortgage". They were NOT buying a homestead. They CRAVED gimmicks that would allow them to buy multiple homes with ZERO down. They were merely buying an investment to flip for profit.

Truly stop and THINK. No one can be THAT dense.

You have no idea how "Wall Street" works. They were supplying F/F with the paper they wanted and were making their own synthetic AAA SubPrime crap paper

such as OSHA, EPA, etc... You CAN'T be serious son

such as OSHA, EPA, etc... You CAN'T be serious son