Zander

Platinum Member

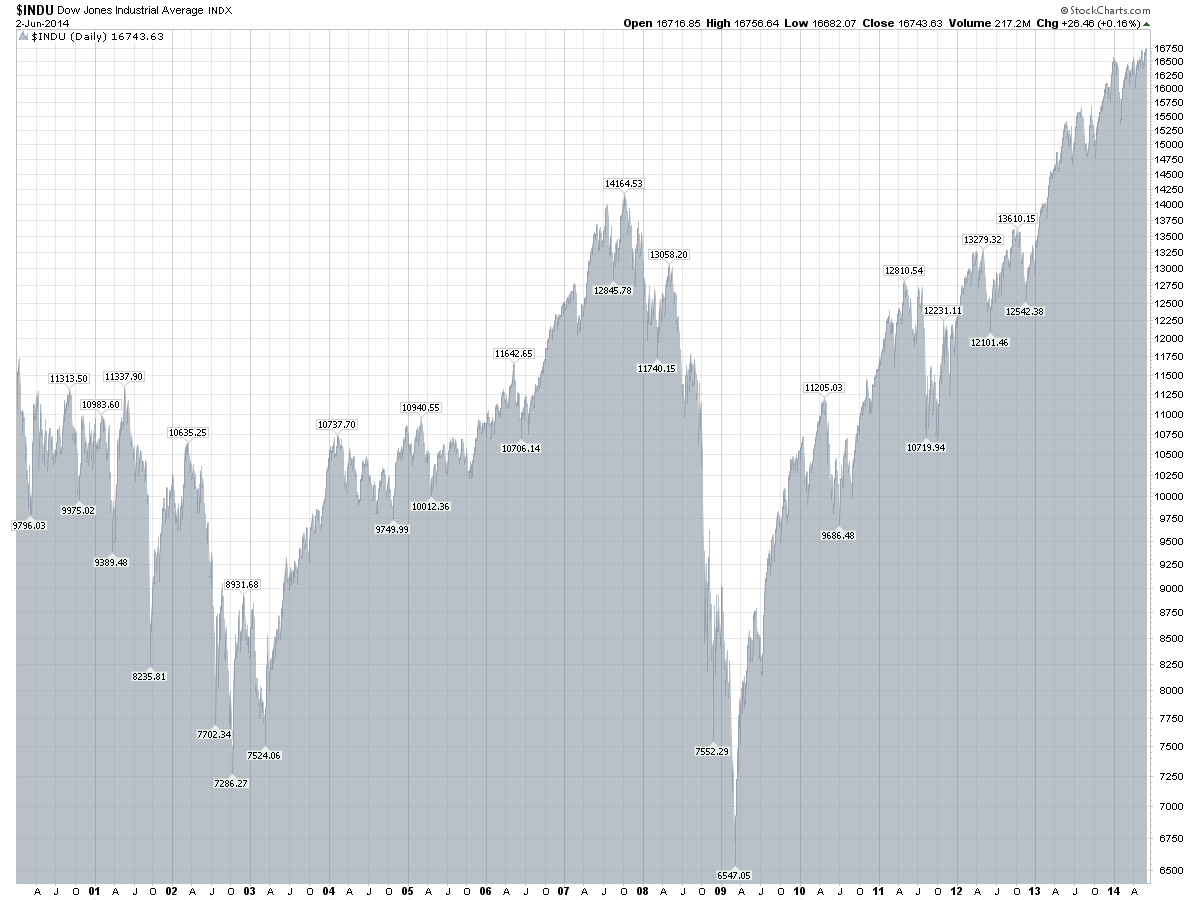

Want to become an investor? Go here......Bogleheads

Read it, apply it, benefit.

Trading is for gamblers, dummies, and people that already have lots of money. 26 year old people need to stay fully invested at all times.

Read it, apply it, benefit.

Trading is for gamblers, dummies, and people that already have lots of money. 26 year old people need to stay fully invested at all times.