bripat9643

Diamond Member

- Apr 1, 2011

- 170,170

- 47,328

- 2,180

Illinois Loses Most Jobs in Nation Following Tax Hikes - Page 1 - Mike Shedlock - Townhall Finance

Thanks to Illinois governor Pat Quinn and the Illinois legislature Illinois Loses Most Jobs in the Nation

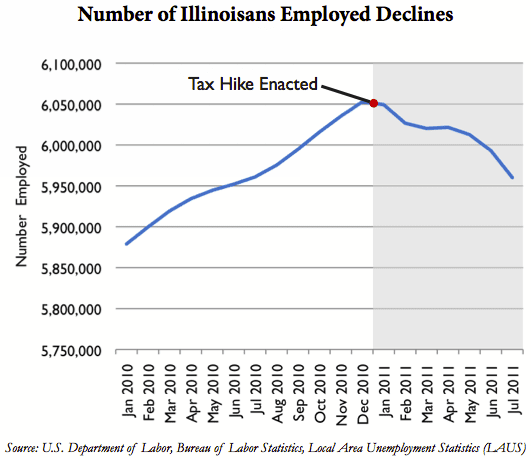

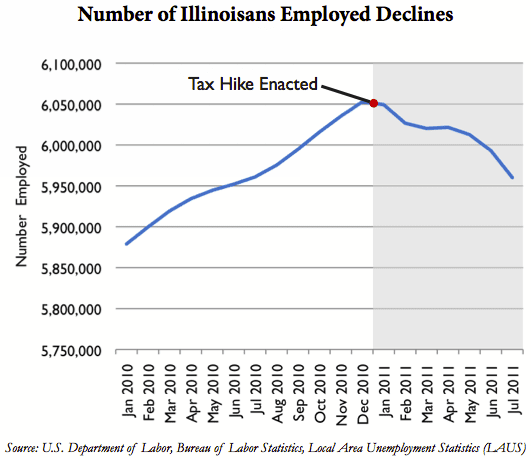

In a trend that continues to worsen, more Illinoisans found themselves unemployed in the month of July.

Illinois lost more jobs during the month of July than any other state in the nation, according to the most recent Bureau of Labor Statistics report. After losing 7,200 jobs in June, Illinois lost an additional 24,900 non-farm payroll jobs in July. The report also said Illinoiss unemployment rate climbed to 9.5 percent. This marks the third consecutive month of increases in the unemployment rate.

Illinois started to create jobs as the national economy began to recover. But just when Illinoiss economy seemed to be turning around, lawmakers passed record tax increases in January of this year. Since then, Illinoiss employment numbers have done nothing but decline.

Thanks to Illinois governor Pat Quinn and the Illinois legislature Illinois Loses Most Jobs in the Nation

In a trend that continues to worsen, more Illinoisans found themselves unemployed in the month of July.

Illinois lost more jobs during the month of July than any other state in the nation, according to the most recent Bureau of Labor Statistics report. After losing 7,200 jobs in June, Illinois lost an additional 24,900 non-farm payroll jobs in July. The report also said Illinoiss unemployment rate climbed to 9.5 percent. This marks the third consecutive month of increases in the unemployment rate.

Illinois started to create jobs as the national economy began to recover. But just when Illinoiss economy seemed to be turning around, lawmakers passed record tax increases in January of this year. Since then, Illinoiss employment numbers have done nothing but decline.