RAISING TAXES during a period of monetary scarcity is not a good idea.

Neither is reducing government spending is good idea in times like these.

Note how one party wants to raise taxes while the other party wants to reduce spending?

Doesn't this make ANY OF YOU PARTISANS kind of suspicious?

Not at all?!

If money was scarce, would the bank-to-bank interest rate be 0?

They're pushing on a string.

As long as the DEMAND side is lacking capital to buy, the SUPPLY SIDE has no interest in borrowing to increase production.

This current economic sitution is why that income and wealth disparity is a problem, amigo.

Further decreasing taxes on the wealthy will not solve the problem because the problem is NOT that the supply side is lacking capital.

Increasing taxes on the weathy will ALSO NOT SOLVE the problem because that will exascerbate the problem.

The problem is that American consumers do not have the money to consume.

And as long as the demand for goods is down, there will be no money put into increasing the supply side.

Hence, no new jobs will be forthcoming.

I can't imainge why people have so much difficulty understanding this.

You all seem to understand the principle of supply demand UNTIL the issue becomes MACRO-ECONOMIC, and them some of you seem to go into MAGICAL THINKING MODE.

And by some of you I mean both the leadership of the RNC and the leadership of the DNC.

Both have plans that not only will not work, but that will make the immediate problem even worse!

Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature currently requires accessing the site using the built-in Safari browser.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

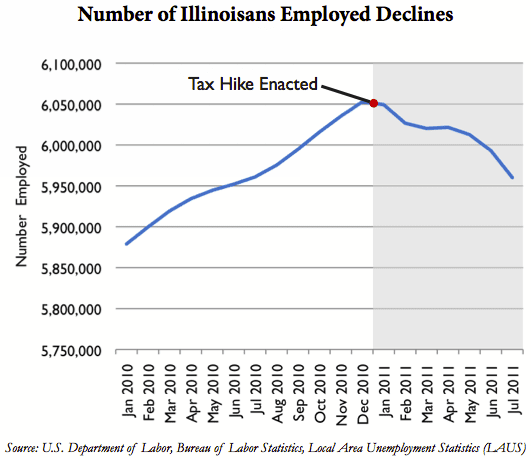

Illinois Loses Most Jobs in Nation Following Tax Hikes

- Thread starter bripat9643

- Start date

Illinois Loses Most Jobs in Nation Following Tax Hikes - Page 1 - Mike Shedlock - Townhall Finance

Thanks to Illinois governor Pat Quinn and the Illinois legislature Illinois Loses Most Jobs in the Nation

In a trend that continues to worsen, more Illinoisans found themselves unemployed in the month of July.

Illinois lost more jobs during the month of July than any other state in the nation, according to the most recent Bureau of Labor Statistics report. After losing 7,200 jobs in June, Illinois lost an additional 24,900 non-farm payroll jobs in July. The report also said Illinoiss unemployment rate climbed to 9.5 percent. This marks the third consecutive month of increases in the unemployment rate.

Illinois started to create jobs as the national economy began to recover. But just when Illinoiss economy seemed to be turning around, lawmakers passed record tax increases in January of this year. Since then, Illinoiss employment numbers have done nothing but decline.

Now--Now--you know libtards are not going to understand this. According to them--taxes HAVE NOTHING to do with economic conditions---

Here is another one--New Jersey LOST 70 BILLION IN state tax revenue in just 5 years--because the wealthy in that state got tired of getting taken to the cleaners--so they just left and went to a lower taxed state.

N.J. loses $70B in wealth during five years as residents depart | NJ.com

Your two links cover entirely different types of taxes. The Illinois link covered corporate tax rates and the New Jersey link covered personal tax rates.

It might interest you to know that after Illinois raised the corporate tax rate there are still 21 states that are still higher. And 30 states have higher personal income tax rates.

Corporate tax in the United States - Wikipedia, the free encyclopedia

State Income Tax Rates

The biggest reason that Illinois loses so many jobs is because of its large manufacturing base. And negative effects on the economy and jobs will more harshly affect Illinois simply because of its size. The corporate tax increase did have a negative effect but not to the extent you are implying.

It might also interest you to know that Illinois is ranked the NUMBER ONE state in which to make a living.

1. Illinois

At $41,986.51, Illinois had the best adjusted-average income. The unemployment rate in Illinois is not especially low, but the state benefits from relatively high average wages, a low state tax rate, and a below-average cost of living. As an added plus, you can make good use of your money once you earn it in Illinois. Four of the best banks in America, based on a MoneyRates.com analysis of factors like customer service, checking account fees, and savings and money market rates, have operations in Illinois.

Rankings of the Best 10 States for Making a Living

Class dismissed.

.

RAISING TAXES during a period of monetary scarcity is not a good idea.

Neither is reducing government spending is good idea in times like these.

Note how one party wants to raise taxes while the other party wants to reduce spending?

Doesn't this make ANY OF YOU PARTISANS kind of suspicious?

Not at all?!

If money was scarce, would the bank-to-bank interest rate be 0?

They're pushing on a string.

As long as the DEMAND side is lacking capital to buy, the SUPPLY SIDE has no interest in borrowing to increase production.

This current economic sitution is why that income and wealth disparity is a problem, amigo.

Further decreasing taxes on the wealthy will not solve the problem because the problem is NOT that the supply side is lacking capital.

Increasing taxes on the weathy will ALSO NOT SOLVE the problem because that will exascerbate the problem.

The problem is that American consumers do not have the money to consume.

And as long as the demand for goods is down, there will be no money put into increasing the supply side.

Hence, no new jobs will be forthcoming.

I can't imainge why people have so much difficulty understanding this.

You all seem to understand the principle of supply demand UNTIL the issue becomes MACRO-ECONOMIC, and them some of you seem to go into MAGICAL THINKING MODE.

And by some of you I mean both the leadership of the RNC and the leadership of the DNC.

Both have plans that not only will not work, but that will make the immediate problem even worse!

We need to increase the demand for employees. We could do it by reducing taxes on employment, like Social Security, but that Ponzi scheme is already running an annual deficit.

Why not reduce taxes on employment in a way that doesn't bankrupt Social Security?

Repeal Obamacare and reform workman's comp. Tort reform would help. Repeal Davis-Bacon.

- Sep 12, 2008

- 14,201

- 3,567

- 185

Correlation doesn't prove causation.

True, it does not. However, if you run the same test over and over, and you get similar results, then there might be a cause and effect relation. We have seen other tests in other places where increases in state tax causes declines in employment. We have also seen tests in the other direction.

What we have here is an assertion that dropping a bowling ball on a mouse might be the reason the mouse died. It could have died of alcoholism, cigarette abuse, old age, congenital defect of some kind, starvation, an aneurysm, or a host of other reasons.

However, if every time we drop the bowling ball on the mouse, and it dies we might discern a patter where we can confidently say that dropping a bowling ball on the mouse is fatal to the mouse.

What happened in IL is not a single data point. It is part of a long series in which we see the same consistant result. Because of the size of the tax hike, the result is also very pronounced. But it is consistant with previous tests.

Soggy in NOLA

Diamond Member

- Jul 31, 2009

- 40,565

- 5,358

- 1,830

Correlation doesn't prove causation.

You should revisit your thread where you whined incessantly about Bush's tax cuts not creating jobs.

NYcarbineer

Diamond Member

Correlation doesn't prove causation.

You should revisit your thread where you whined incessantly about Bush's tax cuts not creating jobs.

They were meant to create jobs. That's why the GOP used the term 'job creators' as a talking point,

about a zillion times.

NYcarbineer

Diamond Member

Correlation doesn't prove causation.

True, it does not. However, if you run the same test over and over, and you get similar results, then there might be a cause and effect relation. We have seen other tests in other places where increases in state tax causes declines in employment. We have also seen tests in the other direction.

What we have here is an assertion that dropping a bowling ball on a mouse might be the reason the mouse died. It could have died of alcoholism, cigarette abuse, old age, congenital defect of some kind, starvation, an aneurysm, or a host of other reasons.

However, if every time we drop the bowling ball on the mouse, and it dies we might discern a patter where we can confidently say that dropping a bowling ball on the mouse is fatal to the mouse.

What happened in IL is not a single data point. It is part of a long series in which we see the same consistant result. Because of the size of the tax hike, the result is also very pronounced. But it is consistant with previous tests.

Well, maybe the election of Rick Scott in Florida caused all the job losses we've seen there since then.

I mean, if I just say so, and don't have to prove it, does it magically become true?

Avorysuds

Gold Member

Correlation doesn't prove causation.

Says the guy who tries to tie the Bush tax cuts (that Democrats and Obama passed) as "not working" simply because Obama's economy fucking sucks and his policies have not managed to meet a single benchmark he himself set. If this chart can't prove that higher taxes hurt jobs then how can YOU prove that the Bush tax cuts don't help create jobs?

Or are the Bush taxes cuts supposed to make up for the effects

4-5 Wars

Obamacare

Obama getting the country downgraded by signing one of the worst budgets in history, the Dems and Bonehard voted for. I mention all that because I know you like to mention Bonehard got 98% of what he wanted but neglet to mention Obama got 100% of what he wanted when he put his name on it.

Talk of higher taxes ALL THE TIME

A stimulus that added massively to the debt when even you admitted it wouldn't work long term... Like you were told over and over and over a nd over and over...........

A stimulus is not meant to work long term. It's a finite amount, so it has a finite effect. Why is that so hard for you 'nuts to understand?

A stimulus that added massively to the debt when even you admitted it wouldn't work long term... Like you were told over and over and over and over and over..........

So, NY... What was the point of the stimulus? It's obviously not hard for me and many others to understand being WE TOLD YOU that's all the stimulus would do.

You supported, fought for and attacked people over a stimulus that you now claim was only going to have a temporary effect... Great, you JUST NOW caught up to where were on the issues years ago. Grats.

If Obama wants another stimulus, and we all say it will just float the economy AGAIN until the money is spent, then when bottom of the economy STILL falls out we will be left with MORE massive debt, AGAIN Will you support it because your butt boy Obama wants it? Or will you man up and say It will only float the economy making the rich richer, the poor poorer and then run out, leave us with massive debt and fix nothing like the last stimulus.

Try realllllly hard not to be an absolute partisan blow hard hack for once.

Avorysuds

Gold Member

Correlation doesn't prove causation.

You should revisit your thread where you whined incessantly about Bush's tax cuts not creating jobs.

They were meant to create jobs. That's why the GOP used the term 'job creators' as a talking point,

about a zillion times.

Prove they didn't...

People sit here and claim Obama saved the US ON FUCKING ACCIDENT BTW! from a Great Depression....... That's right, Obama didn't even know he did it until after it NEVER happened.

So how come people can't claim without Bush tax cuts UE would be around 93%? I mean, Bush saved the future on ACCIDENT too it seems.

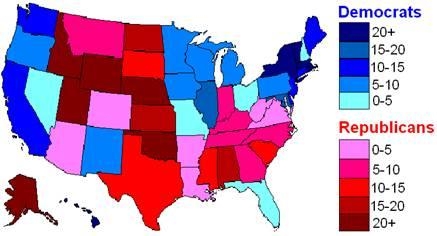

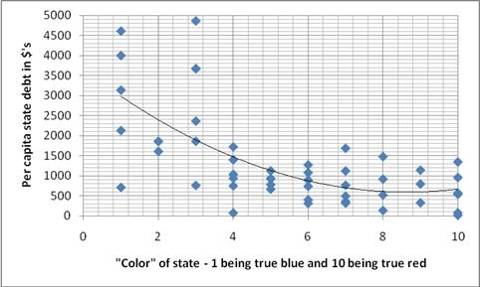

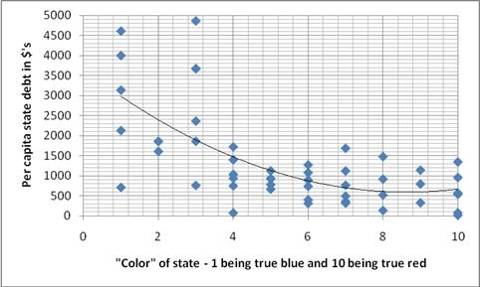

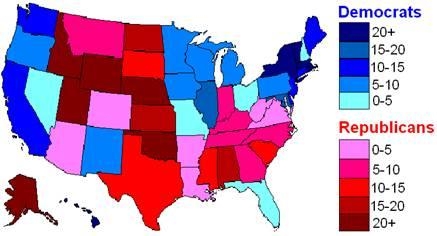

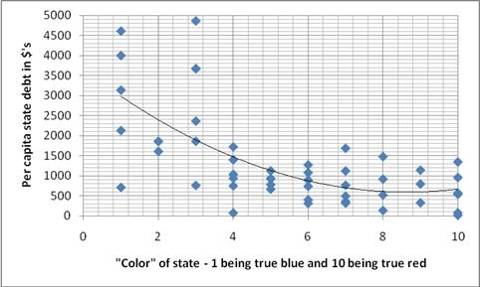

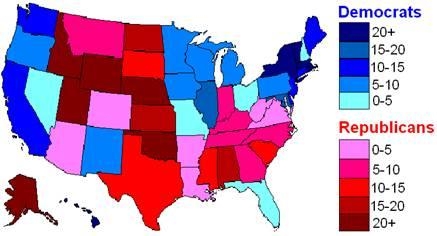

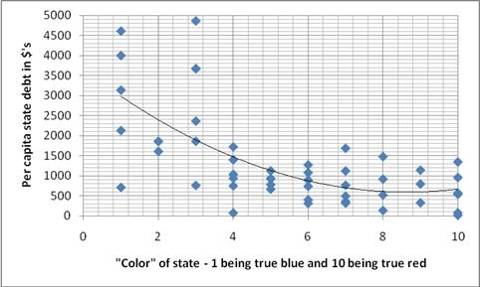

Clearly tax rates have an effect on jobs. Illinois has a structural problem - a massive state debt. Liberals reflexively raise taxes whenever any revenue issue arises. That is why "blue states" are all running massive deficits. Here is a map of the states along with the margins of victory.

The average color of a state is 5.5, suggesting a relatively even split in the states, and the average per capita state debt is $1313.

The average "blue" or Democrat-leaning state (score of 5 or lower) averages a per capita debt of $1896.

The average "red" or Republican-leaning state (score of 6 or higher) averages a per capita debt of $729.

The 10 lowest per capita debt states were all red, or Republican, with an average color of 7.4 and an average debt of $250.

The 10 highest per capita debt states are all blue, or Democrat, with an average color of 2.1 and an average debt of $3214

Draw your own conclusions.....

The average color of a state is 5.5, suggesting a relatively even split in the states, and the average per capita state debt is $1313.

The average "blue" or Democrat-leaning state (score of 5 or lower) averages a per capita debt of $1896.

The average "red" or Republican-leaning state (score of 6 or higher) averages a per capita debt of $729.

The 10 lowest per capita debt states were all red, or Republican, with an average color of 7.4 and an average debt of $250.

The 10 highest per capita debt states are all blue, or Democrat, with an average color of 2.1 and an average debt of $3214

Draw your own conclusions.....

NYcarbineer

Diamond Member

Clearly tax rates have an effect on jobs. Illinois has a structural problem - a massive state debt. Liberals reflexively raise taxes whenever any revenue issue arises. That is why "blue states" are all running massive deficits. Here is a map of the states along with the margins of victory.

The average color of a state is 5.5, suggesting a relatively even split in the states, and the average per capita state debt is $1313.

The average "blue" or Democrat-leaning state (score of 5 or lower) averages a per capita debt of $1896.

The average "red" or Republican-leaning state (score of 6 or higher) averages a per capita debt of $729.

The 10 lowest per capita debt states were all red, or Republican, with an average color of 7.4 and an average debt of $250.

The 10 highest per capita debt states are all blue, or Democrat, with an average color of 2.1 and an average debt of $3214

Draw your own conclusions.....

New England and the Middle Atantic regions (the very blue ones) currently have the lowest average unemployment rates in the country.

NYcarbineer

Diamond Member

[Prove they didn't...

You want me to prove a negative?

Right after you prove that the stimulus didn't prevent us from going to 11% or more UE.

LibocalypseNow

Senior Member

- Jul 30, 2009

- 12,337

- 1,368

- 48

Just another State Socialist/Progressive Democrats have destroyed. Par for the course for them. It's very sad observing their destruction of Illinois and especially Chicago.

NYcarbineer

Diamond Member

Says the guy who tries to tie the Bush tax cuts (that Democrats and Obama passed) as "not working" simply because Obama's economy fucking sucks and his policies have not managed to meet a single benchmark he himself set. If this chart can't prove that higher taxes hurt jobs then how can YOU prove that the Bush tax cuts don't help create jobs?

Or are the Bush taxes cuts supposed to make up for the effects

4-5 Wars

Obamacare

Obama getting the country downgraded by signing one of the worst budgets in history, the Dems and Bonehard voted for. I mention all that because I know you like to mention Bonehard got 98% of what he wanted but neglet to mention Obama got 100% of what he wanted when he put his name on it.

Talk of higher taxes ALL THE TIME

A stimulus that added massively to the debt when even you admitted it wouldn't work long term... Like you were told over and over and over a nd over and over...........

A stimulus is not meant to work long term. It's a finite amount, so it has a finite effect. Why is that so hard for you 'nuts to understand?

A stimulus that added massively to the debt when even you admitted it wouldn't work long term... Like you were told over and over and over and over and over..........

So, NY... What was the point of the stimulus? It's obviously not hard for me and many others to understand being WE TOLD YOU that's all the stimulus would do.

You supported, fought for and attacked people over a stimulus that you now claim was only going to have a temporary effect... Great, you JUST NOW caught up to where were on the issues years ago. Grats.

If Obama wants another stimulus, and we all say it will just float the economy AGAIN until the money is spent, then when bottom of the economy STILL falls out we will be left with MORE massive debt, AGAIN Will you support it because your butt boy Obama wants it? Or will you man up and say It will only float the economy making the rich richer, the poor poorer and then run out, leave us with massive debt and fix nothing like the last stimulus.

Try realllllly hard not to be an absolute partisan blow hard hack for once.

I deal in facts. The stimulus lifted GDP and the job numbers for 2 years, because it was basically a 2 year stimulus.

What's partisan about pointing out that fact? Neither party was going to do nothing in January of 2009, whoever was in power.

They're pushing on a string.

As long as the DEMAND side is lacking capital to buy, the SUPPLY SIDE has no interest in borrowing to increase production.

This current economic sitution is why that income and wealth disparity is a problem, amigo.

Further decreasing taxes on the wealthy will not solve the problem because the problem is NOT that the supply side is lacking capital.

Increasing taxes on the weathy will ALSO NOT SOLVE the problem because that will exascerbate the problem.

The problem is that American consumers do not have the money to consume.

And as long as the demand for goods is down, there will be no money put into increasing the supply side.

Hence, no new jobs will be forthcoming.

I can't imainge why people have so much difficulty understanding this.

You all seem to understand the principle of supply demand UNTIL the issue becomes MACRO-ECONOMIC, and them some of you seem to go into MAGICAL THINKING MODE.

And by some of you I mean both the leadership of the RNC and the leadership of the DNC.

Both have plans that not only will not work, but that will make the immediate problem even worse!

Yes.We need to increase the demand for employees.

already doneWe could do it by reducing taxes on employment,

like Social Security,

A big fat target for sure

but that Ponzi scheme is already running an annual deficit.

That trust fund has trillions of dollars owed to it.

Why not reduce taxes on employment in a way that doesn't bankrupt Social Security?

Show us your plan

Repeal Obamacare and reform workman's comp.

the new HC plan doesn't ring my chimes. Workman's comp I don't know much about,

Tort reform would help.

I'm dubious about that.

Repeal Davis-Bacon.

Bad idea, Works counter to your suggestion that the consumer side needs more money

RAISING TAXES during a period of monetary scarcity is not a good idea.

Neither is reducing government spending is good idea in times like these.

Note how one party wants to raise taxes while the other party wants to reduce spending?

Doesn't this make ANY OF YOU PARTISANS kind of suspicious?

Not at all?!

If money was scarce, would the bank-to-bank interest rate be 0?

They're pushing on a string.

As long as the DEMAND side is lacking capital to buy, the SUPPLY SIDE has no interest in borrowing to increase production.

This current economic sitution is why that income and wealth disparity is a problem, amigo.

Further decreasing taxes on the wealthy will not solve the problem because the problem is NOT that the supply side is lacking capital.

Increasing taxes on the weathy will ALSO NOT SOLVE the problem because that will exascerbate the problem.

The problem is that American consumers do not have the money to consume.

And as long as the demand for goods is down, there will be no money put into increasing the supply side.

Hence, no new jobs will be forthcoming.

I can't imainge why people have so much difficulty understanding this.

You all seem to understand the principle of supply demand UNTIL the issue becomes MACRO-ECONOMIC, and them some of you seem to go into MAGICAL THINKING MODE.

And by some of you I mean both the leadership of the RNC and the leadership of the DNC.

Both have plans that not only will not work, but that will make the immediate problem even worse!

That's 'cause they (our fearful leaders) are the servants of the current campaign-contributing status quo and the current status quo wants no changes to the directionality of the rivers of cash-flow running through our economy.

For things to get and remain this far askew, somebody is working hard to conserve the status quo for as long as possible.

Can you blame them?

They're pushing on a string.

As long as the DEMAND side is lacking capital to buy, the SUPPLY SIDE has no interest in borrowing to increase production.

This current economic sitution is why that income and wealth disparity is a problem, amigo.

Further decreasing taxes on the wealthy will not solve the problem because the problem is NOT that the supply side is lacking capital.

Increasing taxes on the weathy will ALSO NOT SOLVE the problem because that will exascerbate the problem.

The problem is that American consumers do not have the money to consume.

And as long as the demand for goods is down, there will be no money put into increasing the supply side.

Hence, no new jobs will be forthcoming.

I can't imainge why people have so much difficulty understanding this.

You all seem to understand the principle of supply demand UNTIL the issue becomes MACRO-ECONOMIC, and them some of you seem to go into MAGICAL THINKING MODE.

And by some of you I mean both the leadership of the RNC and the leadership of the DNC.

Both have plans that not only will not work, but that will make the immediate problem even worse!

We need to increase the demand for employees. We could do it by reducing taxes on employment, like Social Security, but that Ponzi scheme is already running an annual deficit.

Why not reduce taxes on employment in a way that doesn't bankrupt Social Security?

Repeal Obamacare and reform workman's comp. Tort reform would help. Repeal Davis-Bacon.

I still think we should keep the solution as simple as possible... Fair taxes through simplicity and a budget balanced by law. See what the economy is actually worth before committing to any spending.

Last edited:

Clearly tax rates have an effect on jobs. Illinois has a structural problem - a massive state debt. Liberals reflexively raise taxes whenever any revenue issue arises. That is why "blue states" are all running massive deficits. Here is a map of the states along with the margins of victory.

The average color of a state is 5.5, suggesting a relatively even split in the states, and the average per capita state debt is $1313.

The average "blue" or Democrat-leaning state (score of 5 or lower) averages a per capita debt of $1896.

The average "red" or Republican-leaning state (score of 6 or higher) averages a per capita debt of $729.

The 10 lowest per capita debt states were all red, or Republican, with an average color of 7.4 and an average debt of $250.

The 10 highest per capita debt states are all blue, or Democrat, with an average color of 2.1 and an average debt of $3214

Draw your own conclusions.....

New England and the Middle Atantic regions (the very blue ones) currently have the lowest average unemployment rates in the country.

And the highest deficits and debt. There is no free lunch.

Yes.

already done

A big fat target for sure

That trust fund has trillions of dollars owed to it.

Show us your plan

the new HC plan doesn't ring my chimes. Workman's comp I don't know much about,

I'm dubious about that.

Bad idea, Works counter to your suggestion that the consumer side needs more money

How have taxes on employment been reduced?

My suggestion wasn't that the consumer side needs more money, please re-read.

Yes, the Trust Fund is owed Trillions. It is also running a deficit in the current year.

daveman

Diamond Member

I don't have to prove anything to you, mainly because I can't. There is no amount of evidence I could give you that would convince you that leftist anti-business policies are bad for business.Feel free to prove causation. Feel free to at least make an attempt at it.

You can start with this problem.

Illinois lost the most jobs last month. You say it's because of the tax increase, but you can't prove it.

Florida lost the second most jobs last month. Florida had no tax increase. Explain that.

New York had the biggest job GAIN last month, btw.

So, you just continue beating your dog and being surprised when it runs away.

Similar threads

- Replies

- 11

- Views

- 140

- Replies

- 152

- Views

- 5K

- Replies

- 41

- Views

- 488

- Replies

- 42

- Views

- 2K

Latest Discussions

- Replies

- 524

- Views

- 3K

- Replies

- 129

- Views

- 353

- Replies

- 225

- Views

- 3K

- Replies

- 44

- Views

- 432

Forum List

-

-

-

-

-

Political Satire 8029

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

ObamaCare 781

-

-

-

-

-

-

-

-

-

-

-

Member Usernotes 468

-

-

-

-

-

-

-

-

-

-