usmbguest5318

Gold Member

- Thread starter

- #141

Middle class taxes will be raised.. some now some later..

But you have to lie about it because you trust the guvment.

Middle class taxes will be raised..

What income range is middle class?What income range is middle class?

Seriously? Do you truly not know what income range constitutes middle class (middle income)? If you don't, well, you just don't; that is what it is. But if you don't, why are you participating declaratively in this thread?

- Household Income Quintiles and the Top 5% | Outside the Neatline

- Household income in the U.S. - shares of quintiles | Timeline

- Household Income: HINC-05

How does one propose a tax cut that is unpopular?

You don't.

But when the media lies, nonstop, saying the tax cut will raise middle class taxes, people believed them.

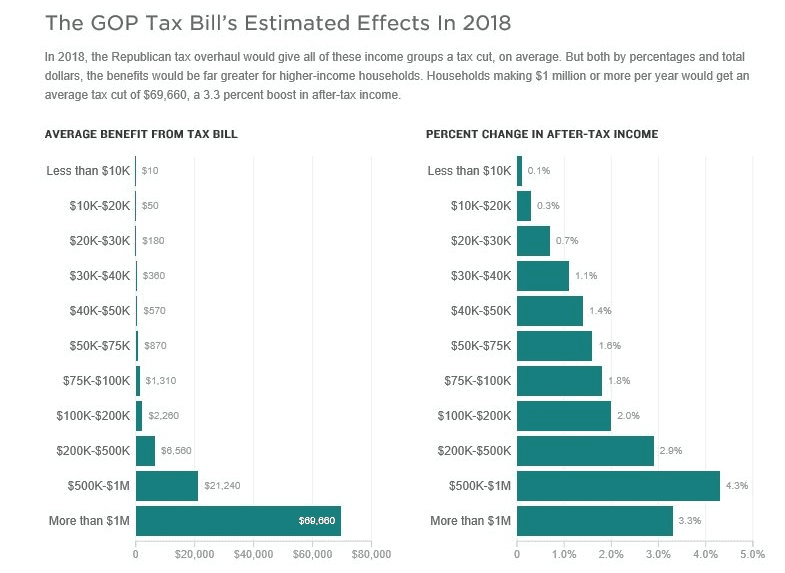

CHARTS: See How Much Of GOP Tax Cuts Will Go To The Middle Class

The numbers look bleaker a decade out for most American households. To help ensure their bill met the budget limits Republicans had set for themselves, lawmakers set many individual income tax changes to sunset after 2025 (however, they made cuts to corporate tax rates permanent).

As a result, the Tax Policy Center predicts that in 2027, the average tax cut would amount to $160, or just a 0.2 percent income bump.

This would mean a tiny tax bump for many lower- and middle-class households — the average $50,000 to $75,000 — earning household would have a tax bill that is $30 higher than today. The average household earning more than $1 million would get a cut of more than $23,000.

Look at them widening the gap between the rich and poor.

You do realize, don't you, that changes in after-tax income include the effects of changes to pre-tax income? One of those pre-tax effects is simple pay increases, and another is inflation, neither of which appears to be accounted for in the chart you've presented above.Thanks for the link. And for proving the media was lying about the bill hiking taxes on the middle class.

View attachment 167049

As a result, the Tax Policy Center predicts that in 2027,

ZZZ.......sorry, I fell asleep after 2027. DERP!

The inadequacy of the chart above is one of the reasons I included in post 130 the JCT analysis that isolates the tax impact, showing it without regard to other factors which, for any individual other than themselves, are unpredictable enough to be validly extrapolated for use in a macroeconomic-level discussion such as this thread.

That said, were I in whatever one deems "middle class," I would be very annoyed upon seeing, be it in the TPC's or JCT's analysis, that the gains accruing to me be proportionally lower than those accruing to folks who already have "a ton" of money. (In almost every U.S. locality, members of households having $500K+/year in income are one-percenters.)

Seriously? Do you truly not know what income range constitutes middle class (middle income)?

Seriously. When some liberal is whining about the middle class, I'm not assuming he means middle quintile.

You do realize, don't you, that changes in after-tax income include the effects of changes to pre-tax income?

I do!

One of those pre-tax effects is simple pay increases, and another is inflation, neither of which appears to be accounted for in the chart you've presented above.

If you feel a certain pay increase or a certain rate of inflation will turn this tax cut into a tax hike....present your data and I'll be happy to look it over. And that's not my chart, it was in a link provided by the other poster.

The inadequacy of the chart above is one of the reasons I included in post 130 the JCT analysis that isolates the tax impact

Be sure to notify The Tax Policy Center of their inadequacy. Please post their response.I'm not assuming he means middle quintile.

Single middle quintile or middle three quintiles. It's all middle class.

If you feel a certain pay increase or a certain rate of inflation will turn this tax cut into a tax hike....present your data and I'll be happy to look it over.

I did already. See post 130 and the linked documents I referenced. (You don't think I posted everything that's here relevant and also contained in those documents, do you? I didn't, and when I post links, one can be sure I have not. I didn't/don't and won't ever do so because I provide(-d) links to them.)

Additionally, the Tax Policy Center (TPC) research which you insisted I examine, like the JTC's research that I referenced earlier, asserts that the JTCA will ultimately amount to being a tax hike.

If you feel a certain pay increase or a certain rate of inflation will turn this tax cut into a tax hike....

You've been trying to derail this thread by repeatedly asking that off-topic question about whether the JTCA is constitutes a tax hike....That is what you've been "on about" even though the topic isn't, as I made clear not in the OP and title, but also that I reiterated to you in post 14.

Besides trying to derail this thread, you have followed Procrustes' bad example so comprehensively that, if I'm to refrain from accusing you of utter villainy, I must infer that like the JCT reports to which I linked, you didn't read the TPC's report to which the other member linked. When will you endeavor to invest more effort in informing yourself than it takes to look at and read more than just the pictures?

[Xelor wrote:] The inadequacy of the chart above is one of the reasons I included in post 130 the JCT analysis that isolates the tax impact

[Toddsterpatriot wrote:] Be sure to notify The Tax Policy Center of their inadequacy. Please post their response.

They don't materially disagree with the JCT, so why would I do that? In the opening paragraph of TPC's full report (dated December 18t, 2017) on the distributional effects of the JTCA, the report from which the data in the chart the other member obtained from the NPR website, is found the following statement.

Those increases are why the damn JTCA is unpopular!Compared to current law, 5 percent of taxpayers would pay more tax in 2018, 9 percent in 2025,and 53 percent in 2027.

The JTCA is an "on the sly" tax increase, and everyone except Trump, GOP partisan sycophants, and myopic know-not-nearly-enoughs, who, like you, don't do more than make invalid inferences from cherry-picked pictures, know it! Even the GOP members of Congress know it; however, for purely temporal political expediency they chose to pass a major bill that's bad rather than take the time to craft a major tax bill that (1) revenue neutral (by which I here mean doesn't increase the deficit any more than it otherwise would increase), (2) is distributionally equitable to middle and lower income groups, and (3) that lowers corporate marginal tax rates. something which could have been done paid for largely via a mix of eliminating corporate loopholes and eliminating high-income individuals' loopholes.

Single middle quintile or middle three quintiles. It's all middle class.

Be sure to tell whiny liberals to specify that in their next whine.

I did already. See post 130 and the linked documents I referenced.

I didn't see mention of pay hikes in those links. Or that a certain rate of inflation turns the cut into a hike.

You've been trying to derail this thread by repeatedly asking that off-topic question about whether the JTCA is constitutes a tax hike....

Only because the media keeps saying it will hike taxes on the middle class.

Compared to current law, 5 percent of taxpayers would pay more tax in 2018, 9 percent in 2025.....Those increases are why the damn JTCA is unpopular!

5% paying more isn't what the media has been claiming.

You've been trying to derail this thread

Only because the media keeps saying it will hike taxes on the middle class.

5% paying more isn't what the media has been claiming.

Let me inform you: I AM NOT "THE MEDIA."

Go derail "the media's" thread(s), not mine! If necessary, post on their websites, or tweet about their reporting.

Go derail "the media's" thread(s), not mine! If necessary, post on their websites, or tweet about their reporting.