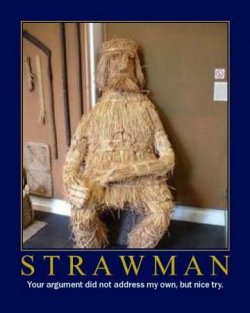

Oh wow, another novel idea. RAISE TAXES.

Great idea. As of April 1st, the U.S. will have the highest corporate tax rates in the world:

TaxProf Blog: Tax Foundation: On April 1, U.S. Is #1 (World's Highest Corporate Tax Rate)

Let's raise them further so we can make double digit unemployment a structural feature of the economy.

The word "statutory" does a lot of heavy lifting in that chart.