- Mar 1, 2008

- 49,947

- 17,326

- 2,250

Cubs are born losers.I hope so.

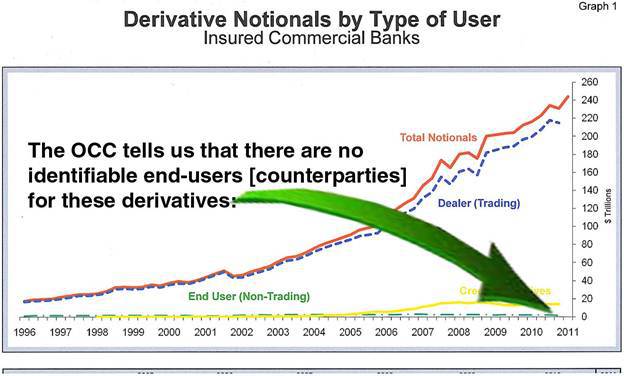

"Royce is clearly on to something. When the stock market tanks, the share prices of the big Wall Street banks plummet to a greater degree than the overall market because of the trillions of dollars (yes trillions) in derivatives they hold and the lack of transparency as to whether the counterparties on the other side of these trades will be solvent in a plummeting market."

Wall Street On Parade

I just placed a $5 bet on a Cubs game.

My bet (derivative) has a notional value of $2.5 billion. Should I worry?

Why would $5 make me worry?

yeah they'll choke in the NL championship game against the Giants.