EdwardBaiamonte

Platinum Member

- Nov 23, 2011

- 34,612

- 2,153

- 1,100

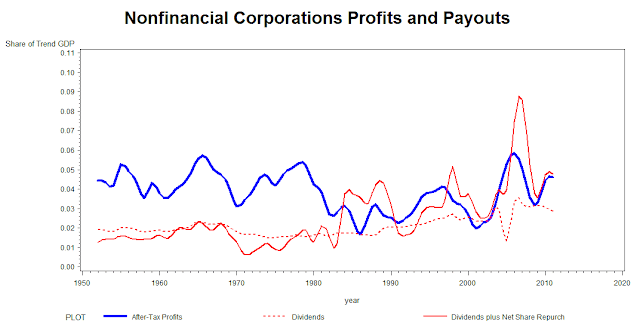

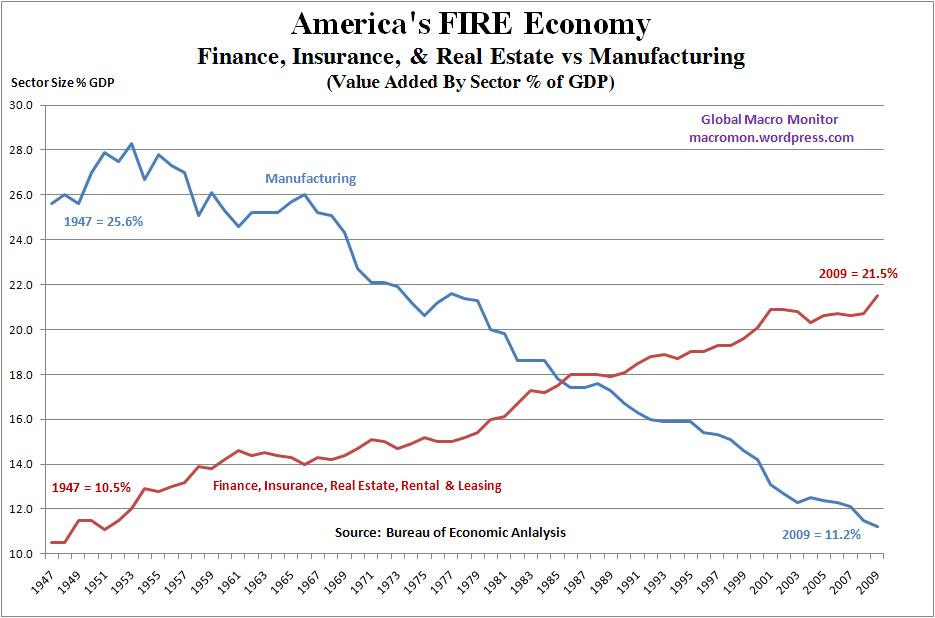

how this money tends to circulate among the rich instead of trickling down as it is expected to.

the liberals thought a luxury tax on yachts was foolproof. The rich stopped buying yachts and the poor and middle class who build and maintained them lost their jobs. The Democrats had to repeal their own fool proof tax.