Toro

Diamond Member

so you completely ignored the historical factual information.

Should I be surprised?

You should be surprised that you don't understand the argument.

You should also know that the world did not begin with the election of Clinton.

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

so you completely ignored the historical factual information.

Should I be surprised?

I understand the argument, you went president , but I WENT TO THE HEART.

NOW YOU ARE DANCING.

You can not dispute recent history.

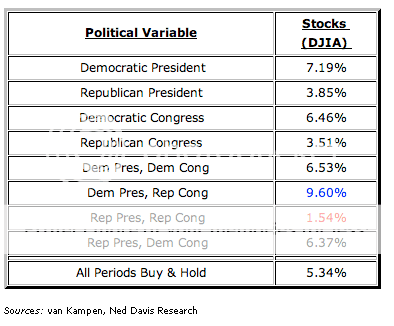

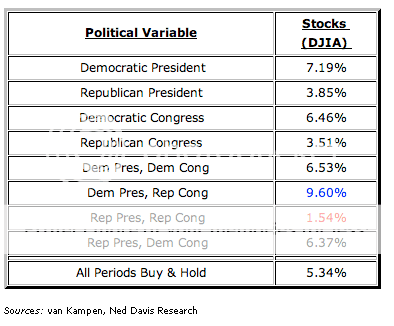

BTW, here is a breakdown of market returns by who has been in power.

"Dow In Positive Territory For The Year"

NEW YORK (CNNMoney.com) -- Stocks churned Friday, at the end of a mixed week on Wall Street, that nonetheless left the Dow industrials in positive territory for the year for the first time since January.

The Dow Jones industrial average (INDU) gained 28 points, or 0.3%, ending above its 2008 close of 8,776.39.

The Dow has now risen in 12 of the last 14 weeks, rising 33% in that time, for its best 14-week stretch since March 1975, according to Dow Jones.

CNNMoney.com Market Report - Jun. 12, 2009

Terral speaks wisdom here, it's the same as any other good or service you buy with inflated dollars. Just because it costs more, doesn't necessarily mean it's WORTH more.

Terral thinks that America is going to be like Zimbabwe, where there was 79,000,000,000% inflation.

The stock marekt responds to all kinds of input.

While certainly the regime in power might have an effect on it, other factors certainly play their role in what happens, too.

I did not credit Clinton for the markets rise, neither do I blame Bush II for its decline.

I'm with TORO here, trying to make political hay out of the DOW is foolish and misinformed.

The stock marekt responds to all kinds of input.

While certainly the regime in power might have an effect on it, other factors certainly play their role in what happens, too.

I did not credit Clinton for the markets rise, neither do I blame Bush II for its decline.

I'm with TORO here, trying to make political hay out of the DOW is foolish and misinformed.

I'm with Terral you can't keep spending trillions of dollars with no backing and expect the outcome to be good.

Does it really matter what the market does if our currency means absolutely nothing? No, I don't believe government is the only factor in the market.The stock marekt responds to all kinds of input.

While certainly the regime in power might have an effect on it, other factors certainly play their role in what happens, too.

I did not credit Clinton for the markets rise, neither do I blame Bush II for its decline.

I'm with TORO here, trying to make political hay out of the DOW is foolish and misinformed.

I'm with Terral you can't keep spending trillions of dollars with no backing and expect the outcome to be good.

Understood.

Apparently the market takes that into account among other factors.

Because, let's face it, if the market ONLY took what the government was doing into account, then the market would be crashing, wouldn't it?

The stock market responds to all kinds of input.

While certainly the regime in power might have an effect on it, other factors certainly play their role in what happens, too.

I did not credit Clinton for the markets rise, neither do I blame Bush II for its decline.

I'm with TORO here, trying to make political hay out of the DOW is foolish and misinformed.

The stock marekt responds to all kinds of input.

While certainly the regime in power might have an effect on it, other factors certainly play their role in what happens, too.

I did not credit Clinton for the markets rise, neither do I blame Bush II for its decline.

I'm with TORO here, trying to make political hay out of the DOW is foolish and misinformed.

I'm with Terral you can't keep spending trillions of dollars with no backing and expect the outcome to be good.

I'll give you some context....The looming demographic train wreck, viz. entitlement spending.Oh, but I agree that you cannot keep spending trillions of dollars without serious reprecusions.

But that is a far cry from saying there is going to be 79 billion percent inflation.

Context people. Context.

Oh, but I agree that you cannot keep spending trillions of dollars without serious repercussions.

But that is a far cry from saying there is going to be 79 billion percent inflation. Inflation is coming, maybe 5% or 10%, but not 79,000,000,000%

Context people. Context.

I'll give you some context....The looming demographic train wreck, viz. entitlement spending.