- Thread starter

- #21

Crude oil price losses give back gains...

Crude oil prices drop more than 1 percent as weak outlook prevails

Tue Dec 29, 2015 - Crude oil futures fell around half a dollar early on Wednesday as the market remained under pressure from slowing demand and high supplies, while forecasts that a cold snap in Europe and the United States would be short-lived also hurt prices.

See also:

Asian stock erase gains as crude oil rebound fizzles

Tue Dec 29, 2015 - Asian shares unwound early gains on Wednesday, as investors turned cautious following renewed selling in recently battered crude oil futures.

Crude oil prices drop more than 1 percent as weak outlook prevails

Tue Dec 29, 2015 - Crude oil futures fell around half a dollar early on Wednesday as the market remained under pressure from slowing demand and high supplies, while forecasts that a cold snap in Europe and the United States would be short-lived also hurt prices.

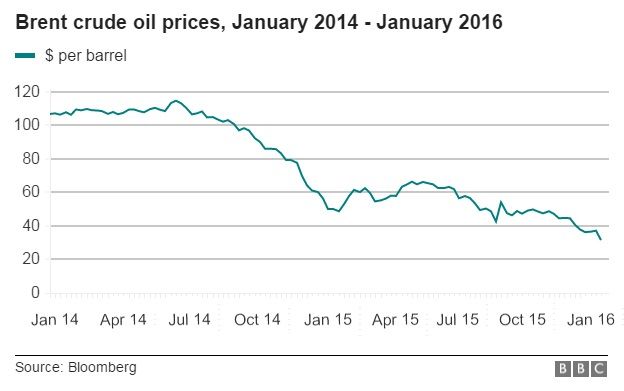

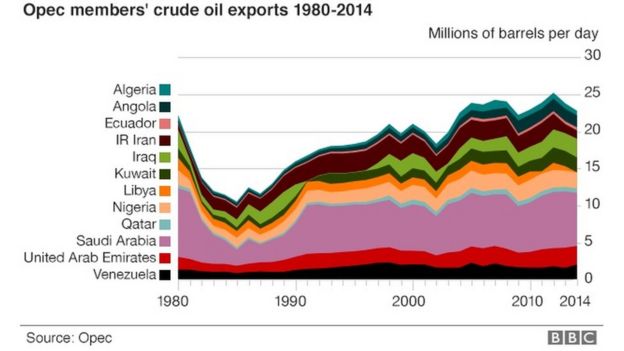

Crude prices have plunged by two-thirds since mid-2014 as soaring output from the Organization of the Petroleum Exporting Countries, Russia and the United States led to a global surplus of between half a million and 2 million barrels per day. More recently, a slowing demand outlook, especially in Asia but also Europe, has started dragging on prices. Front-month U.S. West Texas Intermediate crude futures CLc1 were trading at $37.18 per barrel at 0140 GMT, down 69 cents or 1.82 percent from their last settlement. Brent futures LCOc1 were down 47 cents, or 1.24 percent, to $37.32 a barrel.

Traders said the price falls were largely a result of a weak outlook for next year and the closing of 2015 trade books. "The 2016 outlook is for lower prices, especially early next year. Many are closing their last long positions for the year today as nobody wants to come back in January and be surprised badly. Better start with a clean sheet," a trader said. Forecasts that an upcoming cold weather in Europe will only be short-lived could also hurt crude prices.

U.S. crude and Brent had both rallied about 3 percent in the previous session on hopes that a drop in temperatures would buoy demand for oil for heating purposes. But weather data in Thomson Reuters Eikon shows that average continental European temperatures are expected to drop from around 5 degrees Celsius currently toward and slightly below the seasonal norm of 2.4 degrees by Jan. 3 before rising to as high as 6-8 degrees by Jan. 7. For most of the United States, a brief cold period is also not expected to last for much more than a week.

Crude oil prices drop more than 1 percent as weak outlook prevails

See also:

Asian stock erase gains as crude oil rebound fizzles

Tue Dec 29, 2015 - Asian shares unwound early gains on Wednesday, as investors turned cautious following renewed selling in recently battered crude oil futures.

MSCI's broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS erased a positive start to edge down 0.1 percent, on track for a flat monthly performance and down 12 percent for the year. U.S. crude futures CLc1 skidded 1.8 percent to $37.19 a barrel, while Brent LCOc1 shed 1.2 percent to $37.32. Both had jumped 3 percent overnight, taking back ground lost in the previous session as colder weather forecasts raised expectations of more demand. But weekly data from industry group the American Petroleum Institute (API) showed a rise of almost 3 million barrels in U.S. crude inventories, defying expectations of no change and rekindling fears of a supply glut.

On Wall Street, major U.S. indexes each gained more than 1 percent. All 10 major S&P sectors ended with gains, led by a 1.34 percent rise in the technology sector .SPLRCT, which lifted the S&P 500 .SPX to a modest increase for the year. Japan's Nikkei .N225 was up 0.3 percent, off session highs but still poised to gain over 9 percent for the year, though down more than 3 percent for December. "We're seeing thin volumes at year-end as the number of active participants has decreased due to the holidays," said Martin King, co-managing director at Tyton Capital Advisors. Australian shares outperformed, up 0.9 percent and on track for their ninth consecutive day of gains.

A man, holding a mobile phone, walks past an electronic stock quotation board outside a brokerage in Tokyo, Japan

Higher U.S. Treasury yields underpinned the dollar overnight, although yields were off highs in Asia. The yield on benchmark 10-year U.S. Treasury notes US10YT=RR stood at 2.292 percent, compared with its U.S. close of 2.307 percent on Tuesday. The yield on the U.S. two-year note US2YT=RR closed at 1.095 percent on Tuesday after earlier touching its highest level since April 2010. The dollar index .DXY, which tracks the greenback against a basket of six rival currencies, was up 0.1 percent at 98.207.

The index rose to nearly a one-week high of 98.413 on Tuesday, from a nearly two-week low earlier in the session. It is up 8.8 percent for the year, though down nearly 2 percent for the month as investors pare their dollar-long positions after the U.S. Federal Reserve's widely anticipated interest rate increase earlier in December.

MORE