ColonelAngus

Diamond Member

- Feb 25, 2015

- 53,616

- 54,461

- 3,615

You snowflakes need to educate yourselves because you look like idiots.

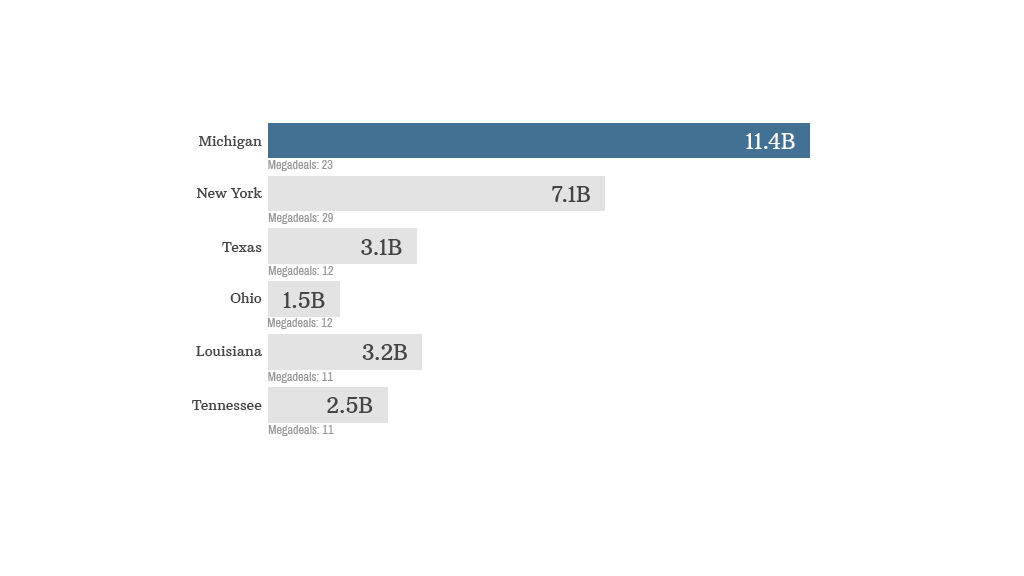

States with sweetest corporate tax breaks

Hmmm.....

States looking to gin up jobs frequently offer sweet tax breaks to lure in new companies or keep businesses from bolting out of state.

But some breaks are considerably sweeter than others.

A new report calculates $64 billion worth of "megadeals" from the past few decades. The report looked at any tax subsidy that cost state and local governments at least $75 million in forgone revenue.

The largest corporations -- from the auto and oil industries to defense and banking -- were big beneficiaries, according to the report, put together by Good Jobs First, a group that tracks state and local tax subsidies.

Michigan offered the greatest number of megadeals -- 29 -- of any state. But New York topped the list in terms of the cumulative value of deals made -- an estimated $11.4 billion.

Among companies, the highest value subsidy went to Alcoa (AA), according to the report. New York offered the aluminium producer a 30-year discounted electricity deal to modernize a plant in 2007. The report estimates the deal's value at $5.6 billion. In exchange, Alcoa agreed to invest $600 million and protect a certain number of jobs.

Boeing (BA) was the recipient of an estimated $4.4 billion in big tax deals, according to the report's calculations. Of that amount, $3.2 billion came from Washington state to support Boeing's aircraft manufacturing facilities in 2003.

In terms of what was most frequently subsidized, the report found that more than half of the 240 deals were for manufacturing facilities. Another 47 were for office facilities such as corporate headquarters.

Related: The 'chicken poop' credit and other bad tax breaks

It identified a number of what it called "job blackmail megadeals" that came about when there was concern a company would pack its bags unless the state made staying more attractive. In this category, Good Jobs First estimated that Nike (NKE) got one of the sweetest deals at the end of 2012 to stay in Oregon -- a guarantee that its state tax computation wouldn't change for 30 years. The report valued that subsidy at $2.02 billion.

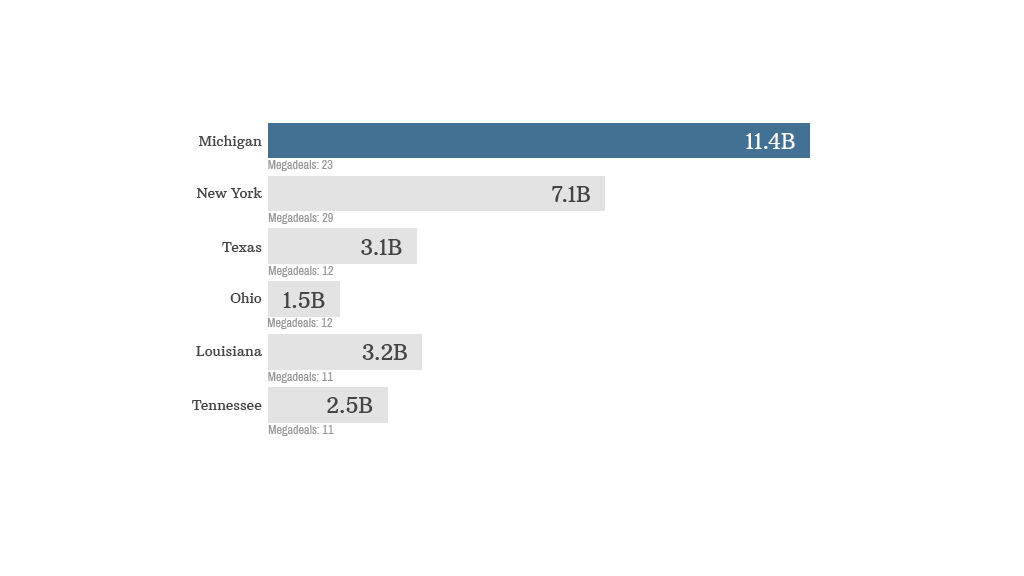

States with sweetest corporate tax breaks

Hmmm.....

States looking to gin up jobs frequently offer sweet tax breaks to lure in new companies or keep businesses from bolting out of state.

But some breaks are considerably sweeter than others.

A new report calculates $64 billion worth of "megadeals" from the past few decades. The report looked at any tax subsidy that cost state and local governments at least $75 million in forgone revenue.

The largest corporations -- from the auto and oil industries to defense and banking -- were big beneficiaries, according to the report, put together by Good Jobs First, a group that tracks state and local tax subsidies.

Michigan offered the greatest number of megadeals -- 29 -- of any state. But New York topped the list in terms of the cumulative value of deals made -- an estimated $11.4 billion.

Among companies, the highest value subsidy went to Alcoa (AA), according to the report. New York offered the aluminium producer a 30-year discounted electricity deal to modernize a plant in 2007. The report estimates the deal's value at $5.6 billion. In exchange, Alcoa agreed to invest $600 million and protect a certain number of jobs.

Boeing (BA) was the recipient of an estimated $4.4 billion in big tax deals, according to the report's calculations. Of that amount, $3.2 billion came from Washington state to support Boeing's aircraft manufacturing facilities in 2003.

In terms of what was most frequently subsidized, the report found that more than half of the 240 deals were for manufacturing facilities. Another 47 were for office facilities such as corporate headquarters.

Related: The 'chicken poop' credit and other bad tax breaks

It identified a number of what it called "job blackmail megadeals" that came about when there was concern a company would pack its bags unless the state made staying more attractive. In this category, Good Jobs First estimated that Nike (NKE) got one of the sweetest deals at the end of 2012 to stay in Oregon -- a guarantee that its state tax computation wouldn't change for 30 years. The report valued that subsidy at $2.02 billion.