Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature currently requires accessing the site using the built-in Safari browser.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Can Italy, and thus the Euro, be Saved?

- Thread starter JimBowie1958

- Start date

william the wie

Gold Member

- Nov 18, 2009

- 16,667

- 2,402

- 280

The last one of comparable percentage of world GDP was I think the Mississippi scheme/South Sea Bubble. That lit the fuse on three unofficial world wars: the seven years war, the American revolution and the revolutionary/Napoleonic wars.Currency crises are bad. If we get into one with the euro, all bets are off.

EdwardBaiamonte

Platinum Member

- Nov 23, 2011

- 34,612

- 2,153

- 1,100

The eurozone has to have a functional lender of last resort. Structural changes would help, but the ECB should just do the job of every other central bank in the world. In general you need the perception that the ECB provides a backstop for rates to drop. Then you need lower spending in the GIIPS countries and higher spending in northern europe, mostly germany. And then you need slightly higher overall inflation, because slow overall inflation means deflation in the periphery, and deflation will cause a recession.

I see you're more confused than ever! Europe firstly needs a Republican Balanced Budget Amendment so the entire world can be assured that conservative policy will dominate in the future. The USA too needs to be free of liberal fiscal irresponsibility.

Mr Liberty

Hater of Socialism

If they don't solve the euro debt crisis, it will effect the our economy as well. Here is the OECD economic outlook report for those of you that are interested: Economic Outlook

william the wie

Gold Member

- Nov 18, 2009

- 16,667

- 2,402

- 280

This debt crisis is at least one magnitude greater than the meltdown and they will not solve it.If they don't solve the euro debt crisis, it will effect the our economy as well. Here is the OECD economic outlook report for those of you that are interested: Economic Outlook

- Jun 18, 2008

- 3,751

- 814

- 130

These Europeans like to spen and give out billions on social programs, but they don't like paying higher

Taxes to fund all their social programs. Economic policies like that, spending more than they take in,

are bound to end in economic catastrophe.!Which is what we are seeing now unfolding in Europe.

Taxes to fund all their social programs. Economic policies like that, spending more than they take in,

are bound to end in economic catastrophe.!Which is what we are seeing now unfolding in Europe.

EdwardBaiamonte

Platinum Member

- Nov 23, 2011

- 34,612

- 2,153

- 1,100

These Europeans like to spen and give out billions on social programs, but they don't like paying higher

Taxes to fund all their social programs. Economic policies like that, spending more than they take in,

are bound to end in economic catastrophe.!Which is what we are seeing now unfolding in Europe.

Let's not forget that in some critical ways Europe is better off than America. They have about the same % debt as we do. Individual European countries have a problem because they cant print money to solve their problems the way we can. But, printing liberal money here in America is like giving a drink to a drunk in withdrawal. It seems to work but in reality it is only making things worse down the road.

Of course they can save it. And the banks loosening up liquidity was a great first start. They are going to have to re-structure debt..and the rich are going to have to take a hair cut.

Simple as that.

Simple as that.

EdwardBaiamonte

Platinum Member

- Nov 23, 2011

- 34,612

- 2,153

- 1,100

Of course they can save it. And the banks loosening up liquidity was a great first start. They are going to have to re-structure debt..and the rich are going to have to take a hair cut.

Simple as that.

Have you noticed that when the rich get a haircut the poor get a lot worse. Unemployment is about 4 times higher among the poor and 3 times higher among non-college grads.

EdwardBaiamonte

Platinum Member

- Nov 23, 2011

- 34,612

- 2,153

- 1,100

The ECB isnt willing to print euros even to lend to solvent but illiquid companies. So i dont think it will just print euros.

This is true, Europe is better off because Germany won't bail out Greece; so now Greece has to become at least somewhat more responsible.

In the USA our central bank will bail out or print dollars to save the USA so our situation gets worse while Europe's improves. We are merely enabling addictive liberal irresponsibility while Europe is confronting it.

Last edited:

cbirch2

Active Member

- Jul 9, 2011

- 1,394

- 49

- 36

The ECB isnt willing to print euros even to lend to solvent but illiquid companies. So i dont think it will just print euros.

This is true, Europe is better off because Germany won't bail out Greece; so now Greece has to become at least somewhat more responsible.

In the USA our central bank will bail out or print dollars to save the USA so our situation gets worse while Europe's improves. We are merely enabling addictive liberal irresponsibility while Europe is confronting it.

Europes situation is improving? Really?

Because since the crisis started the only thing thats happened is the debt to GDP ratios have gotten worse while the economies have slowed down.

I dont know how many times i have to explain this, but this isnt the result of over spending. The governments in the north, the ones that are supposedly the examples of fiscal discipline, arguable have more expansive welfare states than southern europe, the part with debt issues.

The model that over spending caused the crisis only really fits greece anyways. Spain, for example: ran a budget surplus before the recession.

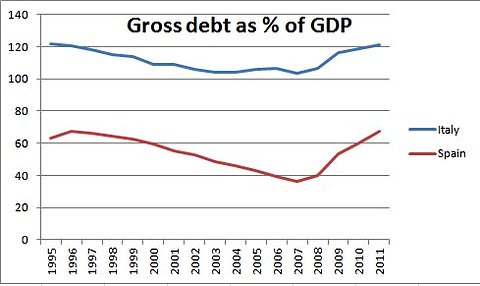

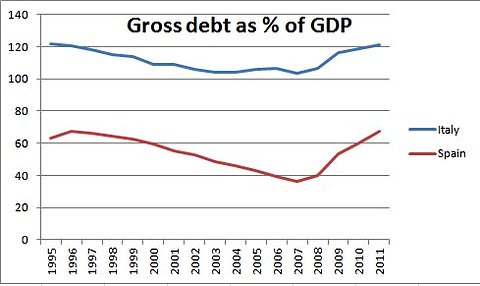

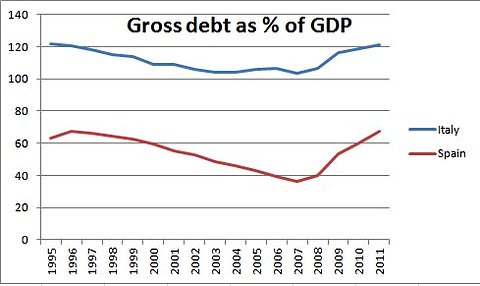

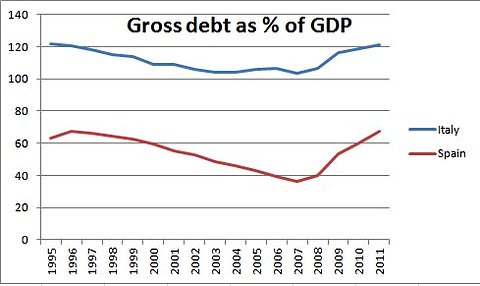

In reality: italy and spain were decreasing their debt rather than increasing it before this crisis started.

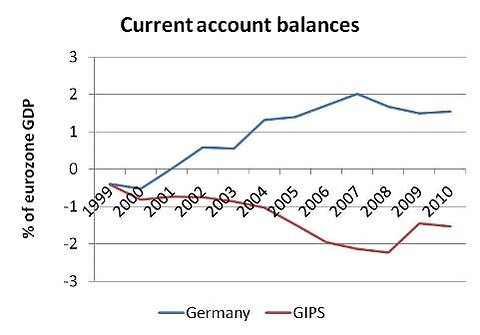

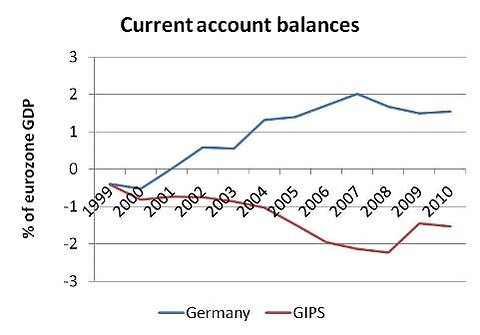

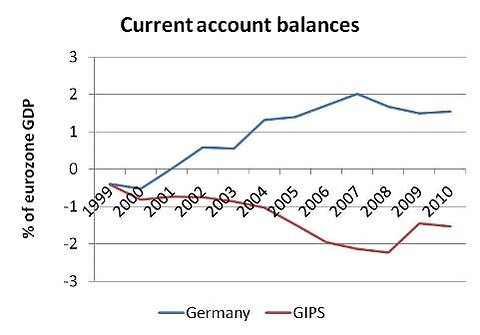

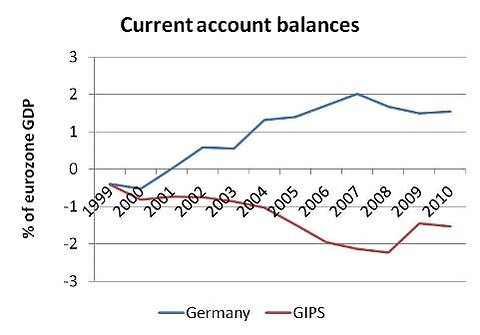

The Problem is that the creation of the euro allowed investors to treat every euro country the same. That caused massive amounts of capital to flow into the country, you can see this in the form of trade deficits. In 2008, that flow abruptly stopped:

This increased capital had the effect of increasing prices and wages and making the periphery economies less competitive:

This is the problem that needs to be unwound. Its not the problem of over spending, its a trade problem caused by the half-assed structure of the euro. Stronger treaties will fix this, thats what Merkel and Sarkozy are doing now.

The periphery needs to spend less, this is true. But Germany and the other northern countries need to spend more to offset, otherwise youll just see the euro as a whole plunge into a recession. You also need slightly higher inflation overall, or else you have deflation in the periphery. Thats why the ECB said over the weekend that it would allow higher inflation overall so that the periphery didnt deflate.

So in case you cant follow: this is not a spending problem, its a trade problem. Conservatives are just giant propaganda machines....

william the wie

Gold Member

- Nov 18, 2009

- 16,667

- 2,402

- 280

While I disagree with your political analysis I strongly agree with your economic read. Merkel and Sarkozcy are going to extend and pretend come Dec. 9 and that could be all she wrote.Europes situation is improving? Really?

Because since the crisis started the only thing thats happened is the debt to GDP ratios have gotten worse while the economies have slowed down.

I dont know how many times i have to explain this, but this isnt the result of over spending. The governments in the north, the ones that are supposedly the examples of fiscal discipline, arguable have more expansive welfare states than southern europe, the part with debt issues.

The model that over spending caused the crisis only really fits greece anyways. Spain, for example: ran a budget surplus before the recession.

In reality: italy and spain were decreasing their debt rather than increasing it before this crisis started.

The Problem is that the creation of the euro allowed investors to treat every euro country the same. That caused massive amounts of capital to flow into the country, you can see this in the form of trade deficits. In 2008, that flow abruptly stopped:

This increased capital had the effect of increasing prices and wages and making the periphery economies less competitive:

This is the problem that needs to be unwound. Its not the problem of over spending, its a trade problem caused by the half-assed structure of the euro. Stronger treaties will fix this, thats what Merkel and Sarkozy are doing now.

The periphery needs to spend less, this is true. But Germany and the other northern countries need to spend more to offset, otherwise youll just see the euro as a whole plunge into a recession. You also need slightly higher inflation overall, or else you have deflation in the periphery. Thats why the ECB said over the weekend that it would allow higher inflation overall so that the periphery didnt deflate.

So in case you cant follow: this is not a spending problem, its a trade problem. Conservatives are just giant propaganda machines....

cbirch2

Active Member

- Jul 9, 2011

- 1,394

- 49

- 36

While I disagree with your political analysis I strongly agree with your economic read. Merkel and Sarkozcy are going to extend and pretend come Dec. 9 and that could be all she wrote.Europes situation is improving? Really?

Because since the crisis started the only thing thats happened is the debt to GDP ratios have gotten worse while the economies have slowed down.

I dont know how many times i have to explain this, but this isnt the result of over spending. The governments in the north, the ones that are supposedly the examples of fiscal discipline, arguable have more expansive welfare states than southern europe, the part with debt issues.

The model that over spending caused the crisis only really fits greece anyways. Spain, for example: ran a budget surplus before the recession.

In reality: italy and spain were decreasing their debt rather than increasing it before this crisis started.

The Problem is that the creation of the euro allowed investors to treat every euro country the same. That caused massive amounts of capital to flow into the country, you can see this in the form of trade deficits. In 2008, that flow abruptly stopped:

This increased capital had the effect of increasing prices and wages and making the periphery economies less competitive:

This is the problem that needs to be unwound. Its not the problem of over spending, its a trade problem caused by the half-assed structure of the euro. Stronger treaties will fix this, thats what Merkel and Sarkozy are doing now.

The periphery needs to spend less, this is true. But Germany and the other northern countries need to spend more to offset, otherwise youll just see the euro as a whole plunge into a recession. You also need slightly higher inflation overall, or else you have deflation in the periphery. Thats why the ECB said over the weekend that it would allow higher inflation overall so that the periphery didnt deflate.

So in case you cant follow: this is not a spending problem, its a trade problem. Conservatives are just giant propaganda machines....

My hopes are that the EU can move towards a legitimate federation that prevents these trade imbalances from occurring. Thats what the treaties need to accomplish. At least in my view.

Europe needs to more resemble the US, where some transfers of wealth occur. In the US, liberal states fund conservative states. Interesting but true:

Last edited:

- May 20, 2009

- 144,267

- 66,584

- 2,330

The banks want the EU taxpayers to bail them out and the Germans (and Chinese) have said no.

Germany could not sell all their bonds last week and they are the best credit on the Continent.

The recent "bail out" is just window dressing and a delaying tactic to let the last rats flee the sinking ship

Germany could not sell all their bonds last week and they are the best credit on the Continent.

The recent "bail out" is just window dressing and a delaying tactic to let the last rats flee the sinking ship

- May 20, 2009

- 144,267

- 66,584

- 2,330

While I disagree with your political analysis I strongly agree with your economic read. Merkel and Sarkozcy are going to extend and pretend come Dec. 9 and that could be all she wrote.Europes situation is improving? Really?

Because since the crisis started the only thing thats happened is the debt to GDP ratios have gotten worse while the economies have slowed down.

I dont know how many times i have to explain this, but this isnt the result of over spending. The governments in the north, the ones that are supposedly the examples of fiscal discipline, arguable have more expansive welfare states than southern europe, the part with debt issues.

The model that over spending caused the crisis only really fits greece anyways. Spain, for example: ran a budget surplus before the recession.

In reality: italy and spain were decreasing their debt rather than increasing it before this crisis started.

The Problem is that the creation of the euro allowed investors to treat every euro country the same. That caused massive amounts of capital to flow into the country, you can see this in the form of trade deficits. In 2008, that flow abruptly stopped:

This increased capital had the effect of increasing prices and wages and making the periphery economies less competitive:

This is the problem that needs to be unwound. Its not the problem of over spending, its a trade problem caused by the half-assed structure of the euro. Stronger treaties will fix this, thats what Merkel and Sarkozy are doing now.

The periphery needs to spend less, this is true. But Germany and the other northern countries need to spend more to offset, otherwise youll just see the euro as a whole plunge into a recession. You also need slightly higher inflation overall, or else you have deflation in the periphery. Thats why the ECB said over the weekend that it would allow higher inflation overall so that the periphery didnt deflate.

So in case you cant follow: this is not a spending problem, its a trade problem. Conservatives are just giant propaganda machines....

My hopes are that the EU can move towards a legitimate federation that prevents these trade imbalances from occurring. Thats what the treaties need to accomplish. At least in my view.

Europe needs to more resemble the US, where some transfers of wealth occur. In the US, liberal states fund conservative states. Interesting but true:

Yes, Liberal states like CA, NY, NJ and IL are known for their fiscal discipline.

You must be the smartest kid on the short bus

cbirch2

Active Member

- Jul 9, 2011

- 1,394

- 49

- 36

The banks want the EU taxpayers to bail them out and the Germans (and Chinese) have said no.

Germany could not sell all their bonds last week and they are the best credit on the Continent.

The recent "bail out" is just window dressing and a delaying tactic to let the last rats flee the sinking ship

For the last time you ignorant fucktard, germany had to pay a premium on its bonds because the markets were preparing to be repaid in deustchmarks.

omfg you dont understand shit. you ignore ever fact someone posts and then pop back in to make some bullshit uneducated claim.

loser.

cbirch2

Active Member

- Jul 9, 2011

- 1,394

- 49

- 36

The banks want the EU taxpayers to bail them out and the Germans (and Chinese) have said no.

Germany could not sell all their bonds last week and they are the best credit on the Continent.

The recent "bail out" is just window dressing and a delaying tactic to let the last rats flee the sinking ship

For the last time you ignorant retard, germany had to pay a premium on its bonds because they were preparing to be repaid in deustchmarks.

You dont understand shit. Every time someone posts a fact you ignore and say its liberal propaganda (even if it comes from the federal reserve). Then you just pop back in to post some bullshit uneducated claim.

loser.

cbirch2

Active Member

- Jul 9, 2011

- 1,394

- 49

- 36

While I disagree with your political analysis I strongly agree with your economic read. Merkel and Sarkozcy are going to extend and pretend come Dec. 9 and that could be all she wrote.

My hopes are that the EU can move towards a legitimate federation that prevents these trade imbalances from occurring. Thats what the treaties need to accomplish. At least in my view.

Europe needs to more resemble the US, where some transfers of wealth occur. In the US, liberal states fund conservative states. Interesting but true:

Yes, Liberal states like CA, NY, NJ and IL are known for their fiscal discipline.

You must be the smartest kid on the short bus

Um, do you understand numbers and maps and logic? Just because CA and IL run deficits doesnt change shit about that map. The US is still a transfer union in which liberal states pay more federal taxes than they get back and conservative states receive more federal aid than they contribute. In other words, when it comes to the federal budget, liberal states are net payers while conservative states generally are net takers.

Numbers dont lie.

Last edited:

EdwardBaiamonte

Platinum Member

- Nov 23, 2011

- 34,612

- 2,153

- 1,100

For the last time you ignorant fucktard, germany had to pay a premium on its bonds because the markets were preparing to be repaid in deustchmarks.

omfg you dont understand shit. you ignore ever fact someone posts and then pop back in to make some bullshit uneducated claim.

loser.

Ever get anything right? Even one thing?

12/2/11 WSJ: Some fund managers and market strategists say[German bonds] bunds are in a lose-lose situation. To resolve the euro-zone debt crisis, a move toward tighter fiscal union may be needed. But that would mean a bigger bailout tab being paid by Germany, potentially threatening its triple-A credit rating. Alternatively, the crisis could worsen, which could result in the collapse of the euro bloc and Germany having to shore up its banks. Both events could hurt bunds at a time when some investors already fret about the yields, which are trading near historic lows.

cbirch2

Active Member

- Jul 9, 2011

- 1,394

- 49

- 36

For the last time you ignorant fucktard, germany had to pay a premium on its bonds because the markets were preparing to be repaid in deustchmarks.

omfg you dont understand shit. you ignore ever fact someone posts and then pop back in to make some bullshit uneducated claim.

loser.

Ever get anything right? Even one thing?

12/2/11 WSJ: Some fund managers and market strategists say[German bonds] bunds are in a lose-lose situation. To resolve the euro-zone debt crisis, a move toward tighter fiscal union may be needed. But that would mean a bigger bailout tab being paid by Germany, potentially threatening its triple-A credit rating. Alternatively, the crisis could worsen, which could result in the collapse of the euro bloc and Germany having to shore up its banks. Both events could hurt bunds at a time when some investors already fret about the yields, which are trading near historic lows.

Thats one opinion. And from the WSJ, so we know what their opinion was going to be in advance.

A third option might be that investors perceive the ECB will allow inflation over 2%, so investors demand increased yields so their assets dont depreciate.

Even a fourth option might be that germany, like every country in the euro to some extent, is paying the price for not having a functional lender of last resort. When you look at EU countries not in the eurozone, but that are still pegged to the euro, you see a clear divergence of interest rates about 2 months ago. Suggesting eurozone countries have to pay higher interest rates because they have no LoLR

Either of these seem more likely than your explanation that germany will be at risk for default. Maybe even more likely than the end-of-the-euro scenario i argued for before.

Last edited:

Similar threads

- Replies

- 40

- Views

- 455

- Poll

- Replies

- 656

- Views

- 14K

- Replies

- 1

- Views

- 115

- Replies

- 17

- Views

- 2K

Latest Discussions

- Replies

- 70

- Views

- 384

- Replies

- 1

- Views

- 2

- Replies

- 4

- Views

- 18

- Replies

- 5

- Views

- 16

Forum List

-

-

-

-

-

Political Satire 8050

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

ObamaCare 781

-

-

-

-

-

-

-

-

-

-

-

Member Usernotes 469

-

-

-

-

-

-

-

-

-

-