Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Bush TAX Cut Extensions Will Increase Deficit

- Thread starter Toro

- Start date

Oddball

Unobtanium Member

Letting people keep what's theirs is not "financed" by anything.You mean "Bush Tax Cuts"?

The answer is still for the gubamint to reduce spending. The average Joe gets a smaller paycheck he reduces spending, gubamint can do the same. I'm tired of hearing bullshit excuses from our gubamint about "we have to PAY for tax cuts!"

Bullshit! You just have to spend less.

Does that mean you would oppose any deficit-financed extensions of (any of) the tax cuts? That is, any bill to extend the tax cuts that doesn't include offsetting spending cuts?

The only thing that costs anything is spending, the duplicitous and disingenuous propaganda semantics of Fabian socialist progressives notwithstanding.

CrusaderFrank

Diamond Member

- May 20, 2009

- 148,629

- 71,936

- 2,330

Letting people keep what's theirs is not "financed" by anything.You mean "Bush Tax Cuts"?

The answer is still for the gubamint to reduce spending. The average Joe gets a smaller paycheck he reduces spending, gubamint can do the same. I'm tired of hearing bullshit excuses from our gubamint about "we have to PAY for tax cuts!"

Bullshit! You just have to spend less.

Does that mean you would oppose any deficit-financed extensions of (any of) the tax cuts? That is, any bill to extend the tax cuts that doesn't include offsetting spending cuts?

The only thing that costs anything is spending, the duplicitous and disingenuous propaganda semantics of Fabian socialist progressives notwithstanding.

That you need to constantly remind people of that shows how fucked we are because there are so so many people who just refuse to learn.

Most people are pretty much spending all their money buying stuff now. Aka market saturation.

2 ways we can go here.

1. Raise prices on what we buy to make economic numbers look good, but hurt the working class. (which is what has been going on for a decade or so)

2. Create jobs and increase wages so we can buy more.

2 ways we can go here.

1. Raise prices on what we buy to make economic numbers look good, but hurt the working class. (which is what has been going on for a decade or so)

2. Create jobs and increase wages so we can buy more.

Oddball

Unobtanium Member

They've learned alright...Learned how to use newspeak to to a degree that would make Orwell blush.Letting people keep what's theirs is not "financed" by anything.Does that mean you would oppose any deficit-financed extensions of (any of) the tax cuts? That is, any bill to extend the tax cuts that doesn't include offsetting spending cuts?

The only thing that costs anything is spending, the duplicitous and disingenuous propaganda semantics of Fabian socialist progressives notwithstanding.

That you need to constantly remind people of that shows how fucked we are because there are so so many people who just refuse to learn.

boedicca

Uppity Water Nymph from the Land of Funk

- Feb 12, 2007

- 59,439

- 24,109

- 2,290

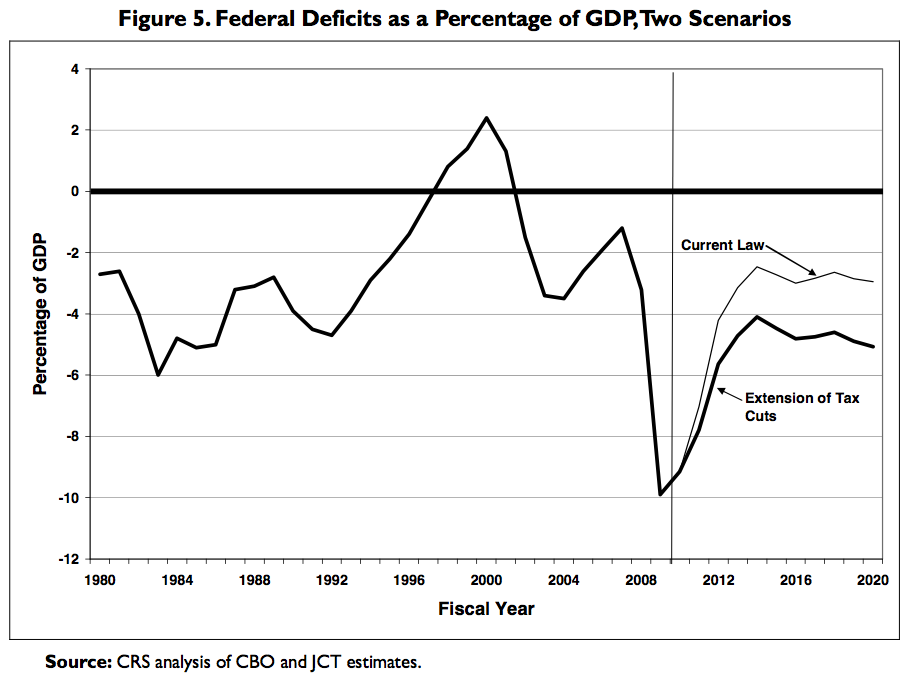

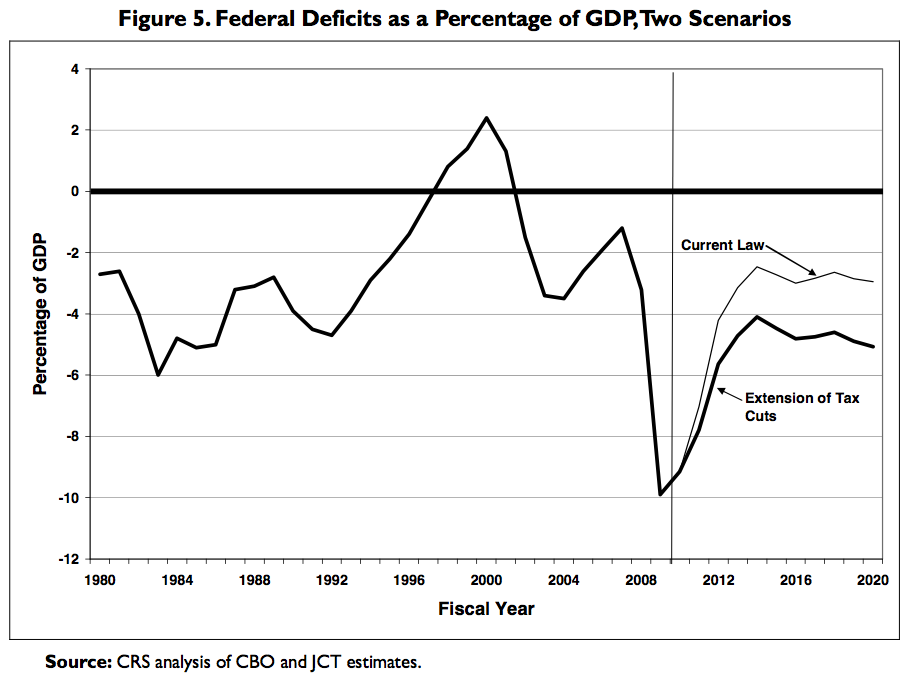

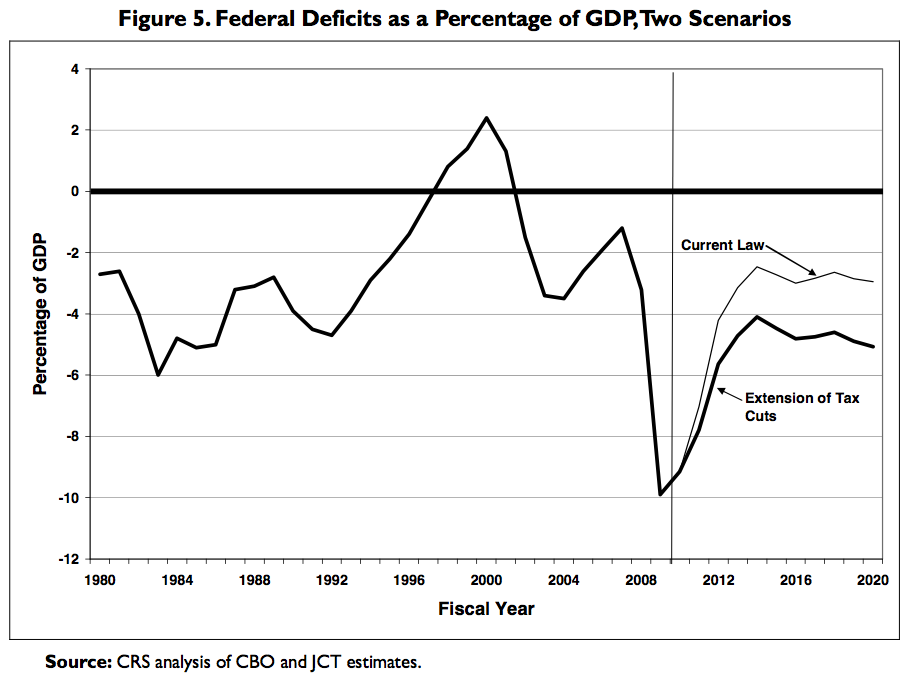

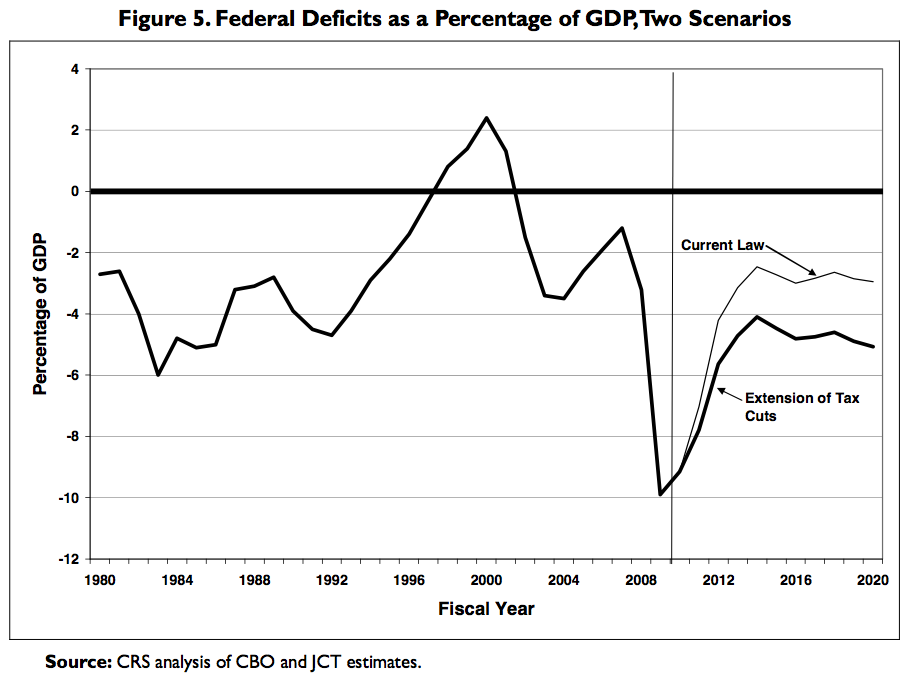

By about 2% of GDP per year.

Bush Tax Cuts: Economic Growth vs. Fiscal Sustainability | The Big Picture

Complete and utter nonsense.

Such models are based on static growth. In reality, we know that lower taxes spur economic growth, with a resultant rise in tax receipts.

By about 2% of GDP per year.

Bush Tax Cuts: Economic Growth vs. Fiscal Sustainability | The Big Picture

Complete and utter nonsense.

Such models are based on static growth. In reality, we know that lower taxes spur economic growth, with a resultant rise in tax receipts.

How do we know that? Because the leaders of the right cannot be wrong?

"Raising taxes on those who invest discourages investment."It's pretty simple math. All other things being equal, if you increase your revenue you decrease the deficit. One can argue that increase taxation on the wealthy will stifle new investments and slow down the recovery. Well, that's a theory, but I don't buy it, at least not in the current economy environment. Money will always be invested somewhere. Large corporations in the US are sitting on tons of cash invested in low yielding treasury bills and bonds. They are not expanding because they don't see consumer demand increasing. Increasing tax rates on the wealthiest people in the country will have little effect on consumer demand or on new investments but will help reduce the deficit.A disincentive to invest will cause the economy to sink further, IMO.

The economy decreased, government needs to decrease proportionately.

The problem with that and the CBO's analysis is that there is no situation where all other things are equal. The economy is dynamic. Raising taxes on those who invest discourages investment.

True raising taxes can discourage investment under the right situation but consider this. The alternative to investment in business expansion is to park money in low interest yielding bonds and treasury bills which is what large corporations are doing today. I don't see that changing until consumer spending and the housing market comes back. I doubt that a change in tax rates for the wealthy will make much difference.

Sallow

The Big Bad Wolf.

This all assumes a static view of the economy which is false. Does anyone know of a projection made by the CBO that came true?

Very true, with the economy continuing to sink it will be worse than predictions.

A disincentive to invest will cause the economy to sink further, IMO.

The economy decreased, government needs to decrease proportionately.

Invest?

They haven't "invested" in 8 years..what makes you think they are going to start now?

CrusaderFrank

Diamond Member

- May 20, 2009

- 148,629

- 71,936

- 2,330

OK, so who is going to tell Walmart that there strategy of lowering prices is an Epic Fail because lower prices reduces revenues?

Sallow

The Big Bad Wolf.

By about 2% of GDP per year.

Bush Tax Cuts: Economic Growth vs. Fiscal Sustainability | The Big Picture

Complete and utter nonsense.

Such models are based on static growth. In reality, we know that lower taxes spur economic growth, with a resultant rise in tax receipts.

They haven't in the past..and they don't in third world nations. So..why should they in the future? Are the rich gonna start cracking open their piggy banks all of sudden out of a sudden urge for altruism?

Very true, with the economy continuing to sink it will be worse than predictions.

A disincentive to invest will cause the economy to sink further, IMO.

The economy decreased, government needs to decrease proportionately.

Invest?

They haven't "invested" in 8 years..what makes you think they are going to start now?

Many think that day trading in the market is investing.

Sallow

The Big Bad Wolf.

A disincentive to invest will cause the economy to sink further, IMO.

The economy decreased, government needs to decrease proportionately.

Invest?

They haven't "invested" in 8 years..what makes you think they are going to start now?

Many think that day trading in the market is investing.

A Large majority of them don't even do that.

The rich don't retain their wealth taking risks (especially with their own money). They do it by getting into a sure thing.

loosecannon

Senior Member

- May 7, 2007

- 4,888

- 269

- 48

A disincentive to invest will cause the economy to sink further, IMO.

The economy decreased, government needs to decrease proportionately.

Invest?

They haven't "invested" in 8 years..what makes you think they are going to start now?

Many think that day trading in the market is investing.

i.e. short selling

Invest?

They haven't "invested" in 8 years..what makes you think they are going to start now?

Many think that day trading in the market is investing.

A Large majority of them don't even do that.

The rich don't retain their wealth taking risks (especially with their own money). They do it by getting into a sure thing.

Yeah like buying congress or elections.

asterism

Congress != Progress

Very true, with the economy continuing to sink it will be worse than predictions.

A disincentive to invest will cause the economy to sink further, IMO.

The economy decreased, government needs to decrease proportionately.

Invest?

They haven't "invested" in 8 years..what makes you think they are going to start now?

No investments in 8 years huh?

When we are talking about investments that create job growth, we aren't talking about day trading or even long investing in mutual funds and listed stocks. The investments that create jobs are investments by businesses to build factories, opening new stores, and facilities. Also investments by entrepreneurs to to create new businesses lead to job growth. Most people who invest in stocks are just buying stocks from someone who wants to sell. It does not provide any additional capital for the company to expand. The exception is secondary offerings by the company and new issues, however this is rather small percent of stock trades. There are other positive benefits of stock trading but job creation is not one of them.Invest?

They haven't "invested" in 8 years..what makes you think they are going to start now?

Many think that day trading in the market is investing.

i.e. short selling

Trajan

conscientia mille testes

By about 2% of GDP per year.

Bush Tax Cuts: Economic Growth vs. Fiscal Sustainability | The Big Picture

if we have gdp growth per grew at say, 5%, and the concomitant jobs and growth appears with that number, I'd give up 2% of the whole number for that. Easily.

Similar threads

- Replies

- 24

- Views

- 416

- Replies

- 102

- Views

- 562

- Replies

- 39

- Views

- 419

- Replies

- 10

- Views

- 114

Latest Discussions

- Replies

- 9

- Views

- 42

- Replies

- 65

- Views

- 290

- Replies

- 283

- Views

- 1K

- Replies

- 20

- Views

- 124

Forum List

-

-

-

-

-

Political Satire 8872

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

ObamaCare 781

-

-

-

-

-

-

-

-

-

-

-

Member Usernotes 492

-

-

-

-

-

-

-

-

-

-