- May 17, 2013

- 67,613

- 32,760

- 2,290

Is the Flat Tax the Biggest Problem of Bulgaria s Economy - 4Liberty.eu

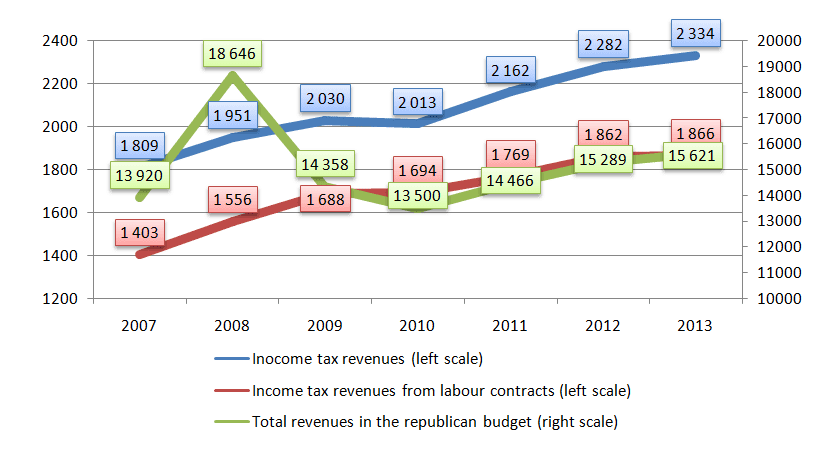

That was clearly seen after the introduction of the proportional 10 percent income tax in 2008 right before the crisis. Despite the big decrease in the number of employed people (by nearly half a million between 2009 and 2012) the income tax for people working under employment contracts was the only tax, the revenues of which kept increasing during the toughest years for the economy and the budget.

see article for economic revenue graph

The graph clearly shows that while overall tax revenues dropped sharply in 2009, income tax revenues kept growing – despite the loss of more than 100 000 jobs in 2009 alone. The one and only explanation for the gap between the dynamics of income tax revenues and the number of employed people is that the size of the grey economy had decreased during this period.

It should be mentioned that taxes on personal income include not only the 10% rate for income received under labour contracts but also the patent tax (which has different rates) and income taxes on copyright, creative and similar activities, where the tax is actually lower because of deduction of eligible costs.

In order to check how effective the proportional income tax is, it would be most appropriate to consider only the revenues from taxes on income under labour contracts. Revenues from this tax kept growing between 2008 and 2013. They even grew in 2010, when the total revenues from taxes on personal income decreased slightly, by 17 million BGN. This positive trend continued in 2014. For the first seven months of the year revenues from the income tax on income received under labor contracts reached 1.19 billion BGN compared to 1.04 billion BGN in the previous year, i.e. they increased by about 153 million BGN.

That was clearly seen after the introduction of the proportional 10 percent income tax in 2008 right before the crisis. Despite the big decrease in the number of employed people (by nearly half a million between 2009 and 2012) the income tax for people working under employment contracts was the only tax, the revenues of which kept increasing during the toughest years for the economy and the budget.

see article for economic revenue graph

The graph clearly shows that while overall tax revenues dropped sharply in 2009, income tax revenues kept growing – despite the loss of more than 100 000 jobs in 2009 alone. The one and only explanation for the gap between the dynamics of income tax revenues and the number of employed people is that the size of the grey economy had decreased during this period.

It should be mentioned that taxes on personal income include not only the 10% rate for income received under labour contracts but also the patent tax (which has different rates) and income taxes on copyright, creative and similar activities, where the tax is actually lower because of deduction of eligible costs.

In order to check how effective the proportional income tax is, it would be most appropriate to consider only the revenues from taxes on income under labour contracts. Revenues from this tax kept growing between 2008 and 2013. They even grew in 2010, when the total revenues from taxes on personal income decreased slightly, by 17 million BGN. This positive trend continued in 2014. For the first seven months of the year revenues from the income tax on income received under labor contracts reached 1.19 billion BGN compared to 1.04 billion BGN in the previous year, i.e. they increased by about 153 million BGN.