william the wie

Gold Member

- Nov 18, 2009

- 16,667

- 2,402

- 280

I don't know his hedges but diseconomies of scale are common in managed funds so why use them as a model?

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature currently requires accessing the site using the built-in Safari browser.

Interesting. But do you really mean on every equity position you had a 6 % stop? And if you sell, when do you start buying back in?All I'm doing is trailing stop limit sell orders, right now at 6%. We had them at 5% on all accounts prior to the drop a few weeks ago and it worked perfectly.I'm curious, if you are able to divulge, what are your 'hedges' currently and at what percentage?I'd say the bias is upwards, and that's how we're positioned right now (with hedges). But yeah, these daily drama meltdowns are getting kinda silly. I've had a couple of clients call, and my response is usually "the market is just having a little temper tantrum", and they calm down. The fundamentals are very good at the moment overall. At this moment. At this very moment....The market is in a trading range until proven otherwise.

.

I'm basing this on a feeling that if the market drops 6% it'll drop quite a bit more.

.

I'm not. I just like to ask questions from people who are knowledgeable about the markets, like you and Mac. I know what I know, but there is a plenty I don't know.I don't know his hedges but diseconomies of scale are common in managed funds so why use them as a model?

No, I keep a certain percentage of equities static, always in there, because I only want to put so much into timing. It depends on the portfolio. So our 80/20 model has 10% VT and 10% SCHB, both with the stops. Getting back in? Well, that's a gut thing. I was happy to see the correction, and probably would have preferred 15% to 18%, but I didn't (and don't) think we're near a bear market. So I bought back in at 10% down, took a 2% hit willingly, and back up we go.Interesting. But do you really mean on every equity position you had a 6 % stop? And if you sell, when do you start buying back in?All I'm doing is trailing stop limit sell orders, right now at 6%. We had them at 5% on all accounts prior to the drop a few weeks ago and it worked perfectly.I'm curious, if you are able to divulge, what are your 'hedges' currently and at what percentage?I'd say the bias is upwards, and that's how we're positioned right now (with hedges). But yeah, these daily drama meltdowns are getting kinda silly. I've had a couple of clients call, and my response is usually "the market is just having a little temper tantrum", and they calm down. The fundamentals are very good at the moment overall. At this moment. At this very moment....The market is in a trading range until proven otherwise.

.

I'm basing this on a feeling that if the market drops 6% it'll drop quite a bit more.

.

I trust the bond market as a barometer more than the stock market, and I think it's not yet convinced about the strength of the economy. Understandable, given the last 10 years. But my guess is that there's strength.The real mystery at this point is why is the 10 year treasury inching up in price instead of the much more usual inching down for treasuries in the run.

I trust the bond market as a barometer more than the stock market, and I think it's not yet convinced about the strength of the economy. Understandable, given the last 10 years. But my guess is that there's strength.The real mystery at this point is why is the 10 year treasury inching up in price instead of the much more usual inching down for treasuries in the run.

.

LOL...thought I was reading a post I forgot I made!But why bother? pick any two criteria of undervaluation and play the long game it wins.

True, but why not do both? I have a core holdings account and a trading account. And occasionally I shuffle money around in my 401K. All three have positive results, and it satisfies the gambler streak in me.

What's really funny is that is entirely possible.lol yet another thread with people all running different and opposing strategies, and yet nobody ever losing money. Hilarious.

What's really funny is that is entirely possible.lol yet another thread with people all running different and opposing strategies, and yet nobody ever losing money. Hilarious.

If my issues are put to me I just write calls. They are also worth more dead than alive so don't throw me in that briar patch.What's really funny is that is entirely possible.lol yet another thread with people all running different and opposing strategies, and yet nobody ever losing money. Hilarious.

Actually it is. Making money in the stock market is less about what strategy you use than it is how you execute that strategy. It doesn't matter to me at all whether you believe that or me.What's really funny is that is entirely possible.lol yet another thread with people all running different and opposing strategies, and yet nobody ever losing money. Hilarious.

Actually it isn't. Gamblers are just notorious liars, is all.

Actually it is. Making money in the stock market is less about what strategy you use than it is how you execute that strategy. It doesn't matter to me at all whether you believe that or me.What's really funny is that is entirely possible.lol yet another thread with people all running different and opposing strategies, and yet nobody ever losing money. Hilarious.

Actually it isn't. Gamblers are just notorious liars, is all.

Maybe the fact that casino owners do well shows there's a very big difference between gambling and holding shares in casino corporations.... Nobody loses money in Vegas, either, yet the place is full of luxury casinos and has been for decades...

Actually it is. Making money in the stock market is less about what strategy you use than it is how you execute that strategy. It doesn't matter to me at all whether you believe that or me.What's really funny is that is entirely possible.lol yet another thread with people all running different and opposing strategies, and yet nobody ever losing money. Hilarious.

Actually it isn't. Gamblers are just notorious liars, is all.

Yes, I know all about how vast the fortunes are on paper with the genius of hindsight and cherry picking min-maxing games. Nobody loses money in Vegas, either, yet the place is full of luxury casinos and has been for decades. Amazing. Wall Street can only function if the losers outnumber the winners; hate to break that news to you, after you've read all those wonderful books touting up that casino and learned a lot of words that make it sound all 'rational' n stuff; race track touts do the sames thing.

Maybe the fact that casino owners do well shows there's a very big difference between gambling and holding shares in casino corporations.... Nobody loses money in Vegas, either, yet the place is full of luxury casinos and has been for decades...

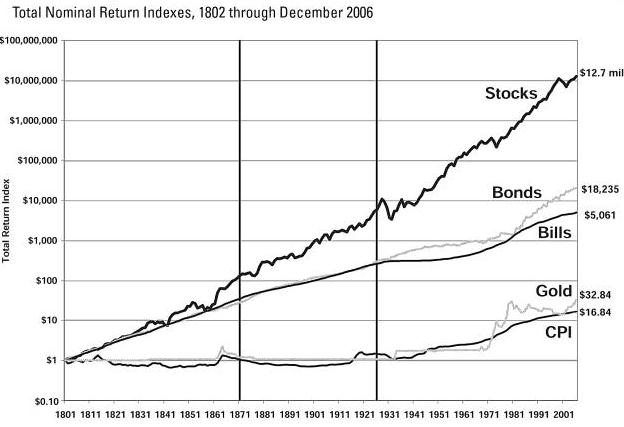

Of course nobody knows the for sure what the future holds, but it's not that big of a risk to bet that total value of U.S. corporations will grow while the population of the U.S. increases and creates new wealth. It's what's been happening for hundreds of years:

--and here I thought I was the only one that felt that way. Aircraft pilots describe their job the same way, as being hours of prolonged boredom punctuated by moments of shear terror.boredom tolerance and discipline is the key.