JimBowie1958

Old Fogey

- Sep 25, 2011

- 63,590

- 16,756

- 2,220

I do not understand why this is necessarily a Marxist perspective.

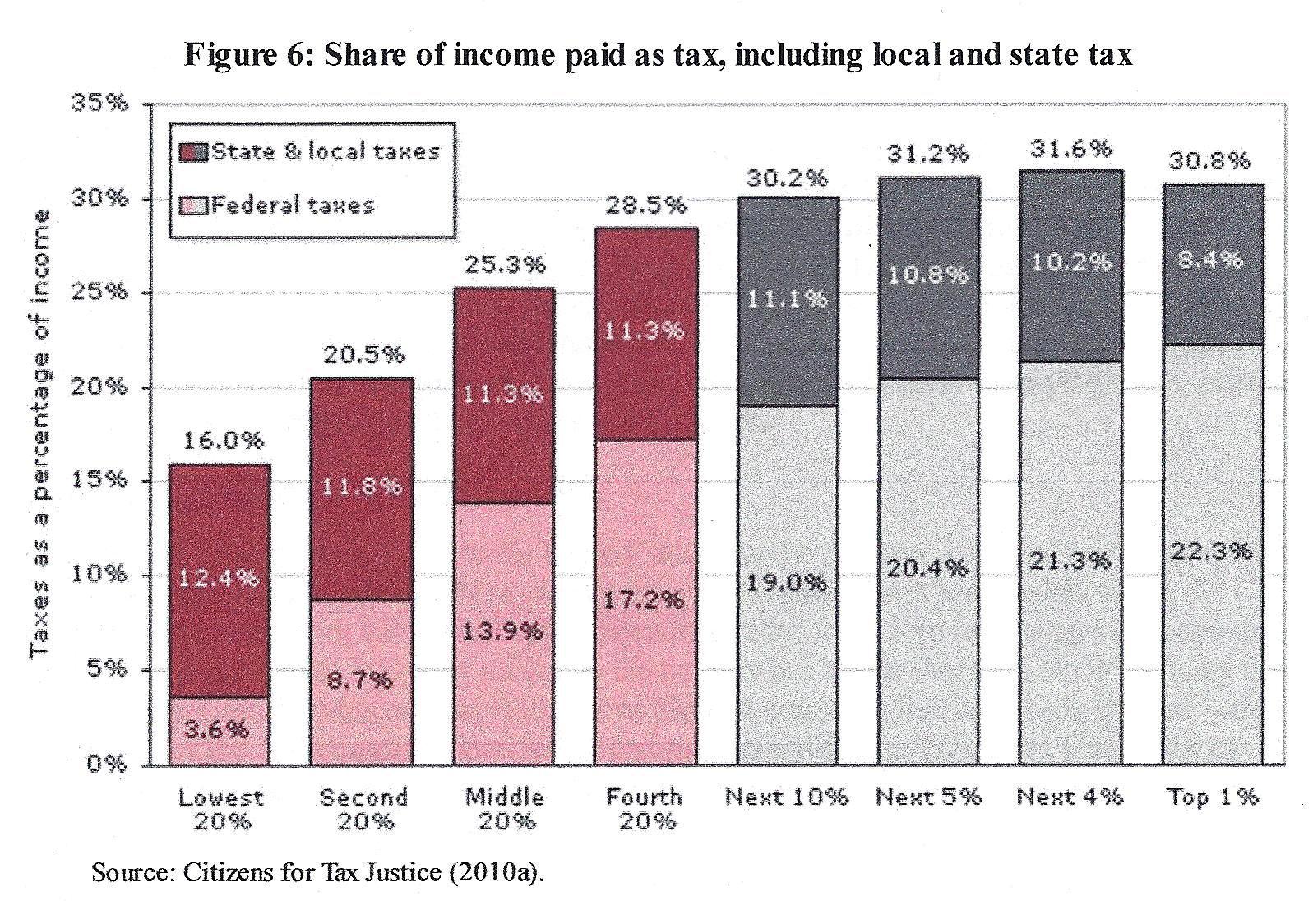

It doesnt require a Marxist to realize that our Wall Street banks are too big, a threat to our economy and thus national security as well. It doesnt take a Marxist to realize that a world in which the rich prosper at record rates of growth while the Middle Class is sacked and pillaged by the government for an ever growing tax base and the poor are locked into frustration and futility is an inherently dangerous and unstable economic system.

It doesnt require a Marxist to realize that our Wall Street banks are too big, a threat to our economy and thus national security as well. It doesnt take a Marxist to realize that a world in which the rich prosper at record rates of growth while the Middle Class is sacked and pillaged by the government for an ever growing tax base and the poor are locked into frustration and futility is an inherently dangerous and unstable economic system.