Damage due to fires, snow, mudslides and other natural disasters may no longer be economically repairable within the blue wall because of SALT driving up the cost of living including home prices and construction costs.

How exactly does a tax on consumers increase the costs builders incur to build homes, thus home prices? All the builders' tax expenses, as before H.R. 1-2018 are deductible as business expenses on Schedules E or C.

Moreover, I don't see how the SALT tax deduction limit is a COL factor for middle-income home buyers.

Tax expenses are a cost. Costs compound throughout the supply and distribution channels. If the local college has an operations research or even just a logistics program you can probably get the necessary software to prove this yourself. Discrete math problems do not have anywhere near as many shortcuts as continuous functions so that software is needed unless you got lots and lots of spare time. NYC spent many years straightening out traffic light heuristics after a somewhat non-conforming parade route during a papal visit. This was before cloud computing became common so back up was really poor.

If the local college has an operations research or even just a logistics program you can probably get the necessary software to prove this yourself.

I am well aware of how costs flow through the supply chain.

I'm also well aware that you've not identified any basis for thinking that SALT taxes are going to in the foreseeable future increase at materially faster/more than they have done historically.

Tax expenses are a cost. Costs compound throughout the supply and distribution channels.

That's all well and good; however, what was just passed was a tax bill that

cut individuals' and business' federal income taxes, at least in the short-term. That makes for a reduction in the overhead costs associated with building construction, not a cost increase, and nobody need do any math at all to know as much. With regard to the impact of H.R. 1-2018 on supply chain SALT costs, it's a cost reduction that filters through the supply chain, not a cost increase. Remember, you wrote:

Damage due to fires, snow, mudslides and other natural disasters may no longer be economically repairable within the blue wall because of SALT driving up the cost of living including home prices and construction costs.

Additionally:

- The cost for repairs of the sort you describe is overwhelmingly borne by property insurers, not property owners, so any potential cost increase that might make damage repairs "no longer economically repairable" -- if even there be one, for insurers are overwhelmingly corporations and they got nearly a 15% tax but -- is that of property insurance premiums, not building construction.

- The price buyers/owners pay for a building is distinct from the sums they pay for property taxes. Builders may or may not consider the property tax attendant to the homes they plan to construct; however, the tax and the price builders charge are two separate items. For instance, the mortgage deduction is based on the price of one's home, not the sum of the price of one's home plus the property tax on the home/land.

- AFAIK, jurisdictions be they "blue" or "red" have not in the wake of and/or due to H.R. 1-2018's changes to have increased SALT taxes; thus there's no basis for asserting that sums property owners must pay in 2018 and beyond will increase on account of anything having to do with H.R. 1-2018.

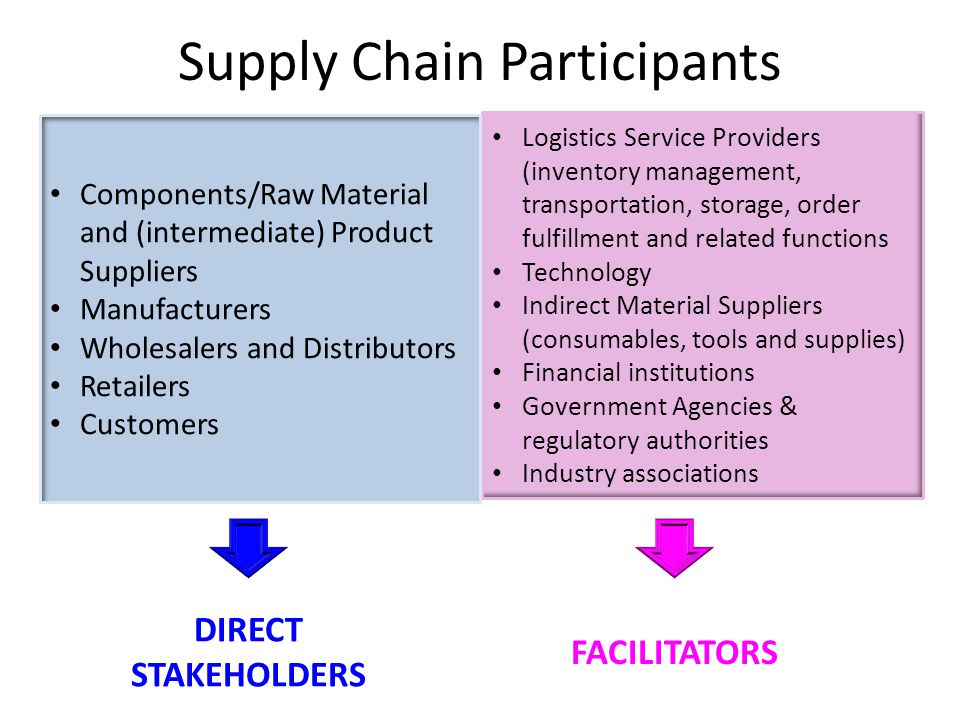

Looking at the graphic above, the only supply chain participants for whom increases in SALT taxes may have an impact on their real property buying decisions are those for whom being able to on Schedule A deduct SALT from their adjusted taxable income is a deal-breaker. Everyone else in the supply chain will in 2018 and onward, as in years past, deduct from their federally taxable income the sum of SALT paid in relation to property they hold for the purpose of conducting whatever business directly or indirectly provides finished goods to customers, be those customers other businesses or consumers.

- Did you even look at the content at link I provided? If you did and used the sorting features there, you've have observed that what constitutes a "high SALT" state is a function of two things: the price of real property and the effective tax rate property owners pay. Texas, for example, has the fifth highest property tax rate (it also has high sales and use tax rates), but it has low house prices; thus more people pay lower sums of real property tax. In contrast, D.C. has a very low effective property tax rate, but the property taxed is pricey.

Indeed in all but two of the so-called "high SALT rate" states property taxes are moderate to low; thus if one is dissuaded from buying real property in most of them, it's the price of the property itself, not the SALT, driving that decision. That's no different than before H.R. 1-2018's limitations on SALT deductibility from 1040-reported one's income.

In light of all of the above, while the amount of SALT consumers pay may affect what real properties they buy and from where they purchase personal property, it'll have no more impact that it has in the past for most buyers.