You don't know whatyou are talking about, failures were primarily in private unregulated loan originations not under ARA program that actually had underwriting standards.

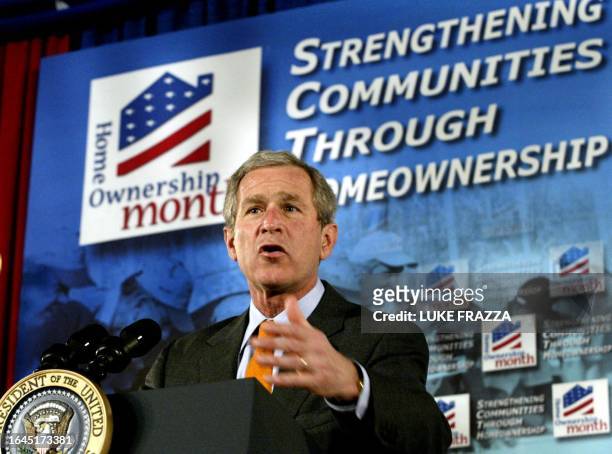

To say that Bush, a president with proactive Home Ownership expansion and market deregulation policies, had nothing to with it, while blaming a community organizer in Chicago is some next level partisan horseshit.

The problem is why? Why did private lenders make sub prime loans?

So let's look at it. First we need to find out when the housing price bubble started.

So the first problem is that housing bubble didn't start under Bush. It started in 1997, under Bill Clinton.

That's not opinion, or partisan stuff. That's just flat out documented fact.

So now, why did the Bubble start in 1997?

So we can clearly see that before 1997, sub-prime mortgages were a niche market, but for some reason in 1998, that market exploded from barely being 1% of the market to 12% of all mortgages, and then higher.

So why did sub-prime loans become a huge part of the market?

First Union Corp. and Freddie Mac racked up a first on Monday by packaging CRA loans into mortgage-backed securities.

www.americanbanker.com

This is behind a pay wall, but here's the full press release from 1997

I keep hearing that the subprime crisis was caused by people willing to buy stuff they couldn't evaluate. Why would smart people do that? One answer is that they were stupid. In an era of rising home prices, it's hard...

cafehayek.com

You can read the entire article, but here's the key points.

Freddie Mac made a deal with First Union (which became Wachovia) and Bear Stearns, to package sub-prime loans into Mortgage Backed Securities, and give them a "AAA" rating.

The Federal Government using their GSEs like Freddie Mac, guaranteed sub-prime mortgage backed securities. That's why the market exploded.

But not only that...... but they also sued banks to force them to make sub-prime loans.

Andrew Cuomo in 1998 announcing proudly, that the Clinton administration had sued banks to make them give sub-prime loans, to in his own words... unqualified buyers. And Andrew Cuomo even admitted openly that the default rate for these loans would be higher.

And he was right on that.

So again, the entire sub-prime crash was due to government regulations and actions by the Democrats.

Now specifically with Obama, Obama was a lawyer on the lawsuit against citibank to give sub-prime loans.

Read Buycks-Roberson v. Citibank Federal Sav. Bank, 162 F.R.D. 322, see flags on bad law, and search Casetext’s comprehensive legal database

casetext.com

His name is listed in the first page. And nearly every single one of these unqualified borrowers in this lawsuit that Citibank was forced to give loans to, ended up defaulting and being foreclosed on. Last I read, not one was able to pay their loans back.

So there you have it.

www.salon.com