I wasn’t prepared when my retirement plans went awry. Are you?

The often-overlooked expense

Know your Social Security strategy

Evaluate income and tax strategies

Check risk in your retirement accounts

Have a cushion

Prepare emotionally

“

One of the hardest things that retirees face is the notion that their retirement account, which has been growing while they worked, will be going down in value over the course of retirement as they make withdrawals,” Herr said. “People can get really uncomfortable with that.”

More details @

Getting close to retirement? Here are 6 key considerations

273,000 union workers and retirees brace for pension cuts

May 2 2016,

About 273,000 union workers and retirees are about to learn the fate of their pensions.

The struggling

Central States Pension Fund is in such bad shape that it's seeking government approval to cut benefits -- and the ruling is expected to come this week.

This is under Obama, not President Trump.

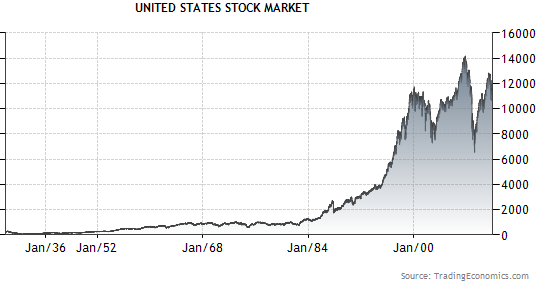

Never rely on someone else to pay you for your retirement. You should be investing into the stock market that has great Dividend Payouts between 4% to 10% per year. You should hold off as long as possible to take those dividends because if they are reinvested till time is needed, you could have a very large income when ready. Never panic in a down market, because the market will(unless a liberal like Bernie Sanders gets in) go up, and keep an eye on what the investments are doing, if they are growing or shrinking. It isnt that hard, for common sense people, but since liberals dont have common sense, they will rely on the government or a union to take care of them. Just remember that he who is promising you a great retirement will get their great retirement before you get yours. Also dividend income is taxed at a much lower rate than a pension which is taxed as income tax. Learn the secrets of uber rich liberals, and avoid paying taxes like I have. It really is that easy..

These are 4 words of wisdom for the wise investor.

JUST REMEMBER DONT PANIC.

When the market is going down, your dividend reinvestments are buying more stocks, when the market is going up, your dividend reinvestments are buying less stocks but the gains are going higher. Cost averaging over a period of time can make you millions...

Dont think "what if I die when before I get to 72". Think "what if I live to be 102". That is 30 years of dividend and possibly capital gains for those 30 years....