Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

Style variation

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

BLM Cofounder Patrisse Cullor Lies about money

- Thread starter jc456

- Start date

Doc7505

Diamond Member

- Feb 16, 2016

- 19,582

- 35,616

- 2,430

Discover How BLM’s Leadership Concealed $40 Million in Diverted Funds

BREAKING EXCLUSIVE: Discover How BLM's Leadership Concealed $40 Million in Diverted Funds | The Gateway Pundit | by Joe Hoft

Guest post by Bob Bishop How BLM’s leadership concealed millions in diverted funds.

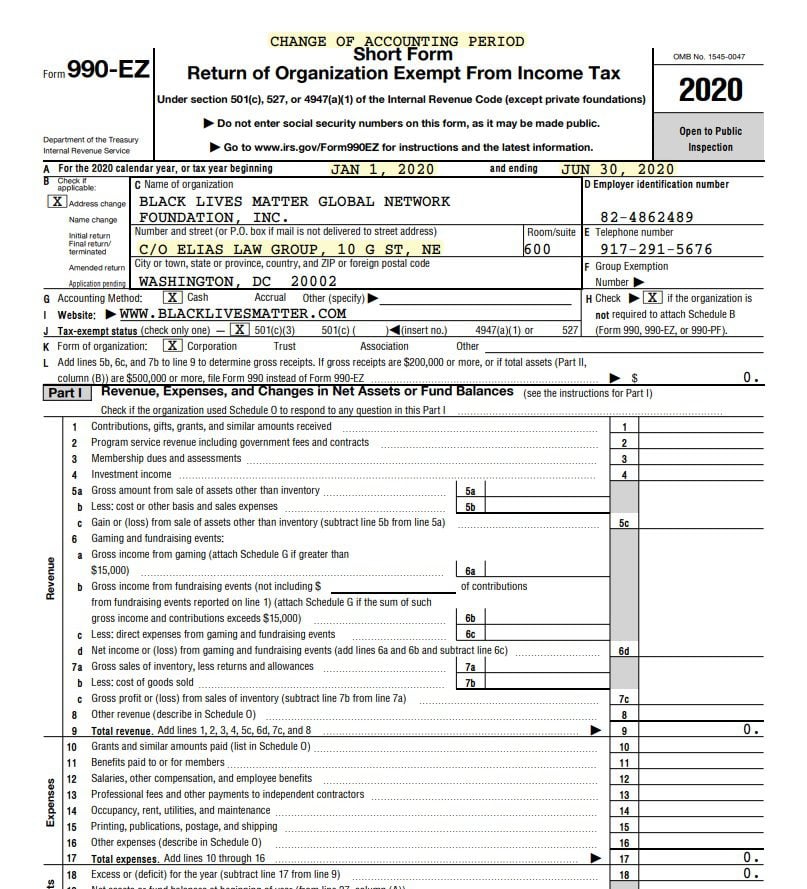

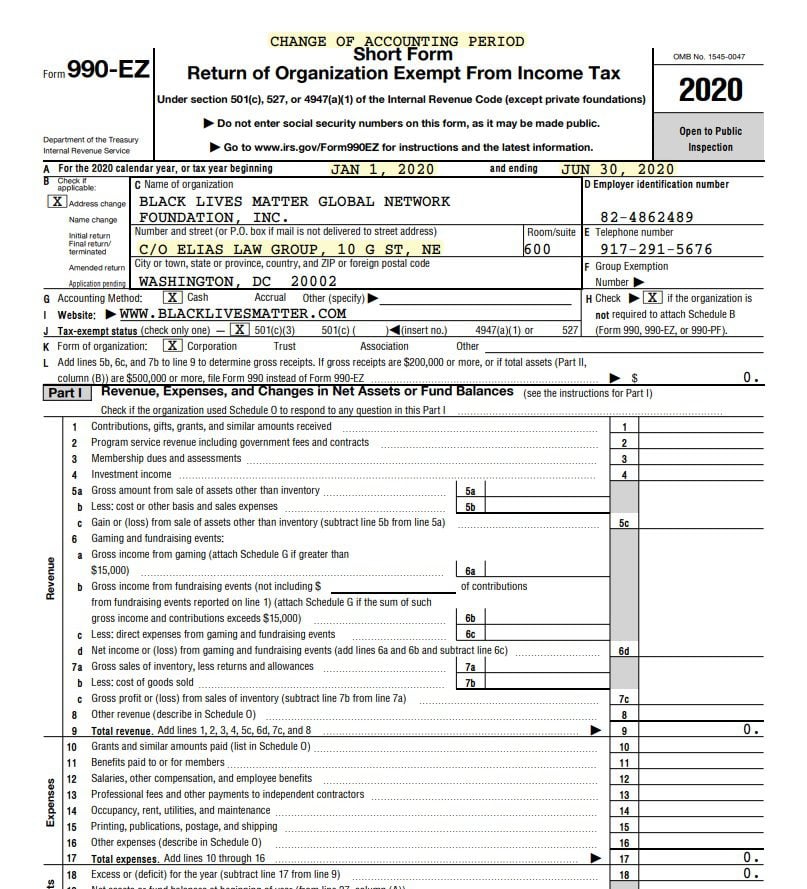

The Black Lives Matter Global Network Foundation (BLMGNF) just released its 2021 990 tax return, the first public financial disclosure since its founding in 2014. The Daily Mail’s deep dive into the return documented related party transactions (friends and family plans) and waste, fraud, and abuse orchestrated by Marxist trained leader Patrisse Cullors.

This article provides a supplemental analysis that traces the BLMGNF’s organizational life cycle. It includes two other crucial unpublished IRS tax returns, revealing huge reporting gaps and substantial unaccounted funds.

BLMGNF Organizational Lifecycle

BLMGNF began as a pseudo nonprofit in late 2014. In 2016, Thousand Currents nonprofit became a donor advisory sponsor for BLMGNF. Fiscal sponsorships funnel money through a “conduit arrangement” from a nonprofit sponsor to a pseudo organization or a group of individuals to legally skirt the IRS tax code. Donors receive a tax deduction receipt from the fiscal sponsor. Often, the arrangements lack oversight leaving them highly susceptible to misuse and fraud, and they conceal the beneficiaries. The IRS does not require fiscal sponsors to disclose their conduit arrangements, donations, donors, or expenses in their 990 tax returns.

BLMGNF used ActBlue to process and remit public donations (BLM indulgences) to Thousand Currents. For those unfamiliar with ActBlue, it facilitates Democrats, progressive groups, and far left-leaning nonprofits fundraising using ActBlue’s fundraising platform. Corporations’ donations (BLM tribute) and far-left Foundation grants were made directly to Thousand Currents.

We first reported on this in June of 2020 during the BLM riots that summer.

~Snip~

The Vice-Chair of the Thousand Currents’ Board of Directors was Susan Rosenberg, a convicted domestic terrorist. She was a member of the Weather Underground and Bill Ayers associate. Due to heavy and adverse publicity disclosing her leadership role in Thousand Currents and possible involvement with the BLM movement, the donor advisory was unceremoniously transferred to the ultra-left Tides Foundation non-profit on July 1, 2020. The assignment and transfer of assets (linked here) were recorded in the California Charity Registry but later surreptitiously scrubbed by the state.

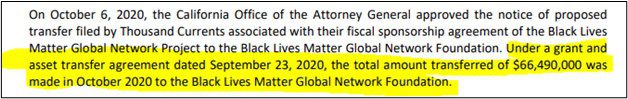

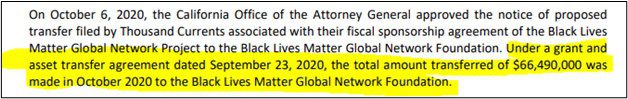

According to Thousand Currents June 2020 audited financial statements, it transferred $66.5 million to BLMGNF. Below is the Thousand Currents financial statements’ footnote omitting disclosure of the fund transfer to the Tide Foundation. Tide continued to collect substantial BLMGNF donations during the George Floyd summer protests during the next six months.

**********

~Snip~

Are Federal Agencies BLM Co-Conspirators?

Various states have revoked BLMGNF’s charitable registrations and are investigating fraud, waste, and abuse of charity funds. However, there is no indication the Department of Justice, FBI, or IRS is investigating or has an interest in BLM charity frauds. To quote George Orwell’s allegorical novel ‘Animal Farm’ “All animals are equal, but some animals are more equal than others”.

Commentary:

Meanwhile Marc Elias recently indicted by Dunham has resigned from BLM.

https://jonathanturley.org/2022/05/...-as-marc-elias-reportedly-leaves-board/Extort money from "Woke" corporation by threatening to Burn, Loot and Murder and that is a "mostly peaceful" protest. Dare to protest an obviously stolen election and it is an INSURRECTION!

To be tax-exempt under section 501(c)(3) of the Internal Revenue Code, an organization must be organized and operated exclusively for exempt purposes set forth in section 501(c)(3), and none of its earnings may inure to any private shareholder or individual. In addition, it may not be an action organization, i.e., it may not attempt to influence legislation as a substantial part of its activities and it may not participate in any campaign activity for or against political candidates.

Organizations described in section 501(c)(3) are commonly referred to as charitable organizations.

Organizations described in section 501(c)(3), other than testing for public safety organizations, are eligible to receive tax-deductible contributions in accordance with Code section 170.

The organization must not be organized or operated for the benefit of private interests, and no part of a section 501(c)(3) organization's net earnings may inure to the benefit of any private shareholder or individual. If the

organization engages in an excess benefit transaction with a person having substantial influence over the organization, an excise tax may be imposed on the person and any organization managers agreeing to the transaction.

Section 501(c)(3) organizations are restricted in how much political and legislative (lobbying) activities they may conduct. For a detailed discussion, see Political and Lobbying Activities. For more information about lobbying activities by charities, see the article Lobbying Issues PDF; for more information about political activities of charities, see the FY-2002 CPE topic Election Year Issues PDF.

jc456

Diamond Member

- Dec 18, 2013

- 149,885

- 34,264

- 2,180

- Thread starter

- #5

There’s so much evidence!!!

Discover How BLM’s Leadership Concealed $40 Million in Diverted Funds20 May 2022 ~~ By Joe Hoft

BREAKING EXCLUSIVE: Discover How BLM's Leadership Concealed $40 Million in Diverted Funds | The Gateway Pundit | by Joe Hoft

Guest post by Bob Bishop How BLM’s leadership concealed millions in diverted funds.www.thegatewaypundit.com

The Black Lives Matter Global Network Foundation (BLMGNF) just released its 2021 990 tax return, the first public financial disclosure since its founding in 2014. The Daily Mail’s deep dive into the return documented related party transactions (friends and family plans) and waste, fraud, and abuse orchestrated by Marxist trained leader Patrisse Cullors.

This article provides a supplemental analysis that traces the BLMGNF’s organizational life cycle. It includes two other crucial unpublished IRS tax returns, revealing huge reporting gaps and substantial unaccounted funds.

BLMGNF Organizational Lifecycle

BLMGNF began as a pseudo nonprofit in late 2014. In 2016, Thousand Currents nonprofit became a donor advisory sponsor for BLMGNF. Fiscal sponsorships funnel money through a “conduit arrangement” from a nonprofit sponsor to a pseudo organization or a group of individuals to legally skirt the IRS tax code. Donors receive a tax deduction receipt from the fiscal sponsor. Often, the arrangements lack oversight leaving them highly susceptible to misuse and fraud, and they conceal the beneficiaries. The IRS does not require fiscal sponsors to disclose their conduit arrangements, donations, donors, or expenses in their 990 tax returns.

BLMGNF used ActBlue to process and remit public donations (BLM indulgences) to Thousand Currents. For those unfamiliar with ActBlue, it facilitates Democrats, progressive groups, and far left-leaning nonprofits fundraising using ActBlue’s fundraising platform. Corporations’ donations (BLM tribute) and far-left Foundation grants were made directly to Thousand Currents.

We first reported on this in June of 2020 during the BLM riots that summer.

~Snip~

The Vice-Chair of the Thousand Currents’ Board of Directors was Susan Rosenberg, a convicted domestic terrorist. She was a member of the Weather Underground and Bill Ayers associate. Due to heavy and adverse publicity disclosing her leadership role in Thousand Currents and possible involvement with the BLM movement, the donor advisory was unceremoniously transferred to the ultra-left Tides Foundation non-profit on July 1, 2020. The assignment and transfer of assets (linked here) were recorded in the California Charity Registry but later surreptitiously scrubbed by the state.

According to Thousand Currents June 2020 audited financial statements, it transferred $66.5 million to BLMGNF. Below is the Thousand Currents financial statements’ footnote omitting disclosure of the fund transfer to the Tide Foundation. Tide continued to collect substantial BLMGNF donations during the George Floyd summer protests during the next six months.

**********

~Snip~

Are Federal Agencies BLM Co-Conspirators?

Various states have revoked BLMGNF’s charitable registrations and are investigating fraud, waste, and abuse of charity funds. However, there is no indication the Department of Justice, FBI, or IRS is investigating or has an interest in BLM charity frauds. To quote George Orwell’s allegorical novel ‘Animal Farm’ “All animals are equal, but some animals are more equal than others”.

Commentary:

Meanwhile Marc Elias recently indicted by Dunham has resigned from BLM.

https://jonathanturley.org/2022/05/...-as-marc-elias-reportedly-leaves-board/Extort money from "Woke" corporation by threatening to Burn, Loot and Murder and that is a "mostly peaceful" protest. Dare to protest an obviously stolen election and it is an INSURRECTION!

To be tax-exempt under section 501(c)(3) of the Internal Revenue Code, an organization must be organized and operated exclusively for exempt purposes set forth in section 501(c)(3), and none of its earnings may inure to any private shareholder or individual. In addition, it may not be an action organization, i.e., it may not attempt to influence legislation as a substantial part of its activities and it may not participate in any campaign activity for or against political candidates.

Organizations described in section 501(c)(3) are commonly referred to as charitable organizations.

Organizations described in section 501(c)(3), other than testing for public safety organizations, are eligible to receive tax-deductible contributions in accordance with Code section 170.

The organization must not be organized or operated for the benefit of private interests, and no part of a section 501(c)(3) organization's net earnings may inure to the benefit of any private shareholder or individual. If the

organization engages in an excess benefit transaction with a person having substantial influence over the organization, an excise tax may be imposed on the person and any organization managers agreeing to the transaction.

Section 501(c)(3) organizations are restricted in how much political and legislative (lobbying) activities they may conduct. For a detailed discussion, see Political and Lobbying Activities. For more information about lobbying activities by charities, see the article Lobbying Issues PDF; for more information about political activities of charities, see the FY-2002 CPE topic Election Year Issues PDF.

Turtlesoup

Diamond Member

- Aug 10, 2020

- 15,903

- 16,742

- 2,288

Can't make up this shit.

Lying may not be the right word choice----DEFRAUDING seems more accurate.

Similar threads

- Replies

- 5

- Views

- 257

- Replies

- 13

- Views

- 323

- Replies

- 0

- Views

- 152

- Replies

- 4

- Views

- 86

New Topics

-

Trump was so upset by ‘small hands’ reference in 1984 GQ cover story he told staff to buy up all copies, writer says

- Started by Zafira Cherry

- Replies: 7

-

Fav 5 movies to watch if you had 24 hours to live ???

- Started by Quasar44

- Replies: 6

-

Are the Aliens visiting the Earth, for Human DNA ??, for their survival, or for something else.?

- Started by 52ndStreet

- Replies: 0

-

When America was predominantly American did Americans hate our President for deporting foreign invaders?

- Started by BrokeLoser

- Replies: 4

-

Einstein said that Time was an Illusion of the Human mind, and may not exist as we think it exists.??!!

- Started by 52ndStreet

- Replies: 0