- Thread starter

- #141

Is this a definition of "speculation" you can subscribe to: an expectation future dividends will be higher than the market currently expects?

If so, what's the value of a company that continuously pays no dividends and does not appear as if it ever will?

WeWork’s Unraveling Is Another Indictment of Wall Street’s Universal Bank Model

Dividends alone is not a determining factor.

Again... you own a share of the company itself. That has value, even without dividends. Warren Buffet's company, Berkshire Hathaway, pays no dividends. But the company itself has grown. That growth has value. You as owner, have part ownership in that company, which has value.

Let's spin this around into something easier.

I own a house. Do I get dividends? No. But that house is an investment. Why? Because it has value that increases. Even without dividends showing me direct value, I know that over time property values do increase. Again... why? Because we all know that people need places to live. We can look at the history of property values, and see the increase.

Just like we know that people will need a car, so owning shares in a car company will have value.

Just like we know that people will need food, so owning shares in a food company will have value.

Now I am NOT saying... 'there is no speculation'. Again, everything has some amount of speculation. Democrats could take over my city, and put in place section 8 housing in my area, and the value of my house will drop like a rock. It could happen.

Government could put in place terrible protectionism, that could kill the auto market, and the car company I own shares in, could close.

But again, there is a huge difference between speculating on a real assets, and a ponzi scheme that has no assets.Even if the car and food company are not paying dividends?Just like we know that people will need a car, so owning shares in a car company will have value.

Just like we know that people will need food, so owning shares in a food company will have value.

Tan Liu: Why Many Of Today's Most-Owned Stocks Are Ponzi Schemes | Seeking Alpha

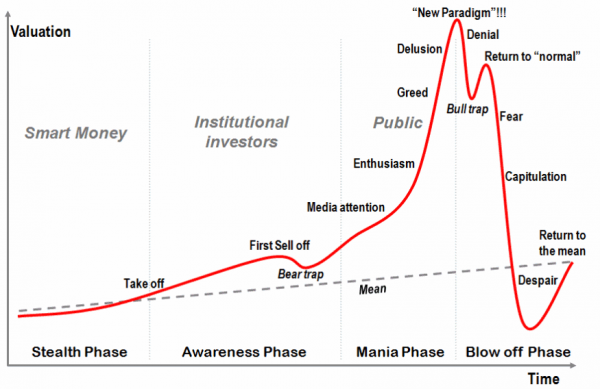

"So when one person buys low and sells high, another is also buying high and needs to sell for even higher. And a system where current investors' profits are dependent on cash from new investors is by definition how a Ponzi scheme works.

"What's wrong with that is a lot of stocks don't pay dividends and why are you an owner of a company if the company never pays the so-called owners?

"that's exactly how it works because when a stock doesn't pay dividends, there is no monetary connection between the revenues and profits of the company and the actual shares."

Of course there is. You directly own a share in a company. That ownership has value. Are you suggesting that I can own something, that produces value, but that ownership of that thing has no value?

Ridiculous. And I can prove it, by simply owning that stock, and seeing it's value increase in proportion to the profits of the company. Which it does. I own shares of Berkshire Hathaway.

There is always a monetary connection between revenues and profits of the company, and the actual shares.

Again... as long as there is an underlying asset, it simply can't be a ponzi scheme. The defining aspect of a ponzi scheme, is the fact there are no assets.Market value or par value?Of course there is. You directly own a share in a company. That ownership has value. Are you suggesting that I can own something, that produces value, but that ownership of that thing has no value?

Google currently trades for over $1200, but the corporation states in writing it doesn't pay dividends, there are no voting rights, and the par value of GOOG is only $0.001 per share. "The value of a stock is just an idea. It is something completely cerebral and imaginary. Real money on the other hand, is finite, traceable, and ...what investors ultimately care about."

How true is the statement that the stock market is essentially a Ponzi scheme? - Quora

Looks like willing buyers-willing sellers decided GOOG was worth about $1260 yesterday.

They earned about $50 per share over the last 12 months. Sounds pretty solid.

Assuming there's always a Greater FoolLooks like willing buyers-willing sellers decided GOOG was worth about $1260 yesterday.

They earned about $50 per share over the last 12 months. Sounds pretty solid.

"The Greater Fool Theory is the notion that even when an asset is fully valued or overvalued, there is room for that asset's value to increase even further because there are 'greater fools' out there to push prices up purely due to hype or speculation."

The Greater Fool Theory — Steemit

/cdn.vox-cdn.com/uploads/chorus_image/image/63915906/vpavic_190529_3458_0003.0.jpg)