Widdekind

Member

- Mar 26, 2012

- 813

- 35

- 16

currency in banks ?

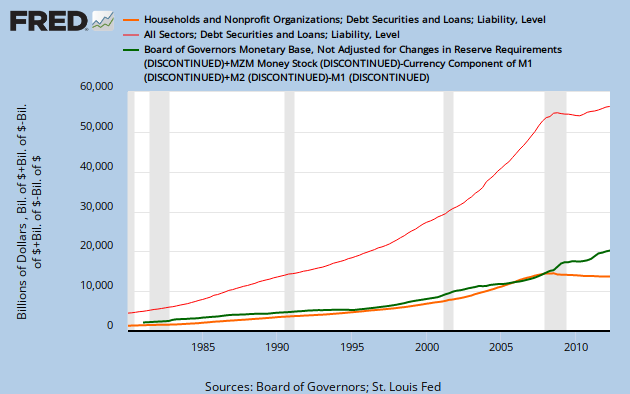

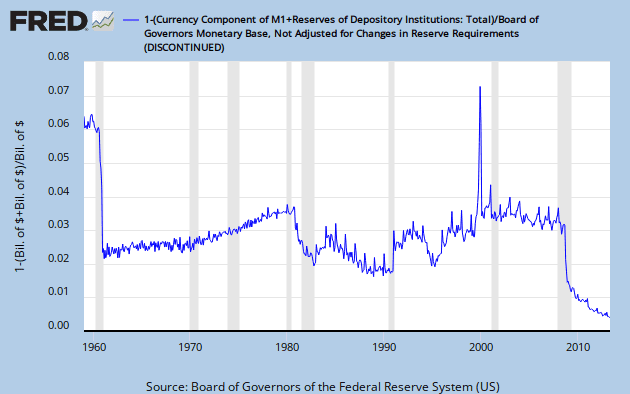

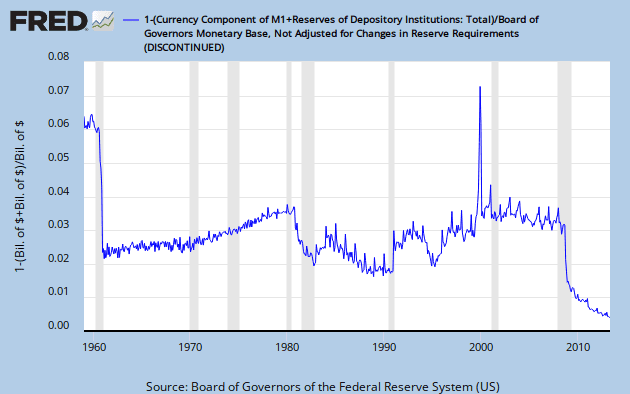

Prima facie, bank-vaults were "cleaned out" in

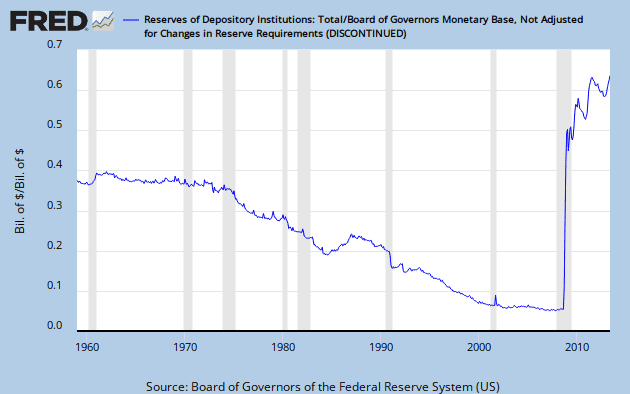

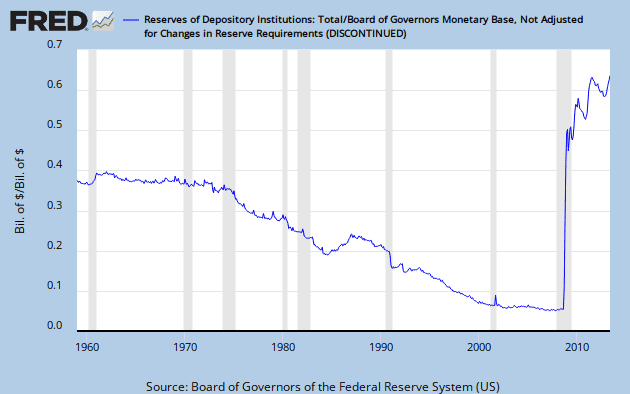

required Reserves ?

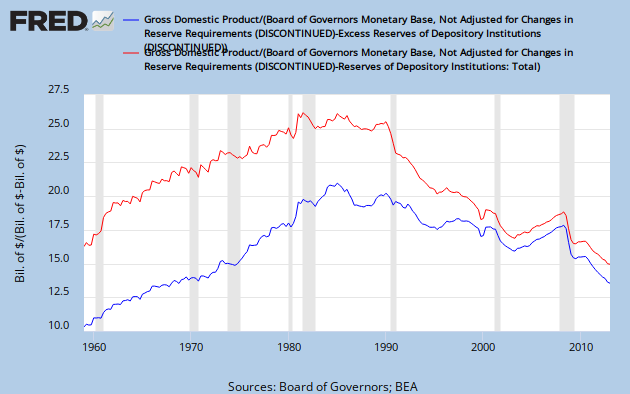

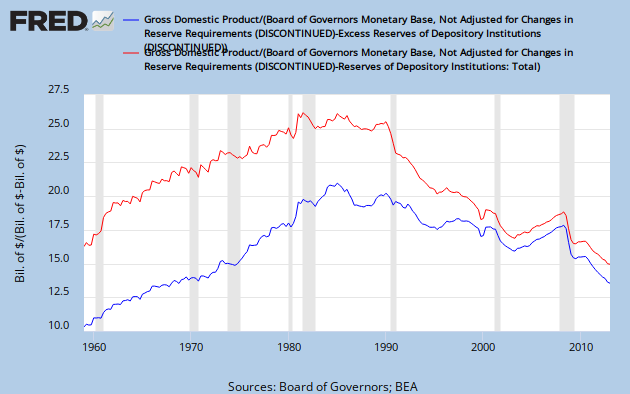

From the Vietnam War to 9/11, required Reserves decreased steadily, from 40% to 5%, then increased suddenly by 13x (to two-thirds), after c.2008.

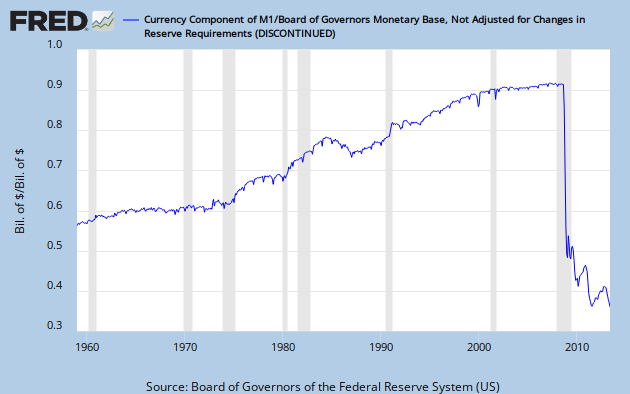

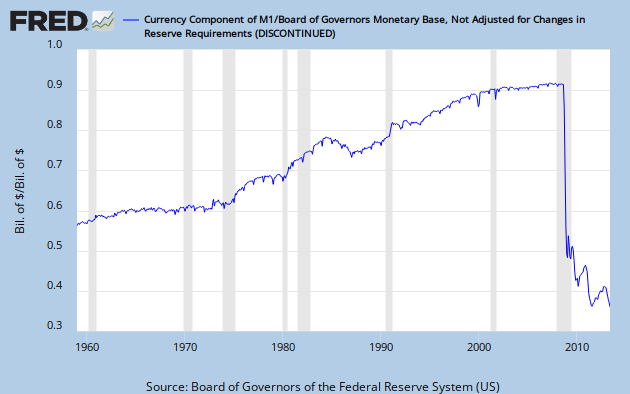

currency in circulation ?

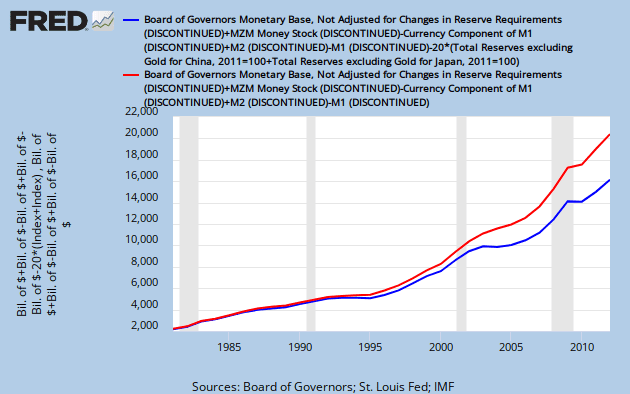

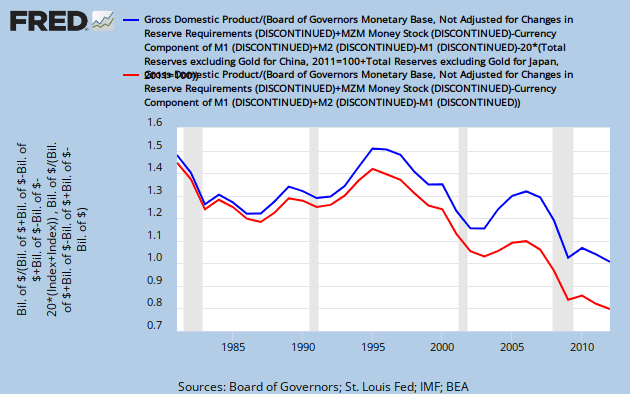

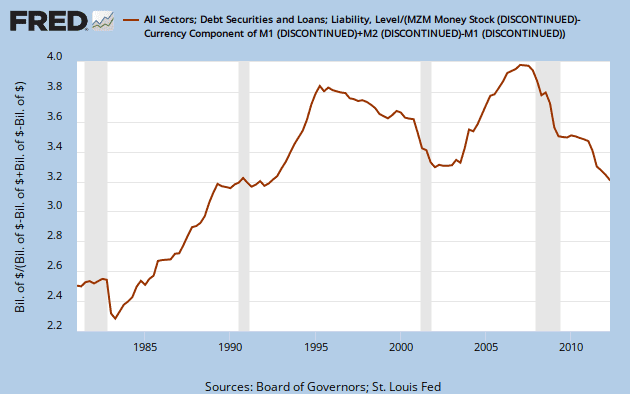

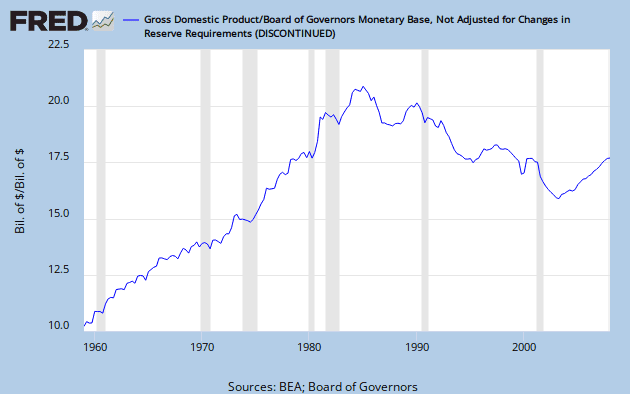

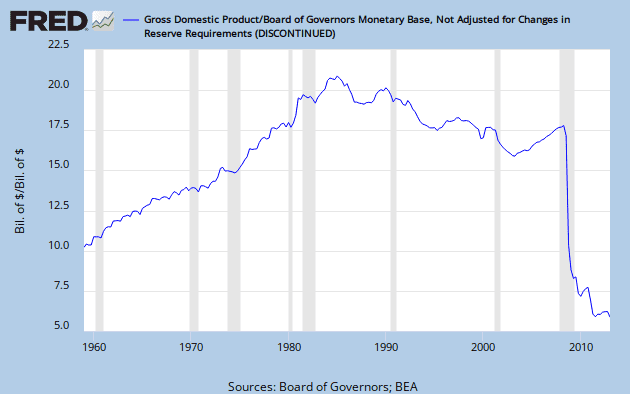

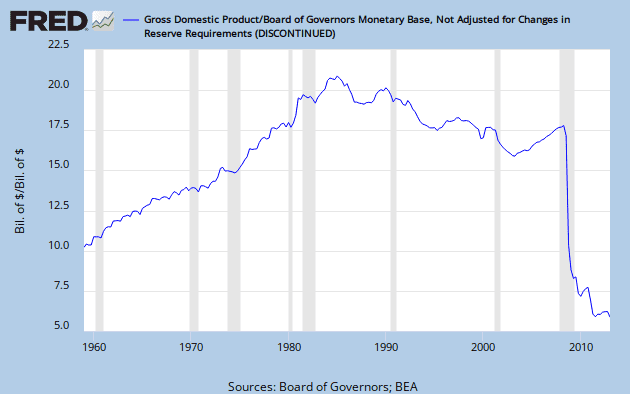

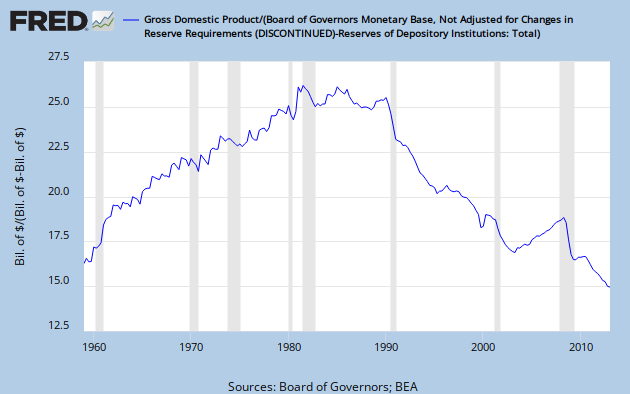

From the Vietnam War to 2008, the fraction of currency in circulation steadily increased by half, from 60-90%, then suddenly decreased to one-third. Prima facie, since 2008, "everybody (including foreign holders ?) parked their money in banks". Indeed, since 2008, the Velocity of the (total) Money-Base (VB = GDP / MB [#/quarter]) has decreased by 3x (from 18 to 6 [transactions/quarter]):

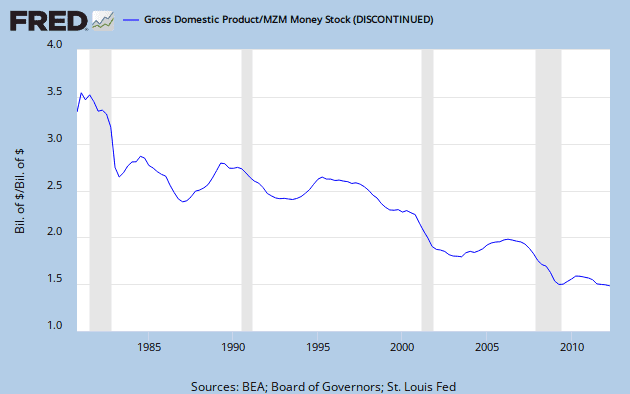

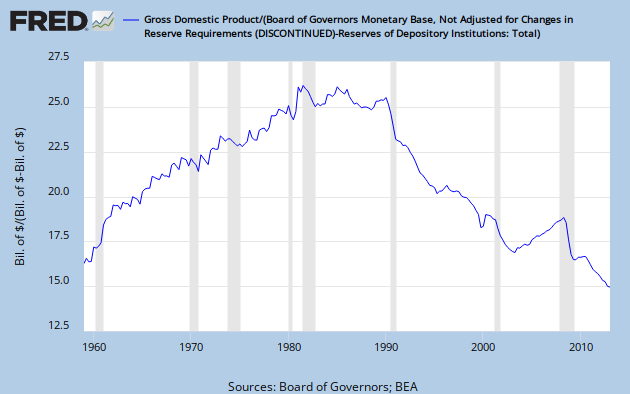

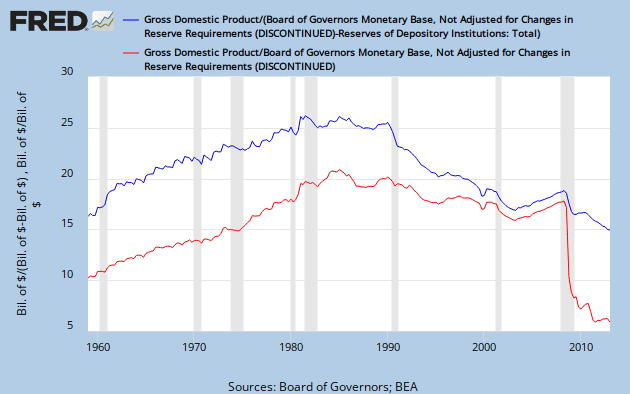

The impact, of 2008, on the Velocity of (active) Currency, was less pronounced, decreasing by one-sixth (from 18 to 15 [transactions/quarter]):

The impact, of 2008, on the Velocity of (active) Currency, was less pronounced, decreasing by one-sixth (from 18 to 15 [transactions/quarter]):

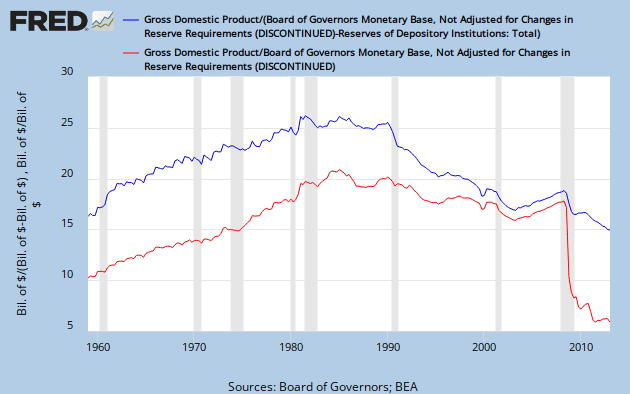

Growing convergence, of VC & VB, reflected de-Savings.

Growing convergence, of VC & VB, reflected de-Savings.

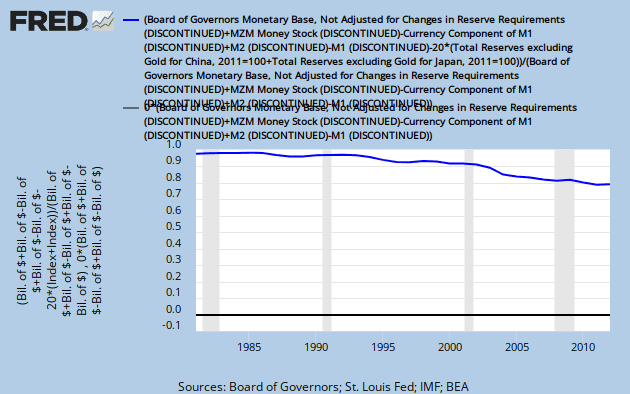

2000 Savings spree ?

Prima facie, c.2000, a sudden "spree" of Savings doubled the amount of (non-Reserve) Currency "on hand" in banks (i.e. "in cash registers behind counters"), from 3.5% to 7% of total Money Base. The "spree", perhaps associated with the tense 2000 Presidential election, ended as suddenly as it began.

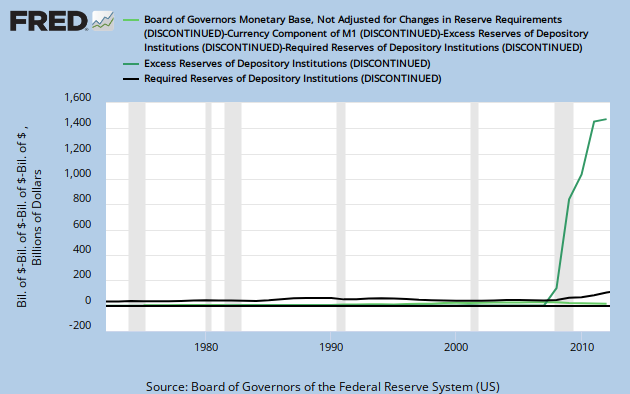

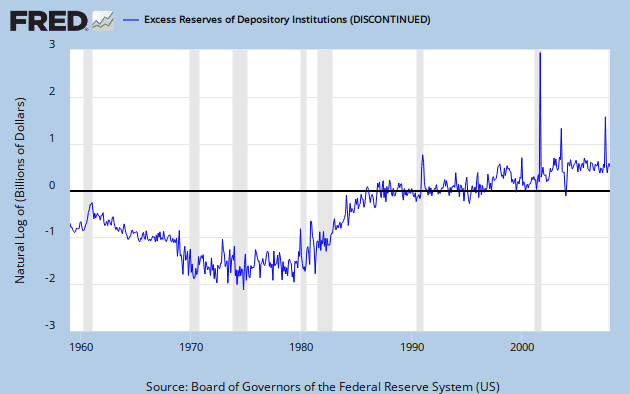

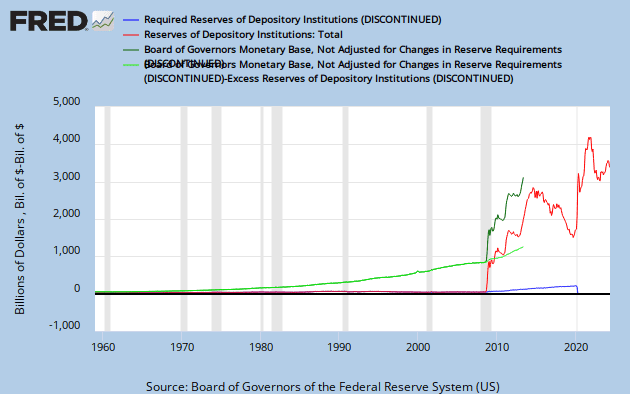

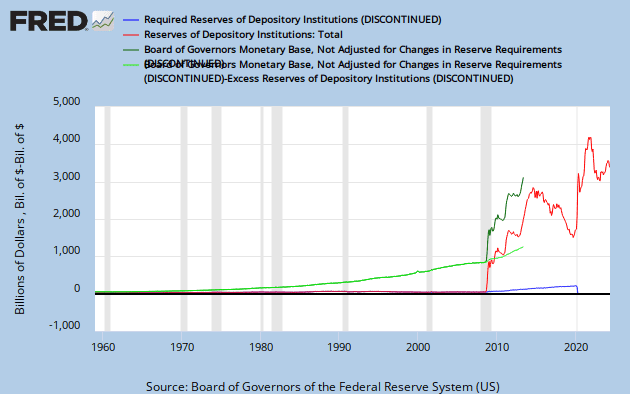

Fed hoarding excess Reserves ?

before 2008, the Federal Reserve system held negligible excess-Reserves; after 2008, excess-Reserves increased allot, accounting for nearly all of the (above trend) increase in Money-Base:

miscellaneous notes (for future reference)

when utilizing the "FRED" online financial data grapher,

according to Wikipedia

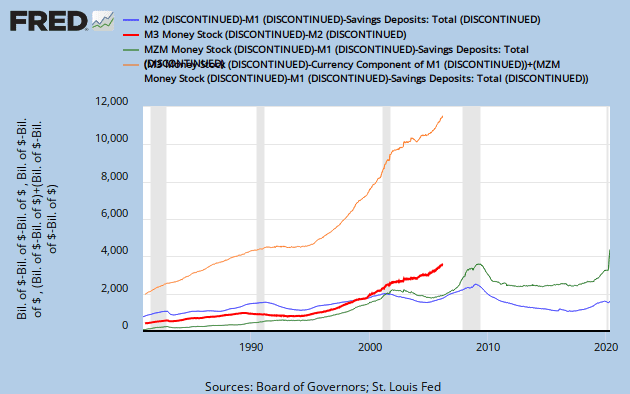

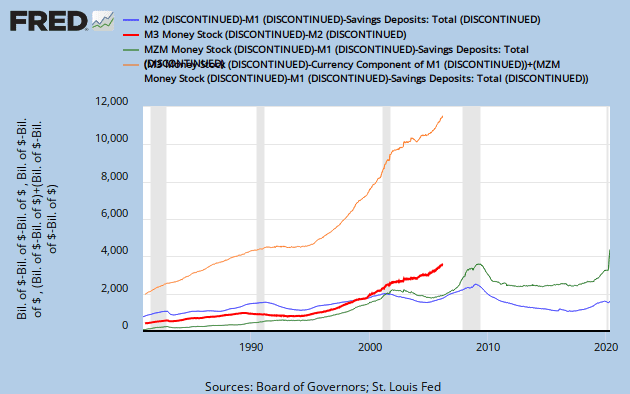

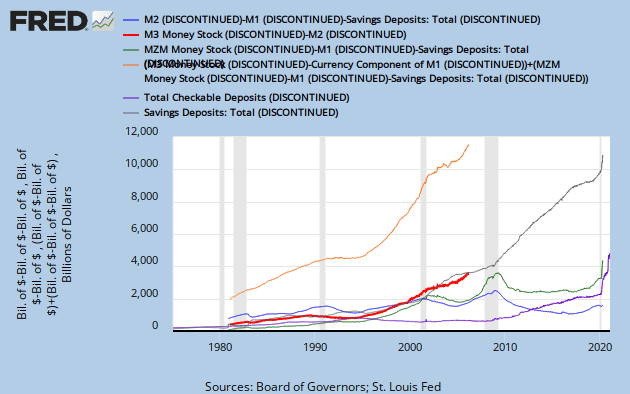

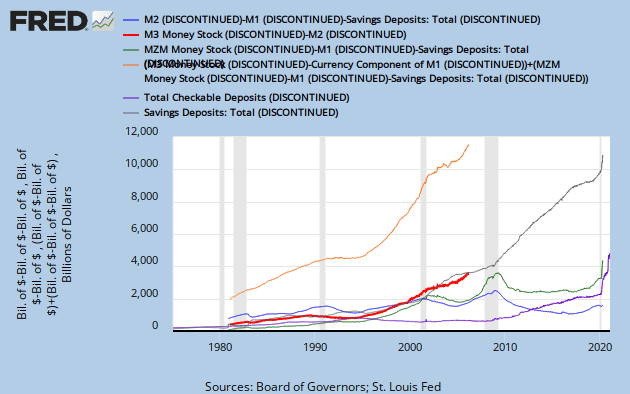

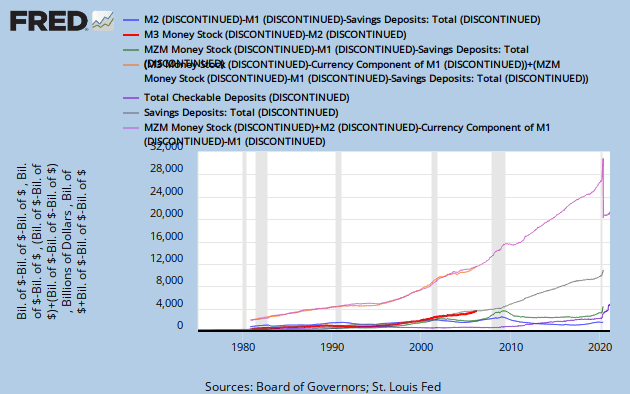

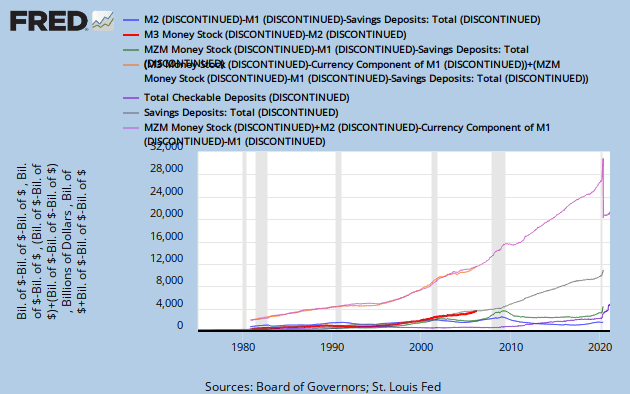

M3 "bond" component sky-rocketed after 1993 NAFTA ratified; M3 is no longer reported, perhaps because China holds all of the (tacitly implied) long-term debt (>$3T) ?

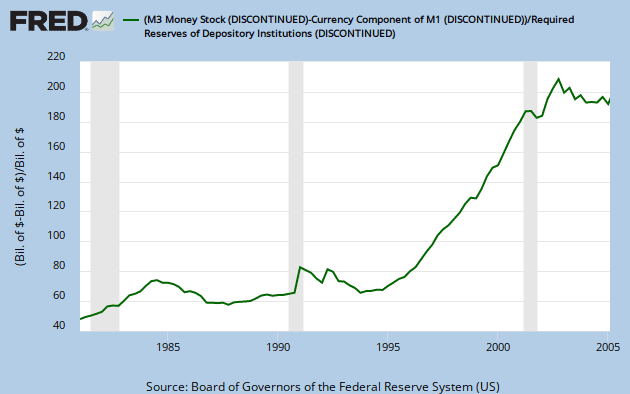

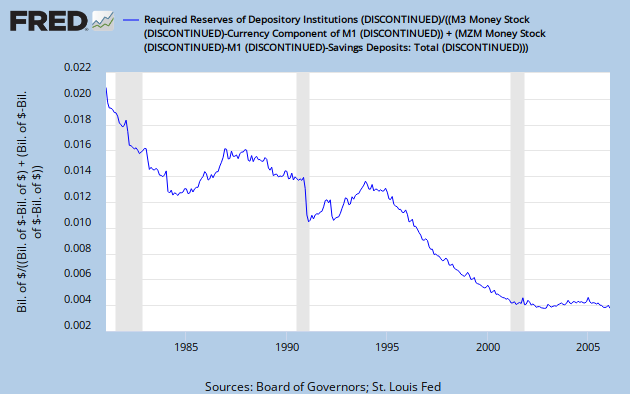

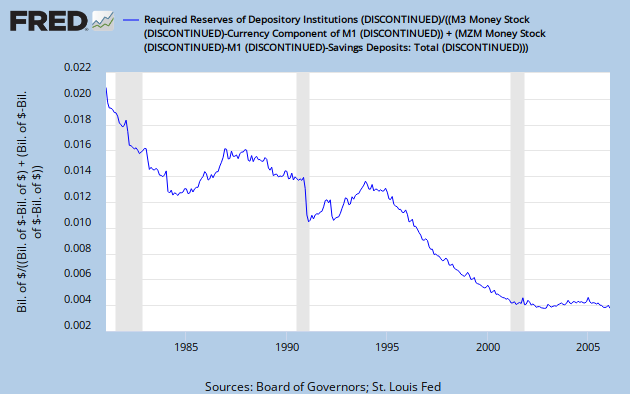

de facto Reserve ratio has decreased, from ~2% under Reagan, to ~1% under Clinton, to <1% under Obama:

components of "pseudo-Money"

in big round numbers, by 2005, total "pseudo-Money" was ~$12T:

over-simplistically, private individuals Save into banks (savings Deposits & MMAs), then banks Invest into businesses & Governments (bonds & MMFs), with some "spill over" if-and-when Invested Money buys securities from private individuals. By such "Money flows", private individuals' Savings is re-loaned, as Investments, back out to

estimating "pseudo-Money" ?

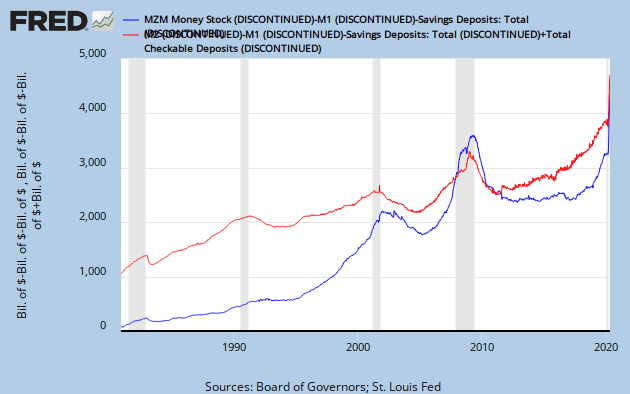

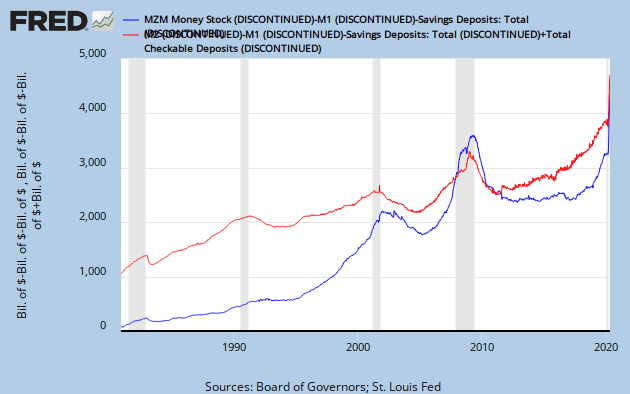

using "savings Deposits" as a proxy for "bonds", we can construct a proxy for "pseudo-Money":

in big round numbers, the top two curves (pseudo-Money vs. estimate) correlate closely.

also in big round numbers, total non-savings Deposits of private individuals approximates total investments into Money-Market Funds:

i.e. "banks use your 'checking accounts' & 'money-market accounts' to Invest in MMFs (which Invest in short-term Government & business bonds)"; banks offer MMAs "to compete against MMFs".

MB = [currency in circulation] + [currency in bank-vaults] + [Reserves in banks]

= M0 + Mv + R

Mv = MB - M0 - R

%Mv = Mv / MB = 1 - [M0 + R]/MB

= M0 + Mv + R

Mv = MB - M0 - R

%Mv = Mv / MB = 1 - [M0 + R]/MB

Prima facie, bank-vaults were "cleaned out" in

- 1960 (JFK elected)

- 1980 (Reagan elected)

- 2008 (Obama elected)

required Reserves ?

R/MB

From the Vietnam War to 9/11, required Reserves decreased steadily, from 40% to 5%, then increased suddenly by 13x (to two-thirds), after c.2008.

currency in circulation ?

M0/MB

From the Vietnam War to 2008, the fraction of currency in circulation steadily increased by half, from 60-90%, then suddenly decreased to one-third. Prima facie, since 2008, "everybody (including foreign holders ?) parked their money in banks". Indeed, since 2008, the Velocity of the (total) Money-Base (VB = GDP / MB [#/quarter]) has decreased by 3x (from 18 to 6 [transactions/quarter]):

[currency] = [currency in circulation] + [currency in bank-vaults]

MC = MB - R

VC = GDP / MC

Ipso facto, USD still in circulation are "moving" almost as fast as they were before 2008; but, large amounts of USD were de-circulated into "frozen" Reserves. Plotting both (VC > VB) together:MC = MB - R

VC = GDP / MC

2000 Savings spree ?

Prima facie, c.2000, a sudden "spree" of Savings doubled the amount of (non-Reserve) Currency "on hand" in banks (i.e. "in cash registers behind counters"), from 3.5% to 7% of total Money Base. The "spree", perhaps associated with the tense 2000 Presidential election, ended as suddenly as it began.

Fed hoarding excess Reserves ?

before 2008, the Federal Reserve system held negligible excess-Reserves; after 2008, excess-Reserves increased allot, accounting for nearly all of the (above trend) increase in Money-Base:

required Reserves, total Reserves, MB, MB - excess Reserves = MB - (total Reserves - required Reserves)

Ignoring excess-Reserves, in Federal Reserve bank "hoards":

M0* = [currency in circulation] + [currency in bank-vaults] ("circulating currency")

= MB - [total Reserves]

MB* = M0* + [required Reserves] ("active currency")

= MB - [excess Reserves]

V0* = GDP / M0* ("circulating currency velocity")

VB* = GDP / VB* ("active currency velocity")

Money Velocities of ~15 per quarter equate to ~1 per business-week.= MB - [total Reserves]

MB* = M0* + [required Reserves] ("active currency")

= MB - [excess Reserves]

V0* = GDP / M0* ("circulating currency velocity")

VB* = GDP / VB* ("active currency velocity")

miscellaneous notes (for future reference)

when utilizing the "FRED" online financial data grapher,

[M1] - [Currency] = [demand Deposits] = "total checkable Deposits"

according to Wikipedia

[MZM] - [M1] - [savings Deposits] = "money-market funds"

[M2] - [M1] - [savings Deposits] = "money-market accounts"

[M3] - [M2] = "bonds"

{[M3] - [Currency]} +{[MZM] - [M1] - [savings Deposits]} = "checking + saving Deposits" + "bonds" + "money-market funds"

= "all extra-Currency pseudo-Monies"

MMFs, MMAs, Bonds, pseudo-Money

[M2] - [M1] - [savings Deposits] = "money-market accounts"

[M3] - [M2] = "bonds"

{[M3] - [Currency]} +{[MZM] - [M1] - [savings Deposits]} = "checking + saving Deposits" + "bonds" + "money-market funds"

= "all extra-Currency pseudo-Monies"

MMFs, MMAs, Bonds, pseudo-Money

M3 "bond" component sky-rocketed after 1993 NAFTA ratified; M3 is no longer reported, perhaps because China holds all of the (tacitly implied) long-term debt (>$3T) ?

de facto Reserve ratio has decreased, from ~2% under Reagan, to ~1% under Clinton, to <1% under Obama:

[pseudo-Money] / [required Reserves] = [de facto Reserve ratio]

Federal Reserve requirements comprise

- no-reserve tranche of 0% (less than $12M)

- low-reserve tranche of 3% (less than $71M)

- high-reserve tranche of 10% (more than $71M)

components of "pseudo-Money"

in big round numbers, by 2005, total "pseudo-Money" was ~$12T:

- savings ~$4T

- MMAs ~$2T

- MMFs ~$2T

- bonds ~$4T

[pseudo-Money] = [checking + savings Deposits] + [money-market Deposits] + [money-market funds] + [bonds]

over-simplistically, private individuals Save into banks (savings Deposits & MMAs), then banks Invest into businesses & Governments (bonds & MMFs), with some "spill over" if-and-when Invested Money buys securities from private individuals. By such "Money flows", private individuals' Savings is re-loaned, as Investments, back out to

- private individuals for Consumption (C)

- businesses for Capital Investment (I)

- Governments (G)

estimating "pseudo-Money" ?

using "savings Deposits" as a proxy for "bonds", we can construct a proxy for "pseudo-Money":

[savings Deposits] ~= [M3] - [M2]

[pseudo-Money] = {[M3] - [Currency]} + {[MZM] - [M1] - [savings Deposits]}

~= {[M2] + [savings Deposits] - [Currency]} + {[MZM] - [M1] - [savings Deposits]}

= [MZM] - [Currency] + [M2] - [M1]

[pseudo-Money] = {[M3] - [Currency]} + {[MZM] - [M1] - [savings Deposits]}

~= {[M2] + [savings Deposits] - [Currency]} + {[MZM] - [M1] - [savings Deposits]}

= [MZM] - [Currency] + [M2] - [M1]

in big round numbers, the top two curves (pseudo-Money vs. estimate) correlate closely.

also in big round numbers, total non-savings Deposits of private individuals approximates total investments into Money-Market Funds:

[MMF] = [MZM] - [M1] - [Currency]

~= [checking Deposits] + [MMA]

= [M2] - [M1] - [savings Deposits] + [checking Deposits]

~= [checking Deposits] + [MMA]

= [M2] - [M1] - [savings Deposits] + [checking Deposits]

i.e. "banks use your 'checking accounts' & 'money-market accounts' to Invest in MMFs (which Invest in short-term Government & business bonds)"; banks offer MMAs "to compete against MMFs".

Last edited: