tigerred59

Gold Member

- Mar 17, 2015

- 21,276

- 2,880

- 290

- Banned

- #1

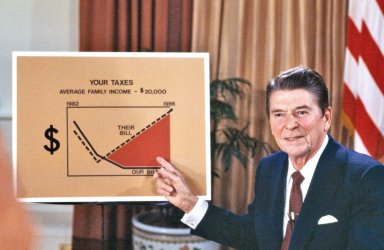

How a small business benefitted from the Republican tax plan

How a small business benefitted from the Republican tax plan

President Trump touts economic boom of first year in White House. Joseph's Lite Cookies gave employees raises as a result of tax reform.

I have yet to see one news story of ordinary tax payers who don't own business's, who get up to go to work every single day, one story about how this tax plan has helped them....as a matter of fact, it didn't!!

How a small business benefitted from the Republican tax plan

President Trump touts economic boom of first year in White House. Joseph's Lite Cookies gave employees raises as a result of tax reform.

I have yet to see one news story of ordinary tax payers who don't own business's, who get up to go to work every single day, one story about how this tax plan has helped them....as a matter of fact, it didn't!!