Toro

Diamond Member

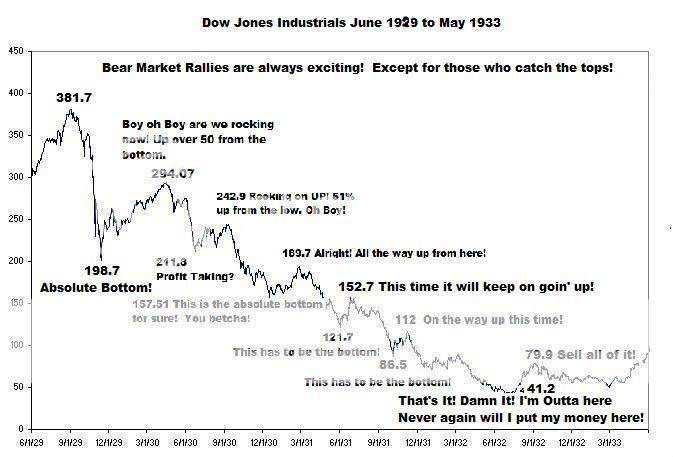

The market now is holding up better than the market during the Great Depression.

In fact, it is most acting like the rebound in 1938 as opposed to 1930.

In fact, it is most acting like the rebound in 1938 as opposed to 1930.