BaronVonBigmeat

Senior Member

- Sep 20, 2005

- 1,185

- 163

- 48

This deflation caused people to fear bank collapses, which caused them to pull their deposits, precipitating bank collapses. In the Austrian school, this type of behavior is not supposed to happen, but it did.

Eh? Austrians would say that banking panics are a market response to unsound banking practices, ie excessive fractional reserve lending.

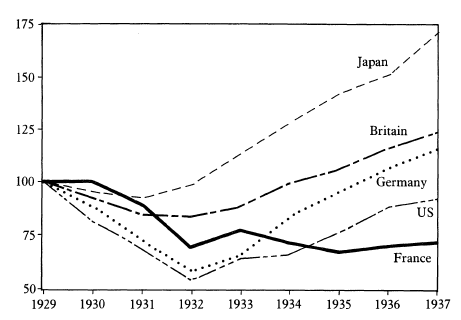

As Rabbi stated, when credit is restrictive, economic activity is constrained, as it was under the gold standard. When countries are no longer bound by those restrictions, credit and economic activity are no longer constrained by this anchor. When countries left the gold standard, their economies began to rise again.

So, how about that 1920 depression that lasted barely over a year?

*whistles past the graveyard*

edit: also why is it that the cost and supply of credit should be centrally planned? Every other commodity you can name--wheat, corn, oil, coffee, OJ--is determined by a meeting of buyers and sellers, who work out a market price. If you advocated central planning the price of these commodities, people would laugh; but advocate centrally planning the price of credit, and suddenly its a great idea.

Last edited: