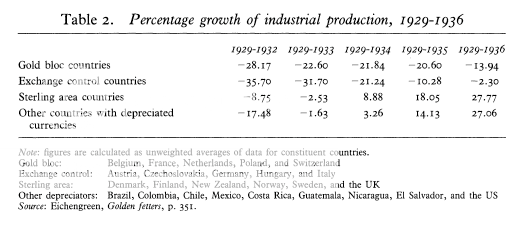

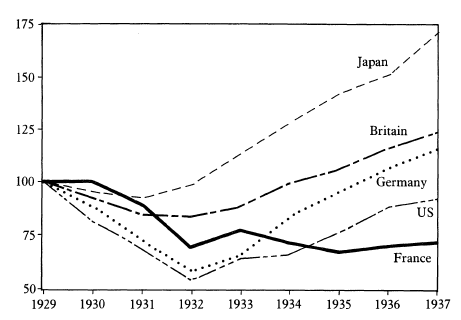

As countries abandoned the gold standard during the Depression, they began to grow again. The longer countries waited to leave the gold standard, the longer they waited for growth to resume.

Modified goldbugism at the WSJ - Paul Krugman Blog - NYTimes.com

Barry Eichengreen pointed out years ago that major economies went off gold in the following order: Japan, Britain, Germany, US, France. [... the correlation between going off gold and recovery is in fact perfect] And here’s what happened to their industrial output:

Modified goldbugism at the WSJ - Paul Krugman Blog - NYTimes.com