Paulie

Diamond Member

- May 19, 2007

- 40,769

- 6,382

- 1,830

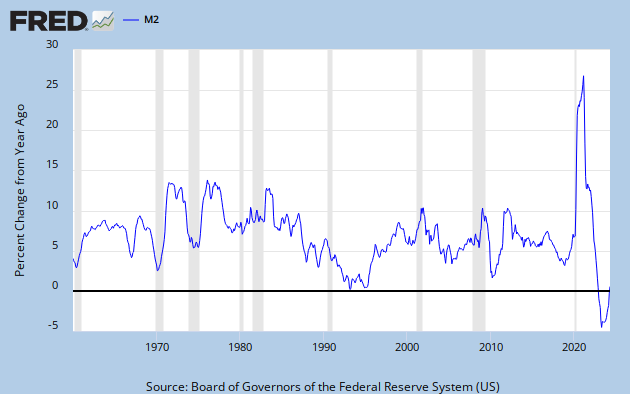

you can't pull a trillion dollars out of your ass and say it has value!

Boy, I wish I knew anyone who could pull money out of their ass. You're spewing bullshit.

Oh, one of those idiots who thinks the Federal Reserve doesn't create money out of thin air.

It's amazing to me that people who don't even understand how the Fed's open market operations work have the audacity to get involved in debates like this.

Fitz, why are you arguing with this idiot?