Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

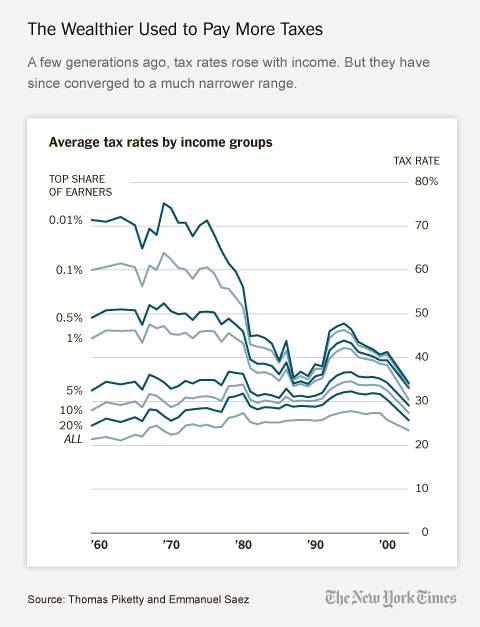

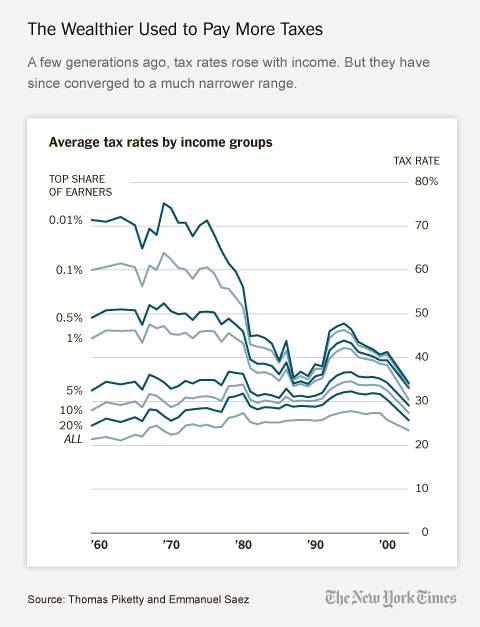

Taxing the rich -- then and now

- Thread starter ilia25

- Start date

- Moderator

- #22

If the rich will end up earning 99% of the overall income, do you think they will complain about paying 99% of taxes?

I am absolutely sure that they will.

Mere speculation based on your bias born from jealous and envy. That's not a good way to go through life.

The fact that the rich are paying a bigger share in taxes ONLY because they are earning a bigger share of overall income is not a speculation.

That is a fact.

"If the rich will end up earning 99% of the overall income, do you think they will complain about paying 99% of taxes?

I am absolutely sure that they will."

That's not a fact, dumb ass. That's speculation, hence the reason I quote those words. Try to keep up.

- Moderator

- #23

I'm referring to you, not the country.

And I was referring to the country that was.

And I was referring to you, so I don't give a fuck.

Which you think was a communist state back then.

I think you're a jealous, parasitic Marxist loser who didn't do anything significant with your life so you think that somehow gives you the right to take what other people have. That's what I think. Actually, that's what I know. How about you grow up, be an adult for once, and pull your own weight. You take care of you and I'll take care of me. That sounds like the fairest plan out there.

ilia25

I can do math

- Jan 12, 2012

- 1,859

- 100

- 48

- Thread starter

- #24

I'm referring to you, not the country.

And I was referring to the country that was.

And I was referring to you, so I don't give a fuck.

Which you think was a communist state back then.

I think you're a jealous, parasitic Marxist loser who didn't do anything significant with your life so you think that somehow gives you the right to take what other people have. That's what I think. Actually, that's what I know. How about you grow up, be an adult for once, and pull your own weight. You take care of you and I'll take care of me. That sounds like the fairest plan out there.

And here is what I think, Bro. You are a looser siding with those fucking you up, because it lets you hope that you too are a bit like them. A rich asshole wannabe.

A house negro -- that's who you are.

Wacky Quacky

Gold Member

- May 16, 2011

- 2,103

- 377

- 130

Bullshit -- cutting the deficit is one of the reasons Dems want to rise taxes

No. They want to raise taxes so they can spend them.

Telling lies only makes you look ridiculous.

I agree with g5000. It's not lies, it's history. Give government more money and they'll just blow it on more crap.

- Moderator

- #26

And I was referring to the country that was.

And I was referring to you, so I don't give a fuck.

Which you think was a communist state back then.

I think you're a jealous, parasitic Marxist loser who didn't do anything significant with your life so you think that somehow gives you the right to take what other people have. That's what I think. Actually, that's what I know. How about you grow up, be an adult for once, and pull your own weight. You take care of you and I'll take care of me. That sounds like the fairest plan out there.

And here is what I think, Bro. You are a looser siding with those fucking you up, because it lets you hope that you too are a bit like them. A rich asshole wannabe.

No, you don't think. That's the problem. And what is a looser?

A house negro -- that's who you are.

And you're a racist to boot. Shocking.... How about you go put your white sheet back on and go burn a cross in some poor black man's yard who you helped enslave to the government welfare state.

Last edited:

GuyPinestra

Senior Member

- Jan 29, 2012

- 6,905

- 673

- 48

If the rich will end up earning 99% of the overall income, do you think they will complain that they pay 99% of taxes?

I am absolutely sure that they will.

If the government is growing its spending faster than America is growing its income, do you think Democrats will complain?

I am absolutely sure that they won't.

Bullshit -- cutting the deficit is one of the reasons Dems want to rise taxes

Bullshit is right, $80 billion a year doesn't even make a dent in $1.1 TRILLION.

GuyPinestra

Senior Member

- Jan 29, 2012

- 6,905

- 673

- 48

the money is already spent, whether it has to be borrowed or generated through new taxes. is this difficult to understand?Bullshit -- cutting the deficit is one of the reasons Dems want to rise taxes

No. They want to raise taxes so they can spend them.

.

Which is why the ONLY solution is to CUT SPENDING!

Avorysuds

Gold Member

WHY DO WE HAVE TO GO THROUGH THIS SHIT 3X A FUCKING WEEK? NO ONE EVER PAID 70% FUCKING TAXES IN AMEICA, NEVER FUCKING EVER!

Deductions you dumb stupid chit for brains, deductions.... https://www.google.com/ Look it fucking up and save us from you making the world a dumber place.

Deductions you dumb stupid chit for brains, deductions.... https://www.google.com/ Look it fucking up and save us from you making the world a dumber place.

alan1

Gold Member

Over the same period, those high-income households have earned a larger and larger share of overall income, too.

A few generations ago, people used to ride a horse if they wanted to get somewhere.

What's yer point? More horses? After all, that's the way it used to be.

ilia25

I can do math

- Jan 12, 2012

- 1,859

- 100

- 48

- Thread starter

- #31

If the government is growing its spending faster than America is growing its income, do you think Democrats will complain?

I am absolutely sure that they won't.

Bullshit -- cutting the deficit is one of the reasons Dems want to rise taxes

Bullshit is right, $80 billion a year doesn't even make a dent in $1.1 TRILLION.

That is why expiring Bush cuts should be only the first step. We should go back to 70% top marginal rates.

ilia25

I can do math

- Jan 12, 2012

- 1,859

- 100

- 48

- Thread starter

- #33

Over the same period, those high-income households have earned a larger and larger share of overall income, too.

A few generations ago, people used to ride a horse if they wanted to get somewhere.

What's yer point? More horses?

No, my point is rising the tax rates to where they used to be.

Are you really so dumb that you can't tell taxes from horses?

LeftCoastVoter

Member

- Nov 29, 2012

- 579

- 23

- 16

actually the top tax bracket reached 94% in 1944 on incomes over $200 annually, which when adjusted for inflation is $2.54M annually.WHY DO WE HAVE TO GO THROUGH THIS SHIT 3X A FUCKING WEEK? NO ONE EVER PAID 70% FUCKING TAXES IN AMEICA, NEVER FUCKING EVER!

Shut the fuck up! You are not saying anything useful.

Income tax in the United States - Wikipedia, the free encyclopedia

Truthmatters

Diamond Member

- May 10, 2007

- 80,182

- 2,272

- 1,283

- Banned

- #35

avy doesnt do facts either

DiamondDave

Army Vet

WHY DO WE HAVE TO GO THROUGH THIS SHIT 3X A FUCKING WEEK? NO ONE EVER PAID 70% FUCKING TAXES IN AMEICA, NEVER FUCKING EVER!

Shut the fuck up! You are not saying anything useful.

Yes.. we know that facts are useless to the chanting progressive

DiamondDave

Army Vet

actually the top tax bracket reached 94% in 1944 on incomes over $200 annually, which when adjusted for inflation is $2.54M annually.WHY DO WE HAVE TO GO THROUGH THIS SHIT 3X A FUCKING WEEK? NO ONE EVER PAID 70% FUCKING TAXES IN AMEICA, NEVER FUCKING EVER!

Shut the fuck up! You are not saying anything useful.

Income tax in the United States - Wikipedia, the free encyclopedia

Once again.. please look at WHAT WAS DEEMED INCOME, what was deductible etc.... the rate may have been 'advertised' as that, but in no way did anyone pay anything close to that

LeftCoastVoter

Member

- Nov 29, 2012

- 579

- 23

- 16

this still doesnt change the fact that the top rate of 94%. everyone's effective tax rate differs depending on their deductions. but the top standard rate was 94%.actually the top tax bracket reached 94% in 1944 on incomes over $200 annually, which when adjusted for inflation is $2.54M annually.Shut the fuck up! You are not saying anything useful.

Income tax in the United States - Wikipedia, the free encyclopedia

Once again.. please look at WHAT WAS DEEMED INCOME, what was deductible etc.... the rate may have been 'advertised' as that, but in no way did anyone pay anything close to that

DiamondDave

Army Vet

this still doesnt change the fact that the top rate of 94%. everyone's effective tax rate differs depending on their deductions. but the top standard rate was 94%.actually the top tax bracket reached 94% in 1944 on incomes over $200 annually, which when adjusted for inflation is $2.54M annually.

Income tax in the United States - Wikipedia, the free encyclopedia

Once again.. please look at WHAT WAS DEEMED INCOME, what was deductible etc.... the rate may have been 'advertised' as that, but in no way did anyone pay anything close to that

I can advertise a top rate of 100% for political games... but if I allow most everything to be exempted or excluded, it really is not paying that much

It is a play on words for the weak... just like those who pay lip service to a flat tax, while advocating a salary floor (thus not making it a flat tax, but indeed a disguised progressive tax)

LeftCoastVoter

Member

- Nov 29, 2012

- 579

- 23

- 16

these were not the advertised rates, these were the actual rates. can you not understand that? im not advocating going back to a top rate of 94%, i am simply pointing out that as a matter of fact that in 1944 the top rate was 94%. just like is was 91% in 1946. and 39.6% in 1996.this still doesnt change the fact that the top rate of 94%. everyone's effective tax rate differs depending on their deductions. but the top standard rate was 94%.Once again.. please look at WHAT WAS DEEMED INCOME, what was deductible etc.... the rate may have been 'advertised' as that, but in no way did anyone pay anything close to that

I can advertise a top rate of 100% for political games... but if I allow most everything to be exempted or excluded, it really is not paying that much

It is a play on words for the weak... just like those who pay lip service to a flat tax, while advocating a salary floor (thus not making it a flat tax, but indeed a disguised progressive tax)

these are facts, not opinions up for debate.

Similar threads

- Replies

- 20

- Views

- 339

- Replies

- 23

- Views

- 249

Latest Discussions

- Replies

- 86

- Views

- 565

- Replies

- 127

- Views

- 977

- Replies

- 49

- Views

- 159

- Replies

- 229

- Views

- 2K

Forum List

-

-

-

-

-

Political Satire 8889

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

ObamaCare 781

-

-

-

-

-

-

-

-

-

-

-

Member Usernotes 492

-

-

-

-

-

-

-

-

-

-