- Oct 31, 2012

- 53,814

- 52,677

- 3,605

- Thread starter

- #61

The Bush Tax Cuts expiring is just one piece of the puzzle as well as ending the wars, curtailing military spending, closing tax loopholes and re-examining social programs all of which Obama ran on for re-election. It actually would be pretty easy to balance the budget, it's just a question of who has the balls to do it.

And there's no point talking to Vel.

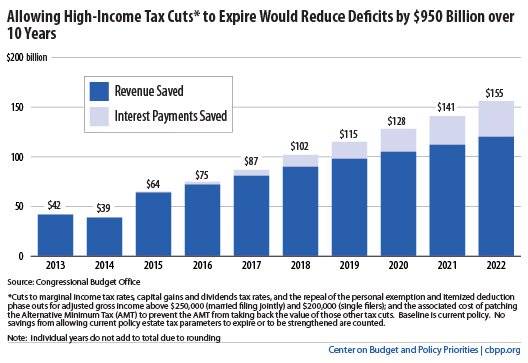

What peice of the puzzle would it be? In short, how much revenue would letting the taxes expire generate?

Last edited by a moderator:

Is this thing on? Mike! Check!

Is this thing on? Mike! Check!

Oh, Seattle... I should have guessed.

Oh, Seattle... I should have guessed.