sakinago

Gold Member

- Sep 13, 2012

- 5,320

- 1,632

- 280

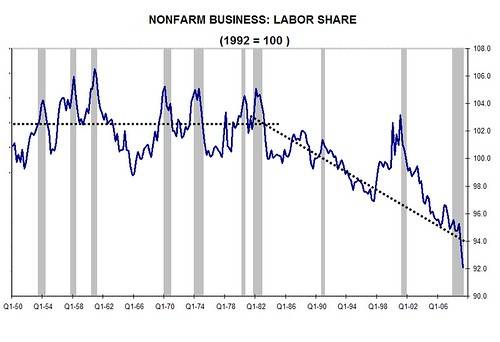

Tax Cuts do a lot of things; increase deficits, explode debts, hurt wage growth...but in concert with unlimited campaign contributions, they actually steal our democracy. The average politician spends about 80% of their time raising money. And from whom are they generally raising the most money? From wealthy donors. And what benefits wealthy donors? Tax cuts. Here are some handy charts showing the extent of the theft of wealth and democracy by the 1% and their Conservative and Neo-Liberal enablers. Since the Reagan tax cuts, working people’s share of the benefits from increased productivity took a sudden turn down:

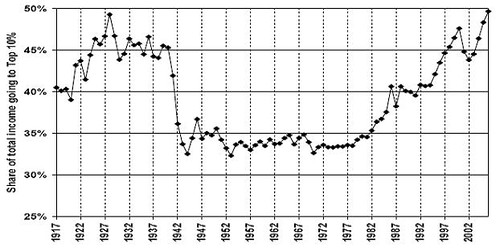

This resulted in intense concentration of wealth at the top:

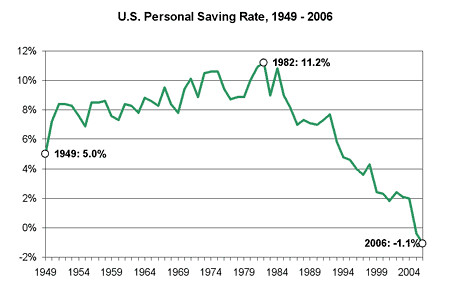

And forced working people to spend down savings to get by:

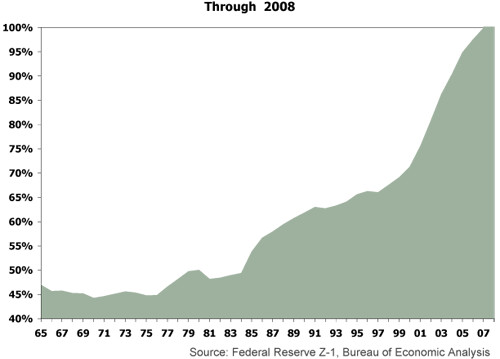

Which forced working people to go into debt: (total household debt as percentage of GDP)

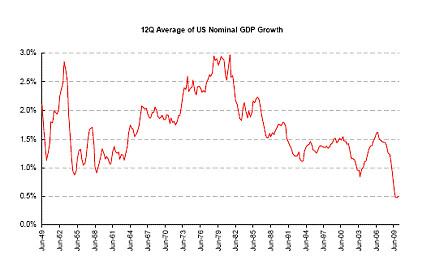

None of which has helped economic growth much: (12-quarter rolling average nominal GDP growth.):

So the conclusion? Trump and the Conservatives' "tax reform" is just more of the same we've heard from them since 1980, and is just a thinly veiled attempt to redistribute wealth from the middle and bottom to the top.

First statement of increase deficits is false...and by explode debt I assume your referring to national debt?

https://object.cato.org/images/pubs/commentary/030304-1.gif

The Historical Lessons of Lower Tax Rates

The Coolidge tax cuts: tax revenue increased 61%, the Kennedy tax cuts: tax revenue increased 62% , and Reagan tax cuts: 94% tax revenue increase.

Second claim of exploding debt is false. Usually debt is caused by spending outside of ones means. The US has been posting record number tax revenues the past couple years...yet our debt has exponentially grown over the past 16 years? So how did you reach your conclusion there?

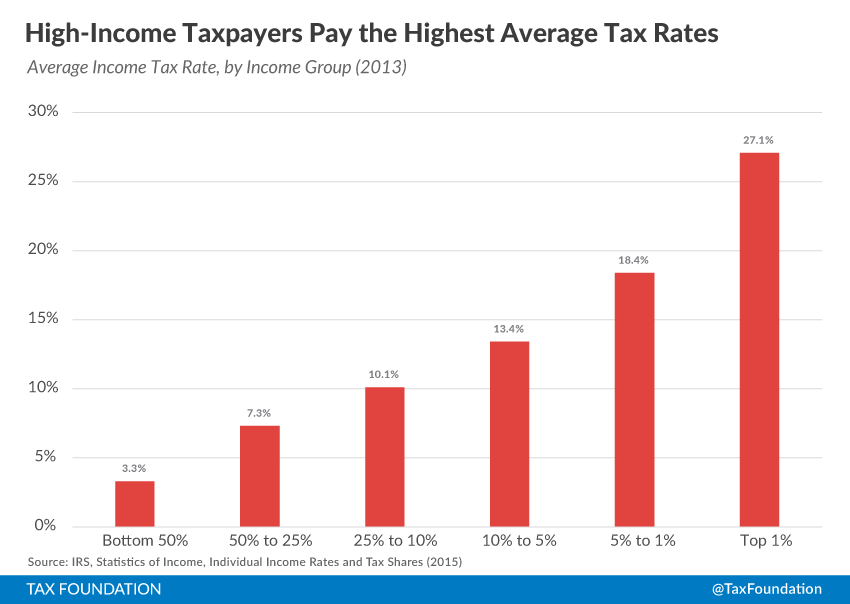

It turns out the rich actually pay more taxes when taxes are lower. Coolidge tax cuts: tax burden of the rich rose from 44% to 78%, Kennedy tax cuts: tax burden of rich rose 57%, Reagan tax cuts: from 48% to 57%.

Ok so we got your first faulty assumptions out of the way. How exactly is increased taxing going to stop politicians from spending 80% of their careers fundraising? How does that make sense? I agree it's a problem they spend so much time doing this, but it's not unreasonable to assume that big donors would be more willing to try to buy influence if you're going after their pockets.

Let's move on to your snapshot graphs. They're telling an incomplete story. If these graphs or so set in stone for all of America, then how is that 70% of Americans will spend at least a year in the top 20%, 53% will spend at least a year in the top 10%, and 11% will spend at least a year in the top 1%.

Income inequality and the myth of the 1% and the 99%

Also take a look at this Forbes article that takes a more critical look at Piketty's economics.

Dispelling Myths About Income Inequality