JimBowie1958

Old Fogey

- Sep 25, 2011

- 63,590

- 16,776

- 2,220

I have often wondered what the states would look like compared to each other if you adjusted for the Purchase Power of the USD in that state and then adjusted for taxes in that state. So I finally got off my dead ass and started working on putting these stats together into a chart and a couple of maps.

First Column is a short form of the states name

Second column is the average income for that state unadjusted

Third column is the PPP for $100 in that state, i.e. how many dollars you have to spend to buy something that on average costs $100 around the rest of the country.

Fourth column is the adjusted income based on the PPP for that state. This is calculated by dividing the average income by the PPP and multiplying by 100.

Fifth Column is the average tax including state income tax, sales tax and property taxes.

Sixth column is the final adjusted income for that state taking into account the PPP and state taxes

Seventh Column is an index I got by using the formula (100-tax)/PPP * 100

State …….Average Inc PPP Adj Income Av Tax Adj Final Inc TaxPPP Index

Alabama "$44,765.00" 86.80 "$51,572.58" 10.2 "$46,312.18" 103.4562212

Alaska …."$73,355.00" 105.60 "$69,464.96" 13.4 "$60,156.66" 82.00757576

Arizona .."$51,492.00" 96.20 "$53,525.99" 16.2 "$44,854.78" 87.11018711

Arkansas "$41,995.00" 87.40 "$48,049.20" 24.8 "$36,133.00" 86.04118993

California "$64,500.00" 113.40 "$56,878.31" 20 "$45,502.65" 70.54673721

Colorado "$63,909.00" 103.20 "$61,927.33" 19.3 "$49,975.35" 78.19767442

Connect. "$71,346.00" 108.70 "$65,635.69" 20.5 "$52,180.38" 73.13707452

Delaware "$61,255.00" 100.40 "$61,010.96" 33.6 "$40,511.27" 66.13545817

Dist Col. "$75,628.00" 117.00 "$64,639.32" 17.5 "$53,327.44" 70.51282051

Florida .."$49,426.00" 99.50 "$49,674.37" 17.6 "$40,931.68" 82.81407035

Georgia "$51,244.00" 92.60 "$55,339.09" 19.2 "$44,713.99" 87.25701944

Hawaii .."$73,486.00" 118.80 "$61,856.90" 18 "$50,722.66" 69.02356902

Idaho …."$48,275.00" 93.40 "$51,686.30" 16.7 "$43,054.68" 89.1862955

Illinois ..."$59,588.00" 99.70 "$59,767.30" 23.3 "$45,841.52" 76.93079238

Indiana "$50,532.00" 90.70 "$55,713.34" 20.8 "$44,124.97" 87.32083793

Iowa ….. "$54,736.00" 90.30 "$60,615.73" 20.5 "$48,189.50" 88.03986711

Kansas "$53,906.00" 90.40 "$59,630.53" 19.2 "$48,181.47" 89.38053097

Kentuc.. "$45,215.00" 88.60 "$51,032.73" 21.2 "$40,213.79" 88.93905192

Louisia. "$45,727.00" 90.60 "$50,471.30" 22.3 "$39,216.20" 85.7615894

Maine .."$51,494.00" 98.00 "$52,544.90" 18.1 "$43,034.27" 83.57142857

Maryla. "$75,847.00" 109.60 "$69,203.47" 22.8 "$53,425.08" 70.4379562

Mass... "$70,628.00" 106.90 "$66,069.22" 25.1 "$49,485.85" 70.06548176

Mich.... "$51,084.00" 93.50 "$54,635.29" 19.8 "$43,817.51" 85.77540107

Minne.. "$63,488.00" 97.40 "$65,182.75" 32.9 "$43,737.63" 68.89117043

Missi... "$40,593.00" 86.20 "$47,091.65" 14.2 "$40,404.63" 99.53596288

Misso.. "$50,238.00" 89.30 "$56,257.56" 22.5 "$43,599.61" 86.78611422

Mont.. "$49,509.00" 94.80 "$52,224.68" 14.7 "$44,547.66" 89.97890295

Nebr... ."$54,996.00" 90.60 "$60,701.99" 22.5 "$47,044.04" 85.54083885

Neva... "$52,431.00" 98.00 "$53,501.02" 15.2 "$45,368.87" 86.53061224

NHam .."$70,303.00" 105.00 "$66,955.24" 16.3 "$56,041.53" 79.71428571

NJers .."$72,222.00" 113.40 "$63,687.83" 24.3 "$48,211.69" 66.75485009

N Mex .."$45,382.00" 94.40 "$48,074.15" 14.7 "$41,007.25" 90.36016949

NYork ..."$60,850.00" 115.30 "$52,775.37" 25.3 "$39,423.20" 64.78751084

N Car …."$47,830.00" 91.20 "$52,445.18" 19.6 "$42,165.92" 88.15789474

N Dak ..."$60,557.00" 92.30 "$65,608.88" 21.5 "$51,502.97" 85.04875406

Ohio ….."$51,075.00" 89.20 "$57,258.97" 26.9 "$41,856.31" 81.95067265

Oklah….."$48,568.00" 89.90 "$54,024.47" 15 "$45,920.80" 94.54949944

Oreg …."$54,148.00" 99.20 "$54,584.68" 19.2 "$44,104.42" 81.4516129

Penn …."$55,702.00" 97.90 "$56,896.83" 21.5 "$44,664.01" 80.18386108

Rh Isl …."$58,073.00" 98.70 "$58,837.89" 25 "$44,128.42" 75.98784195

S Car ..."$47,238.00" 90.30 "$52,312.29" 15.4 "$44,256.20" 93.68770764

S Dak ..."$53,017.00" 88.20 "$60,109.98" 16 "$50,492.38" 95.23809524

Tenne ..."$47,275.00" 89.90 "$52,586.21" 21 "$41,543.10" 87.87541713

Texas .."$55,653.00" 96.80 "$57,492.77" 18.5 "$46,856.61" 84.19421488

Utah.. .."$62,912.00" 97.00 "$64,857.73" 17.8 "$53,313.06" 84.74226804

Verm ..."$56,990.00" 101.60 "$56,092.52" 18.7 "$45,603.22" 80.01968504

Virgi …..."$66,262.00" 102.50 "$64,645.85" 18.1 "$52,944.95" 79.90243902

Wash...."$64,129.00" 104.80 "$61,191.79" 20.8 "$48,463.90" 75.57251908

WVirg ..."$42,019.00" 88.90 "$47,265.47" 14.5 "$40,411.97" 96.17547807

Wisc ….."$55,638.00" 93.10 "$59,761.55" 20.6 "$47,450.67" 85.28464017

wyo.. ..."$60,214.00" 96.20 "$62,592.52" 14.2 "$53,704.38" 89.18918919

This Map Shows the Average Income in Every State—and What It's Really Worth

What's the average annual income after taxes in every state?

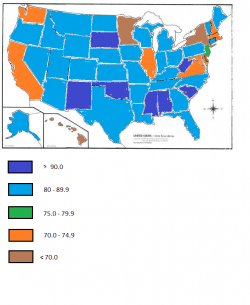

The last map shows the best states to live in if you have a fixed income derived from Social Security, pensions, etc. The higher the PPPTax Index the better for your life style

First Column is a short form of the states name

Second column is the average income for that state unadjusted

Third column is the PPP for $100 in that state, i.e. how many dollars you have to spend to buy something that on average costs $100 around the rest of the country.

Fourth column is the adjusted income based on the PPP for that state. This is calculated by dividing the average income by the PPP and multiplying by 100.

Fifth Column is the average tax including state income tax, sales tax and property taxes.

Sixth column is the final adjusted income for that state taking into account the PPP and state taxes

Seventh Column is an index I got by using the formula (100-tax)/PPP * 100

State …….Average Inc PPP Adj Income Av Tax Adj Final Inc TaxPPP Index

Alabama "$44,765.00" 86.80 "$51,572.58" 10.2 "$46,312.18" 103.4562212

Alaska …."$73,355.00" 105.60 "$69,464.96" 13.4 "$60,156.66" 82.00757576

Arizona .."$51,492.00" 96.20 "$53,525.99" 16.2 "$44,854.78" 87.11018711

Arkansas "$41,995.00" 87.40 "$48,049.20" 24.8 "$36,133.00" 86.04118993

California "$64,500.00" 113.40 "$56,878.31" 20 "$45,502.65" 70.54673721

Colorado "$63,909.00" 103.20 "$61,927.33" 19.3 "$49,975.35" 78.19767442

Connect. "$71,346.00" 108.70 "$65,635.69" 20.5 "$52,180.38" 73.13707452

Delaware "$61,255.00" 100.40 "$61,010.96" 33.6 "$40,511.27" 66.13545817

Dist Col. "$75,628.00" 117.00 "$64,639.32" 17.5 "$53,327.44" 70.51282051

Florida .."$49,426.00" 99.50 "$49,674.37" 17.6 "$40,931.68" 82.81407035

Georgia "$51,244.00" 92.60 "$55,339.09" 19.2 "$44,713.99" 87.25701944

Hawaii .."$73,486.00" 118.80 "$61,856.90" 18 "$50,722.66" 69.02356902

Idaho …."$48,275.00" 93.40 "$51,686.30" 16.7 "$43,054.68" 89.1862955

Illinois ..."$59,588.00" 99.70 "$59,767.30" 23.3 "$45,841.52" 76.93079238

Indiana "$50,532.00" 90.70 "$55,713.34" 20.8 "$44,124.97" 87.32083793

Iowa ….. "$54,736.00" 90.30 "$60,615.73" 20.5 "$48,189.50" 88.03986711

Kansas "$53,906.00" 90.40 "$59,630.53" 19.2 "$48,181.47" 89.38053097

Kentuc.. "$45,215.00" 88.60 "$51,032.73" 21.2 "$40,213.79" 88.93905192

Louisia. "$45,727.00" 90.60 "$50,471.30" 22.3 "$39,216.20" 85.7615894

Maine .."$51,494.00" 98.00 "$52,544.90" 18.1 "$43,034.27" 83.57142857

Maryla. "$75,847.00" 109.60 "$69,203.47" 22.8 "$53,425.08" 70.4379562

Mass... "$70,628.00" 106.90 "$66,069.22" 25.1 "$49,485.85" 70.06548176

Mich.... "$51,084.00" 93.50 "$54,635.29" 19.8 "$43,817.51" 85.77540107

Minne.. "$63,488.00" 97.40 "$65,182.75" 32.9 "$43,737.63" 68.89117043

Missi... "$40,593.00" 86.20 "$47,091.65" 14.2 "$40,404.63" 99.53596288

Misso.. "$50,238.00" 89.30 "$56,257.56" 22.5 "$43,599.61" 86.78611422

Mont.. "$49,509.00" 94.80 "$52,224.68" 14.7 "$44,547.66" 89.97890295

Nebr... ."$54,996.00" 90.60 "$60,701.99" 22.5 "$47,044.04" 85.54083885

Neva... "$52,431.00" 98.00 "$53,501.02" 15.2 "$45,368.87" 86.53061224

NHam .."$70,303.00" 105.00 "$66,955.24" 16.3 "$56,041.53" 79.71428571

NJers .."$72,222.00" 113.40 "$63,687.83" 24.3 "$48,211.69" 66.75485009

N Mex .."$45,382.00" 94.40 "$48,074.15" 14.7 "$41,007.25" 90.36016949

NYork ..."$60,850.00" 115.30 "$52,775.37" 25.3 "$39,423.20" 64.78751084

N Car …."$47,830.00" 91.20 "$52,445.18" 19.6 "$42,165.92" 88.15789474

N Dak ..."$60,557.00" 92.30 "$65,608.88" 21.5 "$51,502.97" 85.04875406

Ohio ….."$51,075.00" 89.20 "$57,258.97" 26.9 "$41,856.31" 81.95067265

Oklah….."$48,568.00" 89.90 "$54,024.47" 15 "$45,920.80" 94.54949944

Oreg …."$54,148.00" 99.20 "$54,584.68" 19.2 "$44,104.42" 81.4516129

Penn …."$55,702.00" 97.90 "$56,896.83" 21.5 "$44,664.01" 80.18386108

Rh Isl …."$58,073.00" 98.70 "$58,837.89" 25 "$44,128.42" 75.98784195

S Car ..."$47,238.00" 90.30 "$52,312.29" 15.4 "$44,256.20" 93.68770764

S Dak ..."$53,017.00" 88.20 "$60,109.98" 16 "$50,492.38" 95.23809524

Tenne ..."$47,275.00" 89.90 "$52,586.21" 21 "$41,543.10" 87.87541713

Texas .."$55,653.00" 96.80 "$57,492.77" 18.5 "$46,856.61" 84.19421488

Utah.. .."$62,912.00" 97.00 "$64,857.73" 17.8 "$53,313.06" 84.74226804

Verm ..."$56,990.00" 101.60 "$56,092.52" 18.7 "$45,603.22" 80.01968504

Virgi …..."$66,262.00" 102.50 "$64,645.85" 18.1 "$52,944.95" 79.90243902

Wash...."$64,129.00" 104.80 "$61,191.79" 20.8 "$48,463.90" 75.57251908

WVirg ..."$42,019.00" 88.90 "$47,265.47" 14.5 "$40,411.97" 96.17547807

Wisc ….."$55,638.00" 93.10 "$59,761.55" 20.6 "$47,450.67" 85.28464017

wyo.. ..."$60,214.00" 96.20 "$62,592.52" 14.2 "$53,704.38" 89.18918919

This Map Shows the Average Income in Every State—and What It's Really Worth

What's the average annual income after taxes in every state?

The last map shows the best states to live in if you have a fixed income derived from Social Security, pensions, etc. The higher the PPPTax Index the better for your life style