Widdekind

Member

- Mar 26, 2012

- 813

- 35

- 16

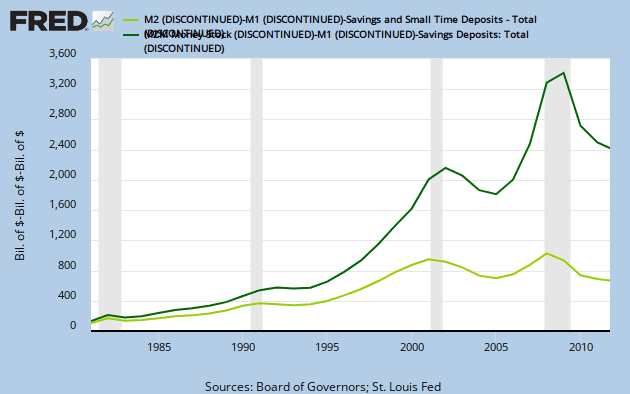

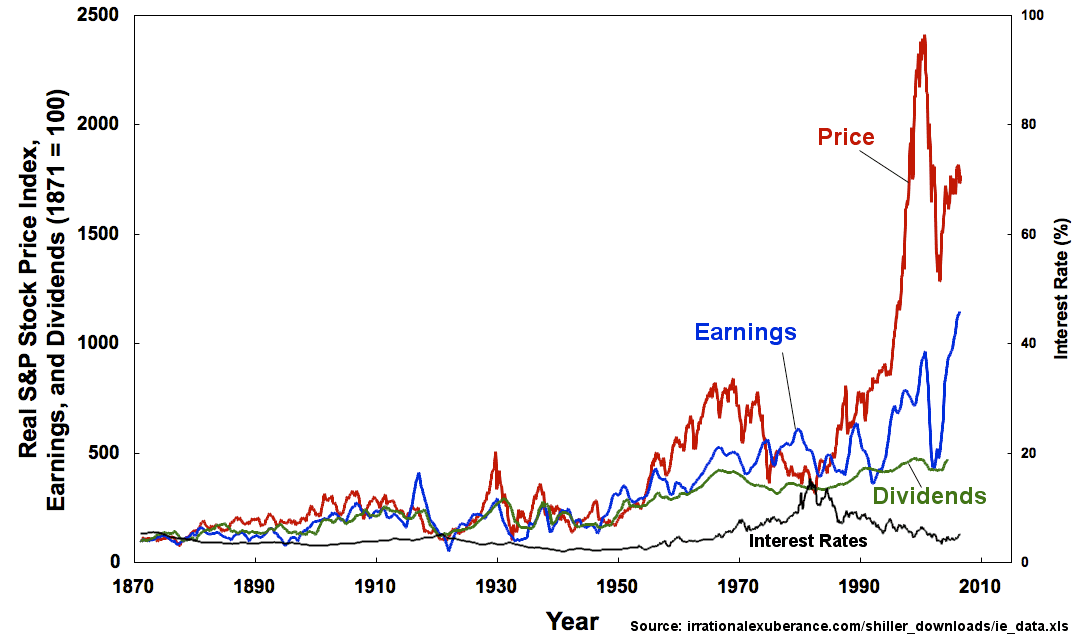

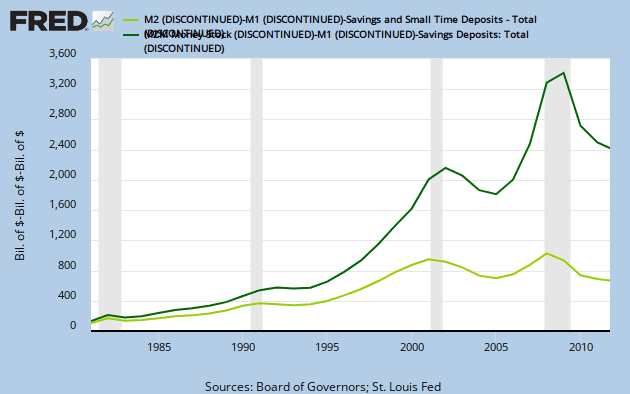

Naively, surges in investments, into Money-Market Accounts (in banks), and into Money-Market Mutual-Funds (in shadow-banks), seem to coincide with "speculative bubbles", e.g. Dot-Com (1995-2000), housing & sub-prime mortgages (2006-2008). Why ? Perhaps people, having Money to invest, and seeking high rates-of-return, simultaneously co-invest funds, into numerous (allegedly) high ROI assets (so that MMAs & MMFs proxy for real-estate et al) ?

MMFs

MMAs

In naive analogy, "speculation" resembles eying more the "price tag" than the "car", i.e. investing more into "fads" than "gadgets", betting on the psychological choices of others ("how many will buy in after me, to boost Prices?") instead of on the merits of "widgets". If so, then "speculations" on Prices might be substituting, for investments into true "entrepreneurial innovation". The latter is Capitalism, the former would be gambling. ("Speculation" is not a "failure of Capitalism", it's not even Capitalism, instead it is gambling.)MMAs